Local vs. National Car Insurance Companies: Pros and Cons

Understanding Car Insurance Options Local vs National

Okay, so you're diving into the world of car insurance, and you're probably overwhelmed with choices. Local companies, national giants – what's the deal? Let's break it down. Think of it like choosing between your neighborhood coffee shop and Starbucks. Both serve coffee, but the vibe, the service, and even the coffee itself are different. Car insurance is the same way.

Local Car Insurance Companies Pros Personalized Service and Community Focus

Local car insurance companies, often smaller and regionally focused, can offer a more personalized touch. You might actually talk to the same person every time you call! They understand the specific needs of your community, like knowing which areas are prone to hail damage or have higher theft rates. They're invested in the local economy and often support community events. Think of them as the friendly face you see at the farmer's market.

Pros:

- Personalized Service: You're not just a number. You're a neighbor.

- Community Knowledge: They understand local risks and regulations.

- Flexibility: They might be more willing to work with you on specific needs.

- Supporting Local Business: You're contributing to your community's economy.

Cons:

- Limited Coverage Area: They might not be available if you move.

- Fewer Resources: They might have fewer financial resources than national companies.

- Less Technology: Their online tools and mobile apps might not be as advanced.

- Potentially Higher Prices: Depending on the area and risk pool, prices could be higher.

National Car Insurance Companies Pros Stability and Wide Coverage

National car insurance companies, on the other hand, are the big players. They have massive resources, sophisticated technology, and a presence across the country. They're like the chain restaurant you know you can find almost anywhere. They offer consistency and a wide range of coverage options.

Pros:

- Wide Coverage Area: You're covered no matter where you travel in the country.

- Financial Stability: They have the resources to handle large claims.

- Advanced Technology: User-friendly websites, mobile apps, and online claims processing.

- Competitive Pricing: They often offer discounts and competitive rates.

Cons:

- Impersonal Service: You might feel like just another number.

- Less Flexibility: They might be less willing to deviate from standard policies.

- Slower Claims Processing: Bureaucracy can sometimes slow things down.

- Lack of Local Knowledge: They might not be as familiar with specific local risks.

Comparing Car Insurance Coverage Options Understanding the Differences

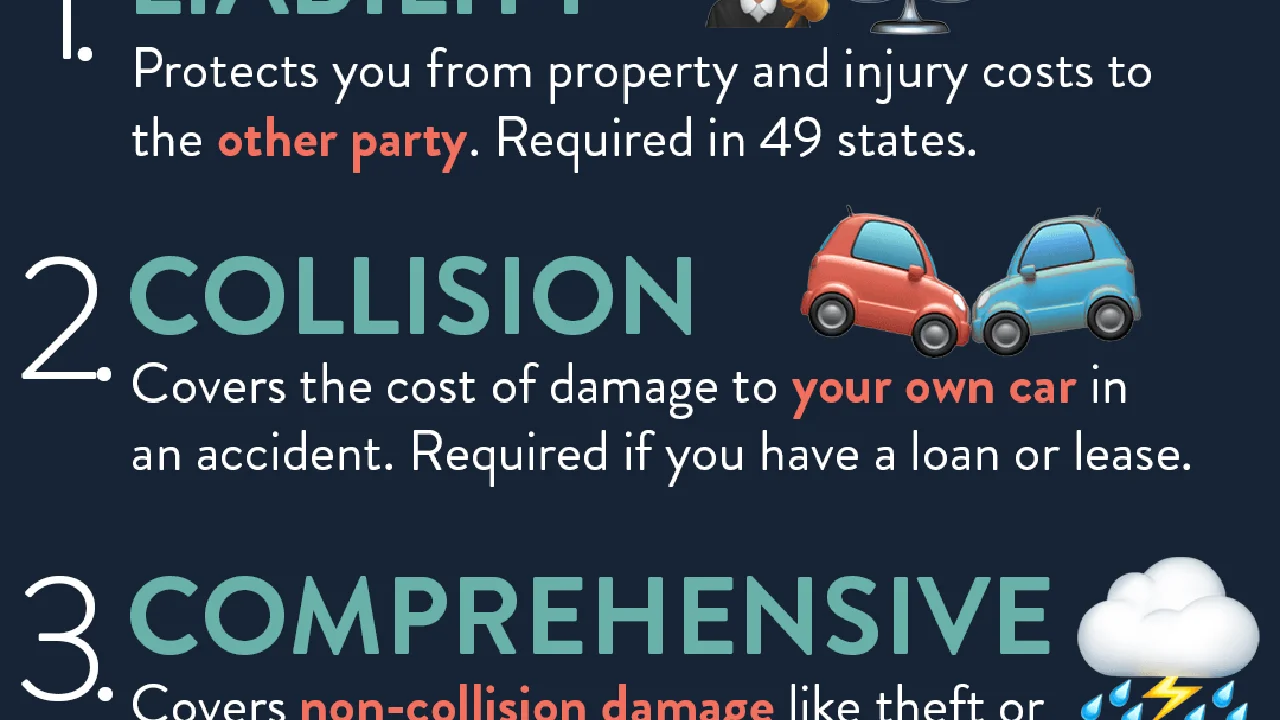

Beyond local vs. national, you need to understand the types of coverage available. Both types of companies offer similar core coverages, but the specifics can vary.

- Liability Coverage: Pays for damages you cause to others in an accident.

- Collision Coverage: Pays for damage to your car, regardless of fault.

- Comprehensive Coverage: Pays for damage to your car from things like theft, vandalism, or weather.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're hit by someone without insurance or with insufficient coverage.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault (in some states).

Car Insurance Product Recommendations and Usage Scenarios Examples and Pricing

Let's talk about some specific products and how they might fit your needs. Remember, prices are just estimates and can vary based on your location, driving history, and other factors. Always get a personalized quote!

Allstate Drivewise Discount Program Safe Driving Savings

Product: Allstate Drivewise

Type: Usage-based insurance (UBI) program

Description: Drivewise tracks your driving habits (speed, braking, time of day) using a mobile app or device. Safer driving earns you discounts. It's great for careful drivers who want to save money.

Usage Scenario: You're a student who drives mostly short distances and avoids late-night driving. You're a safe driver and consistently get good scores.

Pros: Potentially significant savings, encourages safe driving habits, easy to use app.

Cons: Privacy concerns (data tracking), penalties for aggressive driving, discounts aren't guaranteed.

Estimated Price: Discounts can range from 5% to 40% depending on driving habits. Let's say your initial premium is $1200 per year. With a 20% discount, you'd save $240.

State Farm's Steer Clear Program Young Driver Focus

Product: State Farm's Steer Clear Program

Type: Driver education program with potential discounts

Description: A program designed for young drivers (typically under 25). It involves completing online modules and quizzes about safe driving practices. Completion can lead to lower insurance rates.

Usage Scenario: You're a parent with a newly licensed teenager. You want to help them learn safe driving habits and lower their insurance costs.

Pros: Improves driving skills, potential for discounts, peace of mind for parents.

Cons: Time commitment to complete the program, discounts aren't guaranteed, might not be available in all states.

Estimated Price: The program itself is free. Discounts can vary, but let's say a 10% discount on a $1800 annual premium saves you $180.

Progressive's Snapshot Personalized Rates Based on Driving

Product: Progressive's Snapshot

Type: Usage-based insurance (UBI) program

Description: Similar to Allstate's Drivewise, Snapshot tracks your driving habits. It plugs into your car's OBD-II port or uses a mobile app. Progressive reviews the data and adjusts your rate accordingly. It’s ideal if you believe you’re a better driver than what your demographic data suggests.

Usage Scenario: You work from home and only drive occasionally. You're confident in your driving skills and want to prove it to your insurer.

Pros: Potential for significant savings, personalized rates, detailed feedback on driving habits.

Cons: Potential for rate increases if you're a poor driver, privacy concerns, device or app required.

Estimated Price: Savings can vary significantly. Some drivers report saving hundreds of dollars per year, while others see no change or even a slight increase. Let's say you save $300 on a $1500 annual premium.

Geico's Mobile App Easy Policy Management and Claims

Product: GEICO Mobile App

Type: Convenience and Policy Management Tool

Description: While not a specific insurance product, GEICO's mobile app is a powerful tool for managing your policy, filing claims, and accessing roadside assistance. It simplifies the insurance process.

Usage Scenario: You want a hassle-free experience managing your car insurance. You appreciate convenience and easy access to information.

Pros: Easy policy management, quick access to claims filing, roadside assistance at your fingertips, digital ID cards.

Cons: Requires a smartphone and internet access, some features may not be available in all areas.

Estimated Price: The app is free to download and use for GEICO customers. It enhances the overall value of your GEICO policy.

Comparing Car Insurance Companies Customer Service and Claims Handling

Beyond price, consider customer service and claims handling. Read online reviews, check ratings from organizations like J.D. Power, and ask friends and family for recommendations. A smooth claims process can make a huge difference if you're ever in an accident.

Car Insurance Discounts and Savings Maximizing Your Affordability

Don't forget about discounts! Both local and national companies offer a variety of discounts for things like:

- Safe Driving Record: No accidents or tickets.

- Good Student: Maintaining a good GPA.

- Multiple Vehicles: Insuring more than one car with the same company.

- Bundling Policies: Combining car insurance with home or renters insurance.

- Anti-Theft Devices: Installing alarms or tracking systems.

- Military Service: Being a member of the military or a veteran.

The Importance of Car Insurance Policy Reviews and Updates

Your car insurance needs can change over time. Review your policy annually or whenever you experience a significant life event, like getting married, buying a new car, or moving to a new address. Make sure your coverage still meets your needs.

Finding the Right Car Insurance Quote Getting Started

The best way to find the right car insurance is to shop around and compare quotes from multiple companies. Use online comparison tools, contact local agents, and talk to national insurers. Be sure to provide accurate information to get the most accurate quotes.

Final Thoughts on Choosing Car Insurance National or Local

Ultimately, the best choice between local and national car insurance companies depends on your individual needs and preferences. Consider what's most important to you – personalized service, wide coverage, competitive pricing, or advanced technology – and choose the company that best fits your criteria. Don't be afraid to ask questions and do your research. Good luck!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)