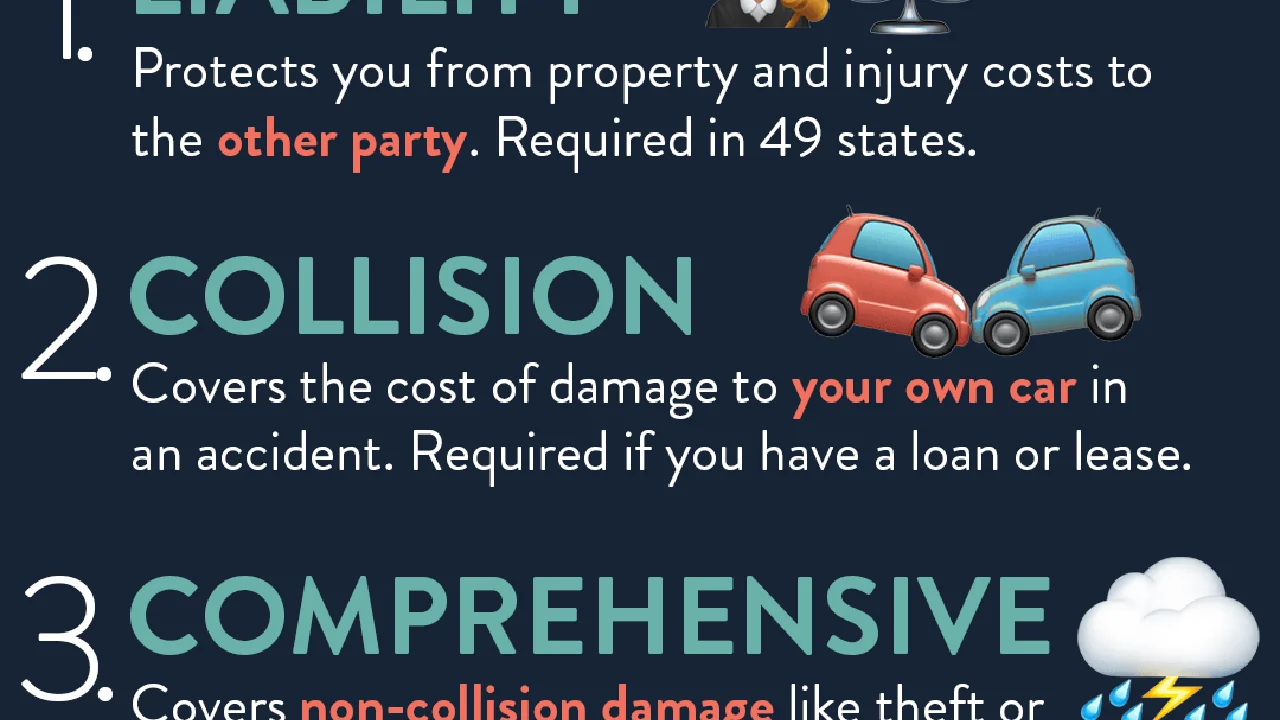

Types of Car Insurance Coverage: A Detailed Look

Understanding Liability Car Insurance Coverage and When to Use It

Okay, let's dive into liability coverage. This is like, the bedrock of your car insurance policy. It's what kicks in if you're at fault in an accident and someone else gets injured or their property gets damaged. Think of it as your financial shield against lawsuits and paying for someone else's medical bills or car repairs. It's broken down into two parts: Bodily Injury Liability (BI) and Property Damage Liability (PD).

Bodily Injury Liability (BI): This covers the medical expenses, lost wages, and pain and suffering of the other party if you're at fault in an accident that causes them injuries. Let's say you rear-end someone and they need physical therapy and can't work for a month. Your BI coverage would help pay for those costs.

Property Damage Liability (PD): This covers the cost of repairing or replacing the other party's vehicle or other property if you damage it in an accident. Imagine you accidentally sideswipe someone's brand new Tesla. Your PD coverage would help cover the cost of the repairs (which, let's be honest, are probably gonna be expensive!).

When to Use It: You'd use liability coverage whenever you're at fault in an accident that causes injury or property damage to someone else. It's not for your own injuries or damages to your car; that's where other coverages come in.

Exploring Collision Car Insurance Coverage Options

Collision coverage is all about protecting your own vehicle when it's damaged in an accident, regardless of who's at fault. Whether you crash into another car, a tree, or even a mailbox (hey, it happens!), collision coverage can help pay for the repairs or replacement of your car. Think of it as your personal car repair fund.

How It Works: Let's say you're driving down the road and a deer jumps out in front of you. You slam on the brakes but still hit the deer, causing significant damage to your car. Collision coverage would kick in to pay for the repairs, minus your deductible (the amount you pay out of pocket before the insurance company pays the rest).

When to Use It: You'd use collision coverage when your car is damaged in an accident involving another vehicle or object, regardless of who's at fault. It's especially helpful if you're at fault and don't have someone else's insurance to rely on.

Comprehensive Car Insurance Coverage and Protection Details

Comprehensive coverage is the superhero of car insurance. It protects your car from pretty much everything except collisions. Think of it as protection against all the unexpected things that can happen to your car that aren't accidents. This includes things like theft, vandalism, fire, hail, flood, and even damage from falling objects (like a tree branch during a storm).

How It Works: Imagine you wake up one morning to find that your car has been stolen. Comprehensive coverage would help pay to replace your car (minus your deductible, of course). Or, let's say a hailstorm rolls through and leaves your car looking like it's been attacked by a giant golf ball. Comprehensive coverage would cover the cost of repairing the hail damage.

When to Use It: You'd use comprehensive coverage when your car is damaged by something other than a collision. It's a great way to protect your investment from unexpected events that are out of your control.

Uninsured and Underinsured Motorist Car Insurance Coverage Explained

Uninsured and underinsured motorist coverage protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages. It's like a safety net that kicks in when the other driver can't or won't pay for your injuries and damages.

Uninsured Motorist (UM): This covers your medical expenses, lost wages, and pain and suffering if you're hit by an uninsured driver. Let's say you're hit by a driver who doesn't have insurance and you suffer serious injuries. UM coverage would help pay for your medical bills and other expenses.

Underinsured Motorist (UIM): This covers the difference between your damages and the other driver's insurance coverage if they don't have enough insurance to cover all of your expenses. Imagine you're hit by a driver who has the state minimum insurance coverage, but your medical bills and lost wages exceed that amount. UIM coverage would help pay for the remaining expenses.

When to Use It: You'd use uninsured or underinsured motorist coverage when you're hit by a driver who doesn't have enough insurance to cover your damages. It's a crucial coverage to have, especially in states with a high number of uninsured drivers.

Personal Injury Protection (PIP) Car Insurance Coverage Details

Personal Injury Protection (PIP), also known as no-fault insurance, covers your medical expenses and lost wages regardless of who's at fault in an accident. It's designed to provide quick and easy access to medical care and lost income without having to determine fault.

How It Works: Let's say you're involved in a car accident, regardless of who's at fault. PIP would pay for your medical bills, lost wages, and even some other expenses like childcare or transportation to medical appointments. It's a no-fault system, meaning you don't have to prove who was at fault to receive benefits.

When to Use It: You'd use PIP coverage whenever you're injured in a car accident, regardless of who's at fault. It's especially helpful if you need immediate medical care and don't want to wait for an insurance investigation to determine fault.

Comparing Car Insurance Products: GEICO vs. State Farm - Pricing and Coverage

Alright, let's talk about some specific car insurance companies and their offerings. We'll compare GEICO and State Farm, two of the biggest players in the industry.

GEICO: GEICO is known for its competitive rates, especially for drivers with good driving records. They offer a wide range of coverages, including all the ones we've discussed above. GEICO also has a user-friendly website and mobile app, making it easy to manage your policy and file claims.

State Farm: State Farm is known for its strong customer service and local agent network. They also offer a wide range of coverages and have a reputation for being reliable and responsive. State Farm might be a good choice if you prefer to work with a local agent and value personalized service.

Pricing: Generally, GEICO tends to be more affordable for most drivers, especially those with good driving records. State Farm can be more expensive, but they may offer better rates for drivers with certain risk factors, like older drivers or those with multiple vehicles.

Coverage: Both GEICO and State Farm offer similar coverage options, but State Farm may have some additional features or endorsements that are not available through GEICO. It's important to compare the specific policy details and coverage limits to see which one best meets your needs.

Real-World Car Insurance Scenarios: When to File a Claim

Let's walk through some real-world scenarios to illustrate when you might need to file a car insurance claim.

Scenario 1: Rear-End Collision: You're stopped at a red light and another car rear-ends you. In this case, you would typically file a claim with the other driver's insurance company (their property damage liability coverage). If they don't have insurance or don't have enough coverage, you might need to use your own uninsured/underinsured motorist coverage or collision coverage.

Scenario 2: Hail Damage: A hailstorm damages your car. You would file a claim with your own comprehensive coverage. Remember, you'll have to pay your deductible before the insurance company pays the rest.

Scenario 3: Hit-and-Run: You wake up one morning to find that your car has been damaged in a hit-and-run. You would file a claim with your own collision coverage (if you have it) or uninsured motorist property damage coverage (if available in your state).

Scenario 4: Single-Car Accident: You swerve to avoid an animal and crash into a tree. You would file a claim with your own collision coverage.

Car Insurance Deductibles: How They Impact Your Premium and Claims

Your deductible is the amount you pay out of pocket before your insurance company pays the rest of a claim. It's an important factor to consider when choosing your car insurance policy.

How It Works: Let's say you have a $500 deductible on your collision coverage and you get into an accident that causes $2,000 worth of damage to your car. You would pay the first $500, and your insurance company would pay the remaining $1,500.

Impact on Premium: Generally, the higher your deductible, the lower your premium (the amount you pay each month for insurance). This is because you're taking on more of the financial risk yourself. Conversely, the lower your deductible, the higher your premium.

Choosing the Right Deductible: The right deductible for you depends on your financial situation and risk tolerance. If you're comfortable paying a higher deductible in the event of an accident, you can save money on your premium. However, if you prefer to have a lower deductible so you don't have to pay as much out of pocket, you'll pay a higher premium.

Understanding Policy Limits in Car Insurance: Choosing the Right Amount

Policy limits are the maximum amount your insurance company will pay for a covered claim. It's crucial to choose the right policy limits to protect yourself from significant financial losses.

Liability Limits: For liability coverage, your policy limits determine how much your insurance company will pay for injuries or property damage you cause to others in an accident. It's generally recommended to choose liability limits that are high enough to cover your assets and potential legal costs.

Uninsured/Underinsured Motorist Limits: For uninsured/underinsured motorist coverage, your policy limits determine how much your insurance company will pay for your injuries and damages if you're hit by an uninsured or underinsured driver. It's generally recommended to choose limits that are similar to your liability limits.

Choosing the Right Limits: The right policy limits for you depend on your financial situation, assets, and risk tolerance. It's generally recommended to choose limits that are high enough to protect yourself from significant financial losses in the event of a serious accident.

Gap Insurance: Protecting Your Investment in a New Car

Gap insurance, or Guaranteed Asset Protection, covers the difference between what you owe on your car loan and the car's actual cash value (ACV) if it's totaled or stolen. This is especially important if you financed a new car, as the ACV can depreciate quickly, leaving you owing more on your loan than the car is worth.

How It Works: Let's say you buy a new car for $30,000 and finance it. A few years later, the car is totaled in an accident and the insurance company determines its ACV to be $20,000. However, you still owe $25,000 on your loan. Gap insurance would cover the $5,000 difference between what you owe and what the car is worth.

When to Get It: You should consider gap insurance if you financed a new car, especially if you made a small down payment or have a long loan term. It can protect you from owing money on a car that you can no longer drive.

Usage-Based Car Insurance: Saving Money with Telematic Devices

Usage-based insurance (UBI) programs use telematics devices or smartphone apps to track your driving habits and offer discounts based on how safely you drive. This can be a great way to save money if you're a safe driver.

How It Works: You install a telematics device in your car or download a smartphone app that tracks your driving behavior, such as speeding, hard braking, and nighttime driving. The insurance company then uses this data to calculate your premium. Safe drivers can earn significant discounts.

Benefits: The main benefit of UBI is the potential to save money on your car insurance. It can also encourage safer driving habits and provide valuable feedback on your driving performance.

Product Recommendations: The Best Dash Cams for Insurance Claims

A dash cam can be a valuable tool for providing evidence in the event of an accident. Here are a few recommended dash cams:

Garmin Dash Cam 67W: This dash cam offers a wide 180-degree field of view, 1440p resolution, and automatic incident detection. It also has voice control and parking surveillance mode.

Thinkware Q800 Pro: This dash cam offers 2K QHD recording, super night vision, and a parking surveillance mode. It also has a built-in GPS and Wi-Fi.

Vantrue N4: This dash cam records front, inside, and rear views simultaneously. It offers 1440P front recording, 1080P inside recording, and 1080P rear recording. It also has infrared night vision for the inside camera.

Specific Product Use Cases: Using Dash Cams to Prove Fault

Let's look at some specific scenarios where a dash cam could be helpful in proving fault in an accident:

Scenario 1: Red Light Runner: You're approaching an intersection and the light turns green. You proceed through the intersection and are hit by a driver who ran a red light. The dash cam footage can clearly show that the other driver ran the red light, proving their fault.

Scenario 2: Sideswipe: You're driving in the right lane and another car attempts to merge into your lane but doesn't see you. They sideswipe your car. The dash cam footage can show that the other driver failed to yield and caused the accident.

Scenario 3: Hit-and-Run: Your car is parked on the street and another car hits it and drives away. The dash cam footage can capture the other car's license plate, allowing you to identify the driver and file a claim with their insurance company.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)