The Impact of Your Driving Record on Insurance Rates

Understanding How Your Driving History Affects Car Insurance Premiums

Okay, let's talk about something super important if you own a car: your driving record. It's not just about avoiding tickets; it significantly influences how much you pay for car insurance. Insurers see your driving record as a crystal ball, predicting how likely you are to file a claim. A clean record? Great! A history of accidents and violations? Get ready to pay more.

Traffic Violations and Their Effect on Insurance Rates

So, what dings your driving record? Speeding tickets are a big one. Even minor ones can raise your rates. More serious offenses, like reckless driving or driving under the influence (DUI), are HUGE red flags for insurance companies. They can lead to drastically higher premiums, policy cancellation, or even difficulty finding insurance at all. Think of it like this: each ticket is a point (or several points, depending on the severity) on your record, and those points add up. The more points you have, the riskier you look to an insurer.

Accidents and Insurance Costs

Accidents, even if they're not your fault, can impact your insurance rates. If you're found at fault for an accident, expect your premiums to increase. Even if you're not at fault, having multiple accidents on your record can still raise concerns for insurers. They might see you as being in a high-risk area or having a tendency to be involved in accidents, regardless of fault. It's all about perceived risk.

The Length of Time a Violation Stays on Your Record – Driving Record Timeline

Good news! Traffic violations don't stay on your record forever. The length of time a violation remains on your record varies by state and the severity of the offense. Minor speeding tickets might drop off after three years, while more serious offenses like DUIs can stay on your record for five to ten years, or even longer in some cases. It's important to check your state's specific rules regarding driving record expungement or removal. Once a violation drops off your record, it should no longer impact your insurance rates.

Shopping Around for the Best Car Insurance Rates with a Less-Than-Perfect Driving Record – Rate Comparison Tools

Don't despair if your driving record isn't spotless. You can still find affordable car insurance. The key is to shop around and compare quotes from multiple insurance companies. Different insurers weigh driving record factors differently. Some might be more lenient towards minor speeding tickets, while others might be more concerned about accidents. Use online comparison tools to get quotes from a variety of insurers quickly and easily. Be honest about your driving record when requesting quotes; withholding information can lead to policy cancellation later on.

Defensive Driving Courses and Insurance Discounts – Improving Your Driving Profile

Consider taking a defensive driving course. Many insurance companies offer discounts to drivers who complete approved defensive driving courses. These courses teach you safe driving techniques and help you become a more aware and responsible driver. Completing a defensive driving course not only improves your driving skills but can also lower your insurance premiums.

Increasing Your Deductible to Lower Insurance Premiums – Deductible Options

Another way to lower your insurance premiums is to increase your deductible. Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you're essentially taking on more of the financial risk in the event of an accident. Insurers reward this by lowering your premiums. However, make sure you can comfortably afford your deductible if you need to file a claim.

Usage-Based Insurance (UBI) Programs and Safe Driving Habits – Telematics Technology

Think about usage-based insurance (UBI) programs. These programs use telematics technology to track your driving habits, such as speed, braking, and mileage. If you demonstrate safe driving habits, you can earn discounts on your insurance premiums. UBI programs are a great option for drivers who are confident in their driving skills and want to be rewarded for safe driving.

Specific Car Insurance Products for High-Risk Drivers – Non-Standard Auto Insurance

If you have a particularly poor driving record, you might need to consider non-standard auto insurance. These policies are designed for drivers who are considered high-risk due to multiple accidents, traffic violations, or DUIs. Non-standard insurance typically comes with higher premiums, but it can provide coverage when other insurers are unwilling to offer it. Some examples include:

- The General: Known for insuring drivers with poor records. They offer a variety of coverage options and are available in most states. Great for drivers who have been turned down by other insurers. Price: Expect premiums to be higher than standard insurers, potentially 20-50% more depending on the severity of the driving record.

- Direct Auto Insurance: Another option for high-risk drivers, offering flexible payment plans. Good for individuals who need to spread out their insurance payments. Price: Similar to The General, expect higher premiums due to the increased risk.

- SafeAuto: Specializes in providing minimum coverage required by law, making it an affordable option for drivers on a budget. Ideal for those who need to meet legal requirements but are struggling to afford standard insurance. Price: Generally more affordable than The General or Direct Auto, but coverage is limited to state minimums.

Comparing High-Risk Insurance Options – Coverage and Cost Analysis

When comparing these options, consider the following:

- Coverage: Ensure the policy meets your state's minimum requirements and provides adequate protection for your needs.

- Cost: Compare premiums, deductibles, and payment options.

- Reputation: Research the insurer's customer service and claims handling.

For example, The General might offer broader coverage options than SafeAuto, but SafeAuto might be more affordable if you only need minimum coverage. Direct Auto Insurance might offer more flexible payment plans, which could be beneficial if you have a tight budget.

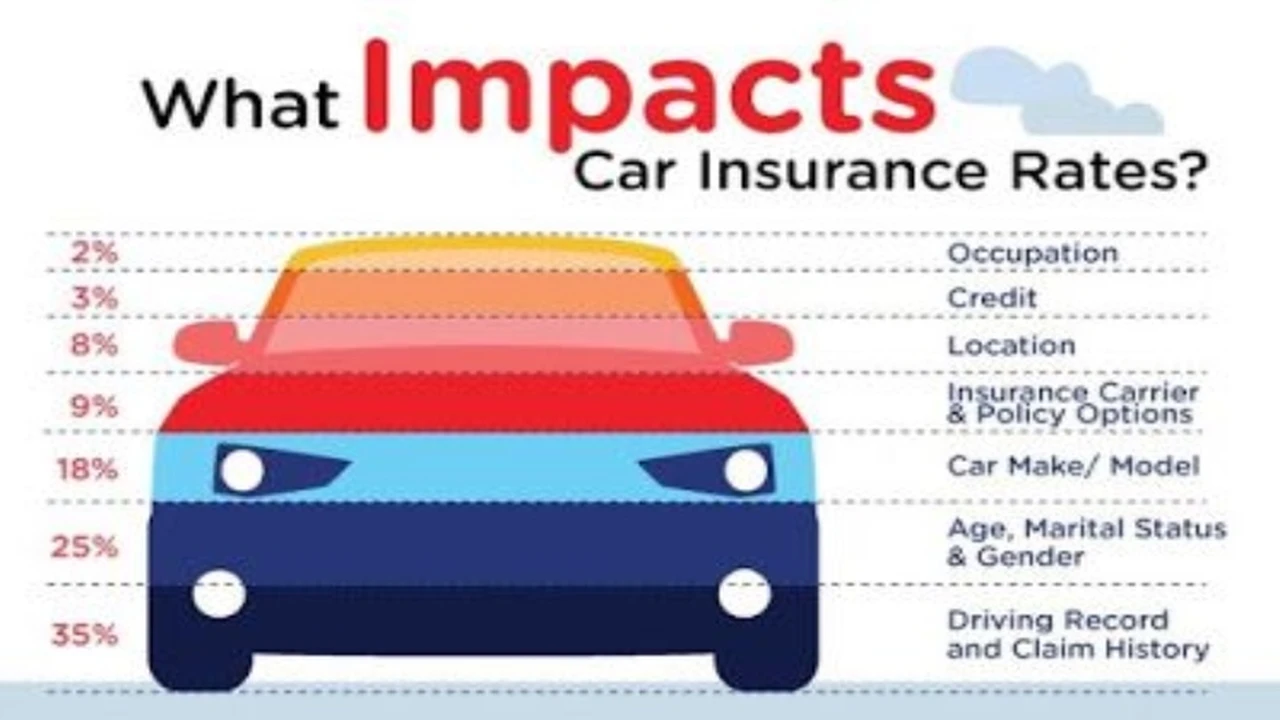

Factors Beyond Your Driving Record That Influence Insurance Rates – Credit Score and Vehicle Type

Remember, your driving record isn't the only factor that influences your insurance rates. Insurers also consider your age, gender, location, vehicle type, and credit score. Improving your credit score and driving a safe vehicle can also help lower your premiums.

Maintaining a Clean Driving Record for Long-Term Savings – Safe Driving Practices

Ultimately, the best way to save money on car insurance is to maintain a clean driving record. Practice safe driving habits, obey traffic laws, and avoid accidents. A clean driving record not only saves you money on insurance but also keeps you and others safe on the road.

Product Recommendations and Usage Scenarios

Let's dive deeper into some specific product recommendations for high-risk drivers and how they might be used in different situations:

The General: Comprehensive Coverage for Peace of Mind

Usage Scenario: John recently had a DUI conviction and is finding it difficult to get insurance. He needs comprehensive coverage to protect his new car and wants a reputable company. The General offers a policy that meets his needs, including collision and comprehensive coverage, even with his DUI on record. He pays a higher premium but has peace of mind knowing he's fully protected.

Features: Offers a variety of coverage options, including collision, comprehensive, and liability. Accepts drivers with poor driving records. Available in most states. Customer service is generally considered adequate.

Price: Expect to pay $200-$400 per month, depending on your specific driving record and coverage needs.

Direct Auto Insurance: Flexible Payment Options for Budget-Conscious Drivers

Usage Scenario: Maria has multiple speeding tickets and is struggling to afford car insurance. Direct Auto Insurance offers her a flexible payment plan that allows her to spread out her payments over time. This makes the insurance more manageable for her budget.

Features: Offers flexible payment plans. Accepts drivers with poor driving records. May have limited coverage options compared to The General. Focuses on providing affordable insurance to high-risk drivers.

Price: Expect to pay $150-$350 per month, depending on your driving record and coverage needs.

SafeAuto: Minimum Coverage for Legal Compliance

Usage Scenario: David needs to reinstate his driver's license after a suspension. He only needs the minimum coverage required by law and is looking for the cheapest option. SafeAuto provides him with a policy that meets the state's minimum requirements at an affordable price.

Features: Offers minimum coverage required by law. Focuses on affordability. Coverage options are limited. Ideal for drivers on a tight budget.

Price: Expect to pay $80-$200 per month, depending on your state's minimum requirements and your driving record.

Product Comparison Table

Here's a quick comparison table to help you visualize the differences between these products:

| Company | Coverage Options | Payment Options | Accepts Poor Records | Price Range (Monthly) |

|---|---|---|---|---|

| The General | Comprehensive | Standard | Yes | $200-$400 |

| Direct Auto Insurance | Limited | Flexible | Yes | $150-$350 |

| SafeAuto | Minimum | Standard | Yes | $80-$200 |

Remember to always get quotes from multiple insurers to find the best rate for your specific situation. Consider all factors, including coverage, cost, and customer service, before making a decision.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)