Mobile Apps: Car Insurance Convenience on the Go

Car Insurance Mobile Apps The Future of Coverage Management

Okay, let's be real. Who doesn't have their phone glued to their hand these days? Car insurance companies know this, which is why they're all scrambling to offer mobile apps. But are these apps actually useful, or just another gimmick? We're diving deep into the world of car insurance mobile apps to see if they truly make your life easier.

Think about it: gone are the days of digging through glove compartments for your insurance card. Now, everything's at your fingertips. We're talking policy details, claims filing, roadside assistance, and even discounts – all accessible from your smartphone. It's like having a mini insurance agent in your pocket!

Key Features of Car Insurance Apps Convenience and Accessibility

So, what can you actually do with these apps? Here's a rundown of the most common features:

- Digital Insurance Card: Say goodbye to paper cards. Your digital card is always with you.

- Policy Information: View your coverage details, deductibles, and payment history.

- Claims Filing: Report accidents, upload photos, and track your claim status.

- Roadside Assistance: Request help with breakdowns, flat tires, or lockouts.

- Payment Options: Manage your payments and set up automatic billing.

- Accident Checklist: Get step-by-step guidance on what to do after an accident.

- Find Local Repair Shops: Locate approved repair shops in your area.

- Driving Safety Tools: Some apps offer features like safe driving scores and trip tracking.

Pretty comprehensive, right? But remember, not all apps are created equal. Some are slick and user-friendly, while others are clunky and confusing.

Top Car Insurance Apps Product Recommendations and Reviews

Alright, let's get down to the nitty-gritty. Which car insurance apps are actually worth downloading? Here are a few of our top picks, along with their pros, cons, pricing (if applicable), and ideal use cases:

Progressive Car Insurance App Snapshot and Analysis

Product: Progressive Mobile App

Description: Progressive's app is known for its Snapshot program, which tracks your driving habits and rewards safe drivers with discounts. It also offers standard features like policy management, claims filing, and roadside assistance.

Pros:

- Snapshot program for potential discounts

- User-friendly interface

- Comprehensive claims filing process

Cons:

- Snapshot program requires allowing driving data collection

- Some users report occasional glitches

Pricing: Free to download and use (discounts based on driving habits)

Ideal Use Case: Safe drivers looking to save money on their car insurance.

Pricing Details: Snapshot savings can vary significantly based on driving behavior. Some users report saving hundreds of dollars a year, while others see minimal discounts. The app provides real-time feedback on driving habits, allowing users to adjust their behavior and potentially increase their savings. Keep in mind that aggressive driving, hard braking, and late-night driving can negatively impact your Snapshot score.

Usage Scenario: Imagine Sarah, a cautious driver who always obeys traffic laws. She downloads the Progressive app and enrolls in Snapshot. Over the next six months, the app tracks her driving and rewards her with a substantial discount on her premium. She's happy because she's saving money, and Progressive is happy because she's a low-risk driver.

GEICO Mobile App Comprehensive Features and User Experience

Product: GEICO Mobile

Description: GEICO's app is a solid all-around performer. It offers all the standard features, plus extras like a virtual assistant and a parking locator.

Pros:

- Virtual assistant for quick answers to questions

- Parking locator feature

- Easy-to-use interface

Cons:

- Some users report slow loading times

- Customer service through the app can be inconsistent

Pricing: Free to download and use

Ideal Use Case: Drivers who want a comprehensive app with helpful extra features.

Pricing Details: The GEICO Mobile app itself is free. However, it allows you to manage your GEICO insurance policy, and your insurance premiums will depend on factors like your driving record, the type of car you drive, and your location. The app also provides access to GEICO's discounts, such as discounts for military personnel, federal employees, and students.

Usage Scenario: John is visiting a new city and struggling to find parking. He uses the GEICO Mobile app's parking locator feature to quickly find a nearby garage. He's relieved he doesn't have to circle the block endlessly, and he appreciates the app's convenience.

State Farm Mobile App Community Features and Educational Resources

Product: State Farm Mobile

Description: State Farm's app focuses on providing educational resources and community features. It includes standard features, but also offers articles and videos on topics like safe driving and home maintenance.

Pros:

- Educational resources and articles

- Community features for connecting with other State Farm customers

- User-friendly interface

Cons:

- Fewer unique features compared to other apps

- Some users find the community features unnecessary

Pricing: Free to download and use

Ideal Use Case: Customers who value educational resources and community interaction.

Pricing Details: As with the other apps, State Farm Mobile is free. Your insurance premiums with State Farm will be determined by your individual circumstances. State Farm also offers various discounts, which can be explored and applied through the app. Be sure to check for discounts related to vehicle safety features, multiple policies, and defensive driving courses.

Usage Scenario: Maria is a new driver and wants to learn more about safe driving practices. She uses the State Farm Mobile app to access articles and videos on topics like defensive driving, distracted driving, and winter driving. She feels more confident and prepared behind the wheel after using the app.

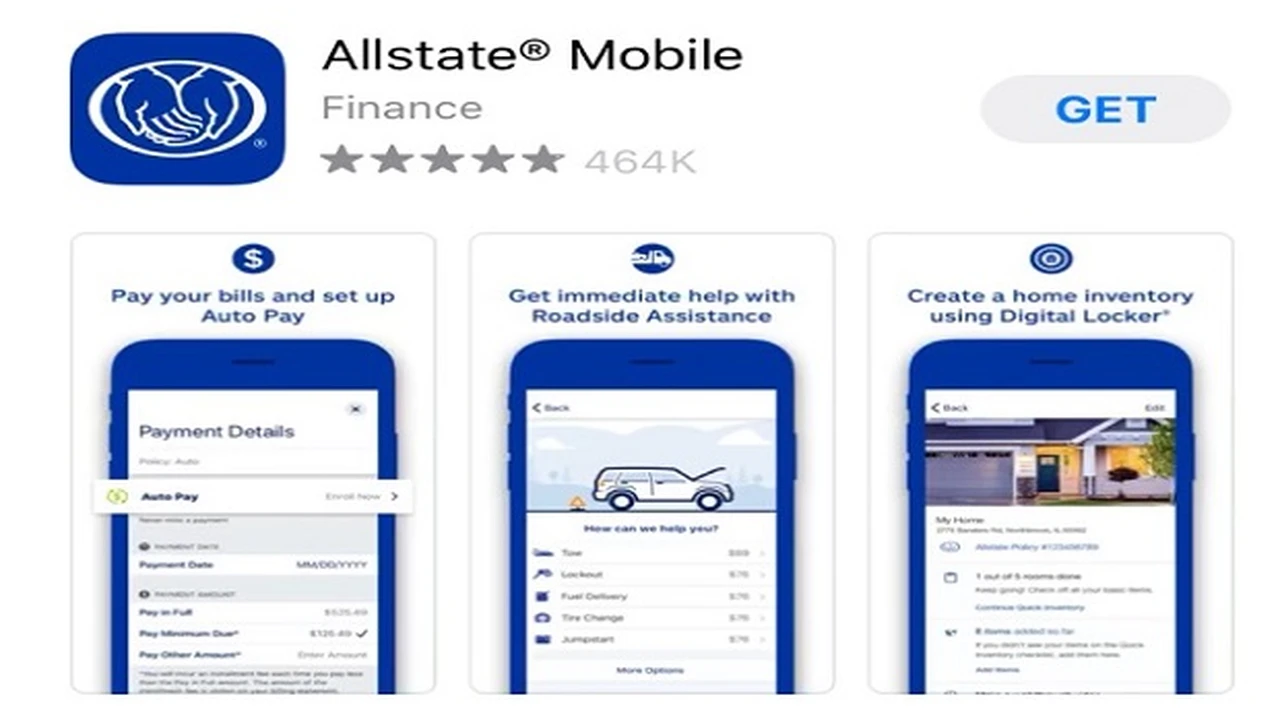

Allstate Mobile App Drivewise Program and Rewards System

Product: Allstate Mobile

Description: Allstate's app is known for its Drivewise program, similar to Progressive's Snapshot. It tracks your driving and rewards safe drivers. It also offers standard features and a rewards system for completing safe driving challenges.

Pros:

- Drivewise program for potential discounts and feedback

- Rewards system for completing safe driving challenges

- Roadside assistance feature

Cons:

- Drivewise program requires data collection

- Some users find the rewards system gimmicky

Pricing: Free to download and use (discounts and rewards based on driving habits)

Ideal Use Case: Drivers who are motivated by rewards and feedback on their driving habits.

Pricing Details: The savings with Drivewise can be substantial for safe drivers. Allstate also offers a variety of other discounts that can be managed through the app. These include discounts for having anti-lock brakes, being a good student, and owning a new car. The app provides personalized recommendations for discounts you may be eligible for.

Usage Scenario: David is competitive and loves challenges. He downloads the Allstate Mobile app and participates in the Drivewise program. He's motivated to drive safely to earn rewards and see his driving score improve. He enjoys the gamified aspect of the app and feels like he's actively improving his driving skills.

Car Insurance App Comparison Choosing the Right Fit for You

So, which app is right for you? It really depends on your individual needs and preferences. Here's a quick comparison:

| App | Key Features | Ideal For |

|---|---|---|

| Progressive Mobile | Snapshot program, user-friendly interface | Safe drivers looking for discounts |

| GEICO Mobile | Virtual assistant, parking locator | Drivers who want comprehensive features |

| State Farm Mobile | Educational resources, community features | Customers who value learning and interaction |

| Allstate Mobile | Drivewise program, rewards system | Drivers motivated by rewards and feedback |

Security Considerations for Car Insurance Apps Data Privacy and Protection

Before you jump on the app bandwagon, let's talk security. You're entrusting these apps with sensitive information, like your policy details, driving data, and even your location. It's crucial to choose apps from reputable companies with strong security measures in place.

Look for apps that use encryption to protect your data and have a clear privacy policy. Also, be mindful of the permissions you grant the app. Do you really need to give it access to your contacts or location all the time? Review the app permissions carefully before installing.

Future Trends in Car Insurance Apps AI Integration and Personalized Services

The world of car insurance apps is constantly evolving. We can expect to see even more innovative features in the future, like:

- AI-powered claims processing: Faster and more efficient claims handling through AI.

- Personalized insurance recommendations: Tailored coverage options based on your individual needs and driving habits.

- Predictive maintenance alerts: Notifications about potential car problems based on data from your vehicle.

- Integration with smart home devices: Seamless connection with your smart home system for added convenience.

The future of car insurance is undoubtedly mobile. By choosing the right app and staying informed about the latest trends, you can take control of your coverage and enjoy a more convenient and personalized insurance experience.

Troubleshooting Common Car Insurance App Issues Connectivity and Technical Problems

Okay, even the best apps can have their hiccups. Let's troubleshoot some common issues you might encounter:

- App Crashing: Make sure you have the latest version installed. Try clearing the app's cache and data. If that doesn't work, try uninstalling and reinstalling the app.

- Login Problems: Double-check your username and password. If you've forgotten your password, use the "forgot password" link to reset it. Contact customer support if you're still having trouble.

- Slow Loading Times: Ensure you have a stable internet connection. Close other apps that might be using bandwidth. If the problem persists, it might be an issue with the app server.

- Data Syncing Issues: Make sure your app is set to sync automatically. Check your phone's settings to ensure the app has permission to access data in the background.

- Claims Filing Problems: Ensure you have all the necessary information and photos. Contact the claims department directly if you're experiencing technical difficulties.

The Impact of Car Insurance Apps on Customer Satisfaction and Loyalty

Think about it - a seamless mobile experience can significantly boost customer satisfaction. Being able to easily access policy information, file claims, and request roadside assistance from your phone can make a huge difference, especially in stressful situations. Insurance companies are realizing this, and investing heavily in their mobile apps to improve customer loyalty. A well-designed app can be a key differentiator in a competitive market.

Comparing Car Insurance App User Interfaces Design and Navigation

User interface (UI) and navigation are crucial. A clunky, confusing app will frustrate users, no matter how many features it has. Look for apps with a clean, intuitive design. The information you need should be easy to find, and the navigation should be straightforward. Many app stores allow you to preview screenshots of the app before you download it, so you can get a feel for the UI before you commit.

The Role of Car Insurance Apps in Promoting Safe Driving Habits

As mentioned with programs like Snapshot and Drivewise, some apps actively promote safe driving. By tracking your driving behavior and providing feedback, these apps can help you identify areas where you can improve. Some apps even offer rewards for safe driving, further incentivizing good habits. This is a win-win - safer roads for everyone, and potential savings on your insurance premium.

Accessibility Features in Car Insurance Apps Ensuring Inclusivity for All Users

It's important for apps to be accessible to everyone, regardless of their abilities. This means features like screen reader compatibility, adjustable font sizes, and alternative text for images. A truly inclusive app will be designed with accessibility in mind from the start. Check the app's description in the app store for information about accessibility features.

Car Insurance App Integration with Wearable Technology Fitness Trackers and Smartwatches

Imagine your fitness tracker automatically sending data about your activity level to your car insurance app. This could potentially lead to discounts for healthy, active individuals. While this is still a relatively new area, the integration of car insurance apps with wearable technology is a growing trend. It's another way for insurance companies to personalize your coverage based on your individual lifestyle.

The Future of Car Insurance Claims Processing Through Mobile Apps Automation and Efficiency

Filing a car insurance claim can be a stressful and time-consuming process. But mobile apps are making it easier than ever. With the ability to upload photos, videos, and other documentation directly from your phone, you can streamline the claims process and get back on the road faster. AI-powered claims processing is also on the rise, which could further automate the process and reduce the need for human intervention.

Comparing Car Insurance App Customer Support Options Live Chat Email and Phone Assistance

Even with the best app, you might need to contact customer support at some point. Look for apps that offer multiple support options, such as live chat, email, and phone assistance. Live chat is often the quickest and most convenient option, while phone support might be preferable for more complex issues. Check the app's help section or website for contact information.

The Ethical Considerations of Data Collection in Car Insurance Apps Balancing Convenience and Privacy

We've touched on data privacy, but it's worth reiterating the ethical considerations. Insurance companies are collecting a lot of data about your driving habits. It's important to be aware of what data is being collected, how it's being used, and who it's being shared with. Read the app's privacy policy carefully and make sure you're comfortable with the terms. It's a balancing act between convenience and privacy.

The Role of Car Insurance Apps in Promoting Electric Vehicle Adoption Incentives and Benefits

Many car insurance companies are offering incentives and benefits for electric vehicle (EV) owners. This could include discounts on insurance premiums, access to EV charging stations, and other perks. Some car insurance apps even allow you to track your EV's battery range and find nearby charging stations. As EVs become more popular, we can expect to see even more integration between car insurance apps and EV technology.

Car Insurance Apps and the Impact on Insurance Fraud Detection and Prevention

Mobile apps can also play a role in preventing insurance fraud. By allowing you to easily upload photos and videos of accidents, apps can help insurers verify claims and identify fraudulent activity. AI-powered fraud detection systems are also becoming more sophisticated, helping to identify suspicious claims and prevent losses.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)