Classic Car Insurance: Protecting Your Investment

Understanding Classic Car Insurance What Makes it Different

So, you've got a classic car. Awesome! Maybe it's a '67 Mustang, a vintage Porsche, or even a lovingly restored Model T. Whatever it is, it's more than just a vehicle; it's an investment, a passion project, and a piece of history. That's where classic car insurance comes in. Unlike regular car insurance, classic car insurance is designed to protect the unique value and needs of your cherished ride. Think about it: your classic isn't depreciating like a new car; it's probably appreciating! Regular insurance often won't cover the true market value if something happens. We need to dive deep into the world of classic car insurance to understand why it's so important and how to find the right coverage for your pride and joy.

Why You Need Specialized Classic Car Insurance Coverage

Why can't you just use your regular car insurance? Good question! Classic cars have different needs and values. Here's why specialized insurance is crucial:

- Agreed Value vs. Actual Cash Value: This is huge! Regular insurance usually pays out the "actual cash value" (ACV), which is the current market value minus depreciation. Classic car insurance typically offers "agreed value" coverage. This means you and the insurance company agree on the car's value upfront, and that's the amount you'll receive if it's a total loss (minus any deductible, of course).

- Specialized Repair and Parts: Classic car insurance understands that you can't just take your '57 Chevy to any mechanic. They often have networks of specialized repair shops and parts suppliers who know how to handle vintage vehicles.

- Limited Use Policies: Classic car insurance policies often have mileage restrictions. This is because they're designed for cars that are driven occasionally, not as daily drivers. This lower risk often translates to lower premiums.

- Coverage for Car Shows and Events: Many policies offer coverage for your car while it's on display at car shows or during transit to and from events.

- Expert Claims Handling: Classic car insurance companies have claims adjusters who understand the nuances of classic car values and repairs. They're better equipped to handle your claim fairly and efficiently.

Key Factors Affecting Classic Car Insurance Cost and Coverage

So, what determines how much you'll pay for classic car insurance? Several factors come into play:

- Year, Make, and Model: The rarity and value of your car are major factors. A rare, high-value car will naturally cost more to insure.

- Agreed Value: As mentioned earlier, the agreed value you set with the insurance company directly impacts your premium.

- Mileage: Lower mileage typically means lower premiums. Be honest about how much you drive your classic!

- Storage: Where you store your car matters. A secure, climate-controlled garage will generally result in lower premiums than storing it outside.

- Driver History: Your driving record is always a factor, even with classic car insurance. A clean record will get you better rates.

- Age and Experience: Insurance companies often prefer experienced drivers, as they're seen as less risky.

- Modifications: Any modifications you've made to your car can affect your insurance. Some modifications may increase the value, while others may increase the risk of damage or theft.

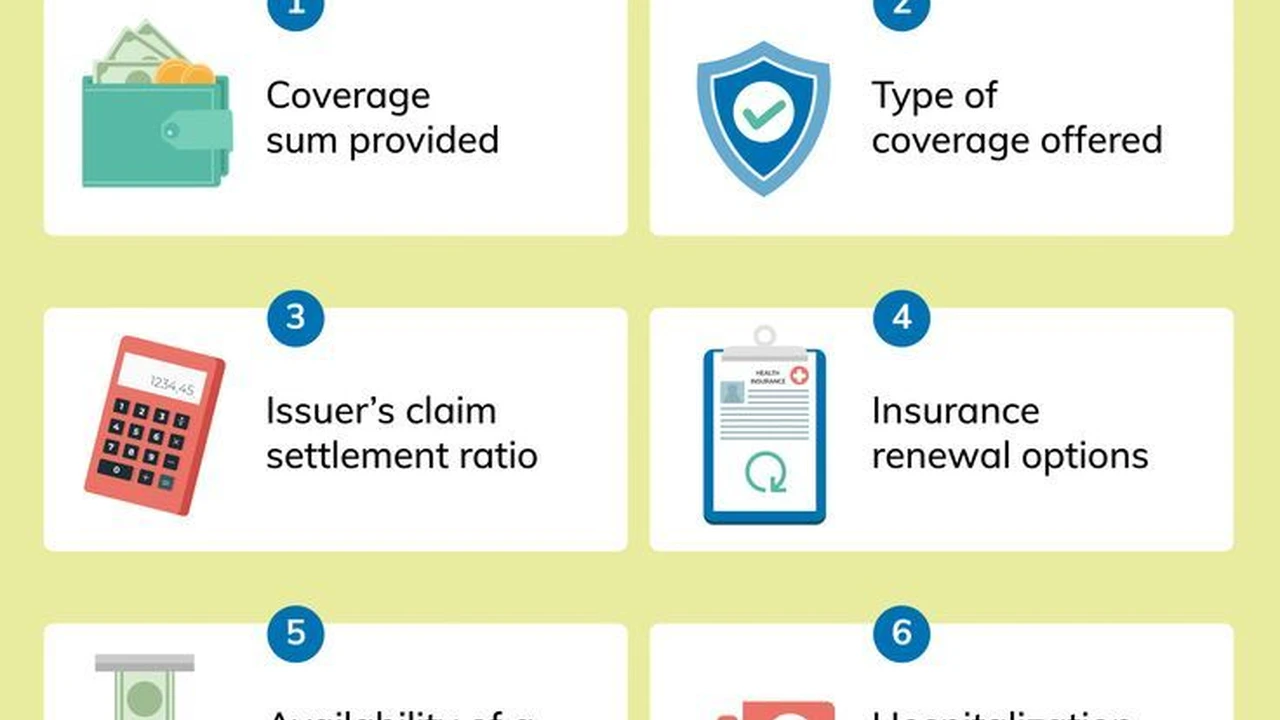

Choosing the Right Classic Car Insurance Policy Considerations

Choosing the right policy involves considering your specific needs and the characteristics of your car. Here's a breakdown of what to look for:

- Agreed Value Coverage: This is non-negotiable. Make sure the policy offers agreed value, not actual cash value.

- Mileage Restrictions: Understand the mileage limits and make sure they align with your driving habits.

- Usage Restrictions: Some policies may restrict when and where you can drive your car.

- Deductibles: Choose a deductible that you're comfortable paying out of pocket in case of a claim.

- Coverage for Spare Parts: Some policies offer coverage for spare parts you own.

- Trip Interruption Coverage: This can cover expenses like lodging and meals if your car breaks down during a trip.

- Inflation Guard: This feature automatically increases your coverage amount each year to keep pace with inflation.

- Check the Company's Reputation: Research the insurance company's financial stability and customer service ratings.

Top Classic Car Insurance Companies A Comparison

Okay, let's talk about some of the big players in the classic car insurance game. Here's a quick rundown of some popular options:

- Hagerty: Hagerty is a well-known name in the classic car world. They offer agreed value coverage, specialized claims handling, and a range of other benefits. They also have a strong online community and offer valuation tools.

- American Collectors Insurance: American Collectors Insurance is another popular choice, offering agreed value coverage, flexible mileage options, and coverage for spare parts.

- Grundy Insurance: Grundy Insurance specializes in classic car insurance and offers agreed value coverage, worldwide coverage options, and no mileage restrictions for some policies.

- Condon Skelly: Condon Skelly has been insuring classic cars for over 50 years. They offer agreed value coverage, flexible payment options, and discounts for storing your car in a secure location.

It's important to get quotes from multiple companies and compare their coverage options and prices before making a decision. Consider things like:

- Coverage Limits: Make sure the coverage limits are sufficient to protect your investment.

- Deductibles: Choose a deductible that you're comfortable with.

- Discounts: Ask about available discounts, such as discounts for storing your car in a secure location or for being a member of a classic car club.

Real-World Examples Classic Car Insurance in Action

Let's look at a couple of scenarios to illustrate how classic car insurance can protect you:

Scenario 1: The Garage Fire

Imagine you own a beautifully restored 1965 Ford Mustang. You've insured it with Hagerty for an agreed value of $50,000. One night, a fire breaks out in your garage, and your Mustang is completely destroyed. With Hagerty's agreed value coverage, you'll receive $50,000 (minus your deductible) to help you replace your beloved Mustang. Without agreed value coverage, you might only receive the "actual cash value," which could be significantly less, especially if the market value of your Mustang has increased since you purchased it.

Scenario 2: The Minor Fender Bender

You're driving your 1957 Chevrolet Bel Air to a car show when someone rear-ends you at a stoplight. The damage is relatively minor, but the parts needed to repair your Bel Air are rare and expensive. With classic car insurance, you can rest assured that your insurance company will work with specialized repair shops to find the correct parts and restore your car to its original condition. A regular insurance company might try to use aftermarket parts or declare the car a total loss, even though it's repairable.

Specific Product Recommendations and Comparisons

Okay, let's get down to specifics. Here are a few example policy comparisons, keeping in mind that pricing and availability can vary based on your location and specific vehicle details. These are *examples only* and you should get personalized quotes.

Example 1: 1967 Chevrolet Corvette Stingray (Agreed Value: $75,000)

Hagerty: Estimated premium: $800/year. Features: Agreed value, guaranteed replacement cost on parts, roadside assistance tailored for classics, valuation tools, access to Hagerty Drivers Club.

American Collectors Insurance: Estimated premium: $750/year. Features: Agreed value, flexible mileage options, spare parts coverage, inflation guard.

Grundy Insurance: Estimated premium: $900/year. Features: Agreed value, worldwide coverage options, potentially fewer mileage restrictions (depending on policy), higher liability limits available.

Analysis: Hagerty is a strong all-rounder, especially if you value their community and roadside assistance. American Collectors is a good value option with flexible mileage. Grundy is worth considering if you need worldwide coverage or higher liability limits.

Example 2: 1932 Ford Hot Rod (Agreed Value: $40,000)

Hagerty: Estimated premium: $600/year. Considerations: Hagerty may have stricter requirements for modified vehicles; ensure all modifications are documented and approved.

American Collectors Insurance: Estimated premium: $550/year. Considerations: Check their policy on custom builds; some may require professional appraisal.

Condon Skelly: Estimated premium: $500/year. Features: Agreed value, discounts for secure storage, flexible payment options. Considerations: Verify their coverage for custom modifications.

Analysis: Condon Skelly might be the most cost-effective option here, but it's crucial to confirm their coverage for the specific modifications on your hot rod. Hagerty and American Collectors are also good choices, but make sure they understand and approve of the modifications.

Understanding Usage Scenarios and Policy Restrictions

Let's talk about *how* you use your classic car. This directly impacts the type of policy you need. Consider these scenarios:

- Occasional Weekend Drives: If you primarily use your classic for leisurely weekend drives, car shows, and club events, a standard classic car insurance policy with mileage restrictions is likely sufficient.

- Regular Events and Shows (Long Distances): If you frequently travel long distances to attend car shows, you might need a policy with higher mileage limits or even unlimited mileage.

- Restoration Projects: If your car is currently undergoing restoration, you might need a "builder's risk" policy that covers it during the restoration process.

- Track Days or Competitive Events: Standard classic car insurance policies typically *exclude* coverage for track days or competitive events. You'll need a specialized policy designed for these activities.

- Daily Driver (Rare, but Possible): While not recommended, if you use your classic as a daily driver, you'll need a policy with high mileage limits and potentially higher premiums. Be aware that this might void some classic car insurance policies altogether.

Important Note: Always read the fine print of your policy to understand the specific restrictions and exclusions. Don't assume anything! Call your insurance agent and ask questions if you're unsure about anything.

The Impact of Modifications on Insurance Premiums and Coverage

Modifications can significantly impact your insurance premiums and coverage. Here's what you need to know:

- Document Everything: Keep detailed records of all modifications, including receipts and photos. This will help you establish the value of the modifications and ensure that they're properly covered.

- Inform Your Insurance Company: Be upfront about all modifications when you apply for insurance. Hiding modifications can void your policy.

- Potential Premium Increases: Some modifications, such as engine upgrades or custom paint jobs, can increase your premium because they increase the value of the car.

- Potential Coverage Exclusions: Certain modifications, such as performance enhancements, can increase the risk of accidents and may be excluded from coverage.

- Professional Appraisal: If your car has extensive modifications, you might need a professional appraisal to determine its accurate value.

Maintaining Your Classic Car to Reduce Insurance Risk

Proper maintenance is not only essential for keeping your classic car running smoothly, but it can also help reduce your insurance risk and potentially lower your premiums. Here are some key maintenance tips:

- Regular Servicing: Schedule regular servicing with a qualified mechanic who specializes in classic cars.

- Fluid Checks: Regularly check and top off all fluids, including oil, coolant, brake fluid, and transmission fluid.

- Tire Maintenance: Maintain proper tire pressure and inspect your tires regularly for wear and tear.

- Brake Inspection: Have your brakes inspected regularly and replace worn brake pads or rotors.

- Electrical System: Keep your electrical system in good working order to prevent fires.

- Storage Conditions: Store your car in a clean, dry, and secure environment.

The Future of Classic Car Insurance Trends and Predictions

The classic car market is constantly evolving, and so is the insurance industry. Here are some trends and predictions to keep in mind:

- Increasing Values: Classic car values are generally increasing, which means you'll need to adjust your agreed value coverage accordingly.

- Electric Classic Cars: The rise of electric classic cars is creating new challenges for insurers, as they need to understand the unique risks associated with electric vehicles.

- Data-Driven Pricing: Insurance companies are increasingly using data to personalize pricing, which could mean that your premiums will be based on your driving habits and the specific characteristics of your car.

- Online Insurance Platforms: Online insurance platforms are making it easier to compare quotes and purchase classic car insurance.

Finding a Qualified Classic Car Appraiser for Accurate Valuation

Getting an accurate valuation is crucial for setting the right agreed value for your classic car. Here's how to find a qualified appraiser:

- Look for Certification: Choose an appraiser who is certified by a reputable organization, such as the American Society of Appraisers (ASA) or the International Automotive Appraisers Association (IAAA).

- Check Their Experience: Make sure the appraiser has experience appraising classic cars similar to yours.

- Ask for References: Ask the appraiser for references from previous clients.

- Review Their Methodology: Ask the appraiser about their appraisal methodology and make sure they use a comprehensive approach.

- Get a Written Report: Make sure the appraiser provides a written report that includes photos, documentation, and a detailed explanation of their valuation.

Protecting Your Investment A Summary of Key Takeaways

Insuring your classic car is a crucial step in protecting your investment. By understanding the unique needs of classic cars and choosing the right insurance policy, you can rest assured that your cherished ride is protected against loss, damage, and liability. Remember to get agreed value coverage, consider your driving habits, and maintain your car properly to minimize your risk and potentially lower your premiums. Happy motoring!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)