Best Car Insurance for Military Members

Understanding Car Insurance Needs for Military Personnel Military Car Insurance Considerations

Being in the military comes with unique challenges and responsibilities, and that extends to your car insurance needs. Unlike civilians who might only consider commute distance and driving record, military members often face deployments, frequent relocations, and specific vehicle usage scenarios that impact their insurance requirements. This section explores the key factors military personnel should consider when choosing car insurance.

- Deployment Coverage: Many standard car insurance policies don't adequately cover vehicles while deployed. You need to ensure your policy covers storage, potential damage, or even the possibility of selling your vehicle while overseas.

- Relocation Flexibility: Military families move frequently, often across state lines. Your car insurance needs to be transferable and compliant with the regulations of each new location. Some companies specialize in handling these transitions.

- Discounts for Military Members: Several insurance providers offer significant discounts to active duty, veterans, and their families. These discounts can significantly reduce your premiums.

- Vehicle Usage: Consider how you'll be using your vehicle. Will it be primarily for local commuting, or will you be driving long distances for leave or weekend trips? This impacts the level of coverage you need.

Top Car Insurance Companies Offering Military Discounts Comparing Military Car Insurance Options

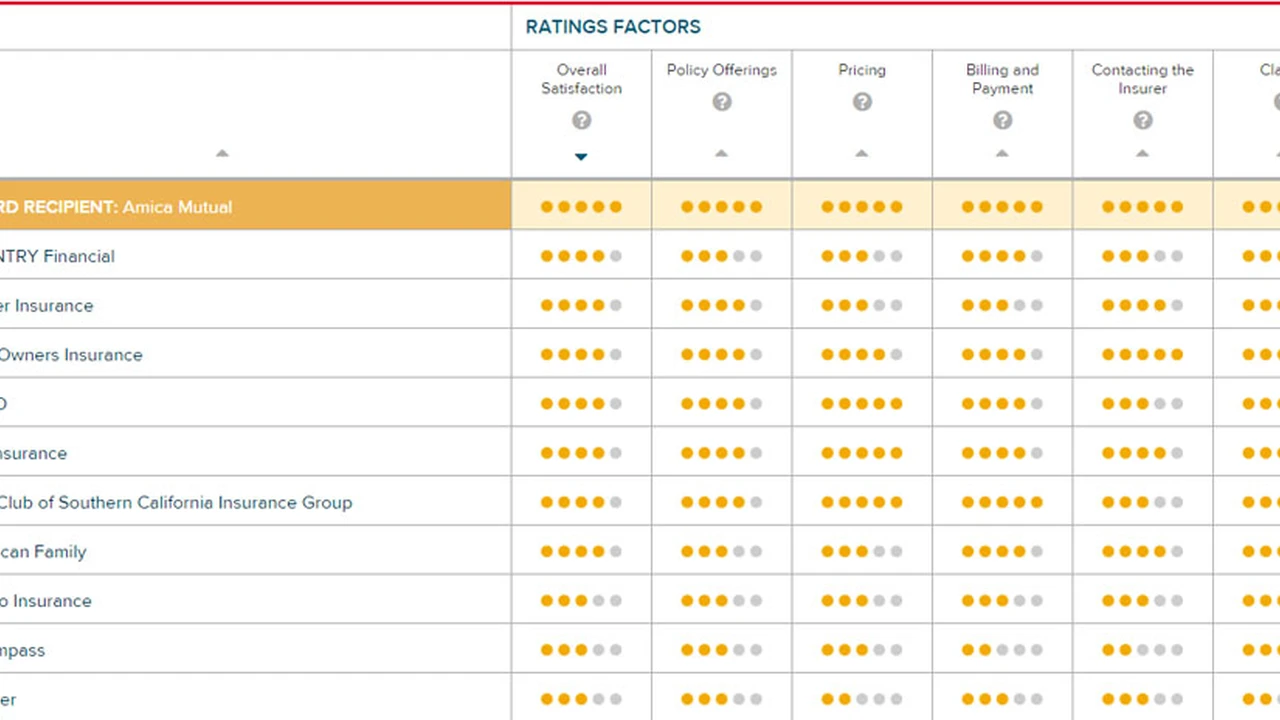

Finding the right car insurance company can be overwhelming. To simplify the process, we've compiled a list of top providers known for their exceptional military discounts and comprehensive coverage options.

- USAA: USAA is consistently ranked as one of the best insurance providers for military members. They offer competitive rates, excellent customer service, and a range of benefits tailored to military needs. To be eligible for USAA insurance, you generally need to be an active duty member, veteran, or a qualifying family member.

- GEICO: GEICO also provides military discounts and has a strong reputation for affordable rates. They offer a Military Assistance Team to help with specific needs and offer coverage in all 50 states.

- Armed Forces Insurance (AFI): AFI is specifically designed for military members and their families. They offer personalized service and a wide range of coverage options, including policies for deployed personnel.

- Liberty Mutual: Liberty Mutual offers military discounts and has a strong presence across the country, making them a convenient option for frequent movers.

USAA Car Insurance for Military Members Detailed USAA Car Insurance Review

USAA is a powerhouse in the military insurance market, and for good reason. Their commitment to serving the military community is evident in their policies, customer service, and overall approach. Let's delve deeper into what makes USAA a top choice.

- Pros:

- Excellent Customer Service: USAA is known for its exceptional customer service, with representatives trained to understand the unique needs of military members.

- Competitive Rates: USAA consistently offers some of the most competitive rates for car insurance, especially for those who qualify for their military discounts.

- Comprehensive Coverage: USAA offers a wide range of coverage options, including collision, comprehensive, liability, and uninsured/underinsured motorist protection.

- Deployment Coverage: USAA offers specific coverage for deployed personnel, including storage options and assistance with selling vehicles overseas.

- Financial Stability: USAA is a financially stable company, ensuring they can meet their obligations in the event of a claim.

- Cons:

- Eligibility Requirements: USAA is only available to active duty members, veterans, and their qualifying family members. This exclusivity limits their reach.

- Potential for Higher Rates in Some Areas: While generally competitive, USAA's rates might be higher in certain geographic areas due to local regulations or risk factors.

Coverage Details: USAA offers standard coverage options, but also provides unique benefits like:

- Accident Forgiveness: After a certain period of safe driving, USAA may forgive your first accident, preventing your rates from increasing.

- Diminishing Deductible: You can earn credits towards reducing your deductible over time by maintaining a safe driving record.

- Rental Car Reimbursement: USAA offers rental car reimbursement if your vehicle is being repaired after a covered accident.

GEICO Military Car Insurance Options GEICO Military Discount Explained

GEICO is another popular choice for military members, offering a combination of affordability, convenience, and a dedicated Military Assistance Team. Here's a closer look at GEICO's military car insurance options.

- Pros:

- Affordable Rates: GEICO is known for its competitive rates, making it a budget-friendly option for military members.

- Military Discounts: GEICO offers discounts to active duty, veterans, and members of the National Guard and Reserves.

- Military Assistance Team: GEICO has a dedicated Military Assistance Team to assist with specific needs and inquiries.

- Mobile App: GEICO's mobile app allows you to manage your policy, file claims, and access roadside assistance from your smartphone.

- Cons:

- Customer Service: While generally good, GEICO's customer service may not be as personalized as USAA's.

- Coverage Options: GEICO's coverage options may not be as comprehensive as some other providers.

Coverage Details: GEICO offers a range of standard coverage options, including:

- Liability Coverage: Covers damages you cause to others in an accident.

- Collision Coverage: Covers damages to your vehicle caused by a collision.

- Comprehensive Coverage: Covers damages to your vehicle caused by events other than a collision, such as theft, vandalism, or weather damage.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages.

Armed Forces Insurance AFI Car Insurance Review for Military Families

Armed Forces Insurance (AFI) is a specialized insurance provider exclusively serving the military community. Their focus on military needs allows them to offer tailored policies and personalized service.

- Pros:

- Military-Specific Policies: AFI offers policies specifically designed for military members, including coverage for deployments and frequent relocations.

- Personalized Service: AFI prides itself on providing personalized service, with representatives who understand the unique challenges faced by military families.

- Wide Range of Coverage Options: AFI offers a wide range of coverage options, including policies for homes, renters, and personal property.

- Cons:

- Eligibility Requirements: AFI is only available to active duty members, veterans, and their qualifying family members.

- Potentially Higher Rates: AFI's rates may be higher than some other providers, depending on your specific circumstances.

Coverage Details: AFI offers a variety of coverage options, including:

- Car Insurance: Provides coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection.

- Homeowners Insurance: Protects your home and personal property from damage or loss.

- Renters Insurance: Protects your personal property if you're renting a home or apartment.

- Personal Property Insurance: Covers your personal belongings, regardless of where they are located.

Comparing Car Insurance Costs for Military Members Factors Affecting Military Car Insurance Rates

The cost of car insurance can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and find the best rates.

- Driving Record: Your driving record is one of the most significant factors affecting your car insurance rates. A clean driving record with no accidents or violations will typically result in lower premiums.

- Vehicle Type: The type of vehicle you drive also impacts your rates. More expensive vehicles or those with higher repair costs tend to have higher premiums.

- Location: Your location plays a significant role in determining your rates. Urban areas with higher traffic density and crime rates typically have higher premiums than rural areas.

- Coverage Level: The level of coverage you choose also affects your rates. Higher coverage limits and additional features will result in higher premiums.

- Military Discounts: As discussed earlier, military discounts can significantly reduce your premiums. Be sure to inquire about available discounts when getting quotes.

Sample Rate Comparisons: (These are hypothetical examples and should not be taken as actual quotes. Actual rates will vary based on individual circumstances.)

- USAA: For a 30-year-old active duty member with a clean driving record and a 2020 Toyota Camry, a policy with liability, collision, and comprehensive coverage might cost around $1200 per year.

- GEICO: For the same driver and vehicle, GEICO might offer a similar policy for around $1300 per year.

- AFI: For the same driver and vehicle, AFI might offer a similar policy for around $1400 per year, with more personalized service.

Specific Car Insurance Products Recommended for Military Personnel Product Recommendations and Use Cases

Beyond choosing a specific insurance company, consider these specific products and features that can be particularly beneficial for military members.

- Gap Insurance: If you finance your vehicle, gap insurance can cover the difference between the loan amount and the vehicle's actual cash value if it's totaled in an accident. This is especially important if you have a long-term loan or put little money down.

- Rental Car Reimbursement: If your vehicle is being repaired after an accident, rental car reimbursement can cover the cost of a rental car, allowing you to maintain your mobility.

- Roadside Assistance: Roadside assistance provides coverage for services like towing, jump-starts, and tire changes, which can be invaluable if you experience a breakdown.

- Personal Injury Protection (PIP): PIP coverage can help pay for medical expenses and lost wages if you're injured in an accident, regardless of who is at fault. This is especially important if you live in a state with no-fault insurance laws.

- Usage-Based Insurance: Some companies, like Metromile, offer usage-based insurance, where your rates are based on how much you drive. This can be a good option if you don't drive frequently, especially if you're deployed for extended periods.

Navigating Frequent Relocations Military PCS Car Insurance Tips

Permanent Change of Station (PCS) moves are a common part of military life. Here's how to ensure your car insurance is up-to-date and compliant with the regulations of your new location.

- Update Your Address: As soon as you have a new address, notify your insurance company immediately. Failure to do so could invalidate your policy.

- Review State Requirements: Each state has different minimum car insurance requirements. Ensure your policy meets the requirements of your new state.

- Shop Around: Relocating is a good opportunity to shop around for new car insurance quotes. Rates can vary significantly between states.

- Consider Local Factors: Research the local driving conditions, traffic patterns, and crime rates in your new location. These factors can impact your insurance rates.

- Ask About Military Discounts: Be sure to ask about military discounts offered in your new state.

Addressing Vehicle Storage During Deployment Car Insurance for Deployed Military Members

If you're deploying for an extended period, you'll need to decide what to do with your vehicle. Here's how to handle car insurance when your vehicle is in storage.

- Suspend Coverage: You may be able to suspend certain coverage options, such as collision and liability, while your vehicle is in storage. However, you'll still need comprehensive coverage to protect against theft, vandalism, or weather damage.

- Lower Your Coverage Limits: You may be able to lower your coverage limits while your vehicle is in storage to reduce your premiums.

- Store Your Vehicle Safely: Store your vehicle in a secure location, such as a garage or storage facility, to minimize the risk of damage or theft.

- Notify Your Insurance Company: Let your insurance company know that your vehicle is in storage and provide them with the storage location.

Understanding Uninsured and Underinsured Motorist Coverage Protecting Yourself from Uninsured Drivers

Uninsured and underinsured motorist coverage protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages. This coverage is particularly important if you live in a state with a high percentage of uninsured drivers.

- Uninsured Motorist Coverage: Pays for your medical expenses, lost wages, and pain and suffering if you're hit by an uninsured driver.

- Underinsured Motorist Coverage: Pays for your damages if you're hit by a driver who has insurance, but their policy limits are not high enough to cover your damages.

- Consider Higher Limits: Consider purchasing higher limits of uninsured and underinsured motorist coverage to adequately protect yourself.

Leveraging Military Associations for Car Insurance Discounts Group Discounts for Military Personnel

Many military associations offer discounts on car insurance to their members. Check with your military associations to see if they offer any discounts.

- USAA: As mentioned earlier, USAA is a financial services company exclusively serving the military community and offers excellent rates and benefits.

- American Legion: The American Legion offers discounts on car insurance through various providers.

- Veterans of Foreign Wars (VFW): The VFW also offers discounts on car insurance to its members.

- Military Officers Association of America (MOAA): MOAA offers discounts on car insurance through various providers.

Final Thoughts on Choosing the Best Car Insurance for Military Members

Choosing the best car insurance for military members requires careful consideration of your unique needs and circumstances. By understanding the factors that affect your rates, comparing quotes from different providers, and leveraging available discounts, you can find a policy that provides adequate coverage at an affordable price. Don't hesitate to contact insurance companies directly to discuss your specific needs and get personalized recommendations.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)