Advocating for Better Car Insurance Policies: Consumer Rights

Understanding Your Car Insurance Rights and How to Use Them

Okay, let's talk about something super important: your rights as a car insurance policyholder. A lot of people just blindly pay their premiums and hope they never need to use their insurance. But what happens when you *do* need it? Knowing your rights can be the difference between getting a fair settlement and getting totally ripped off. We're going to break down the key things you need to know, using real-world examples and keeping it as straightforward as possible.

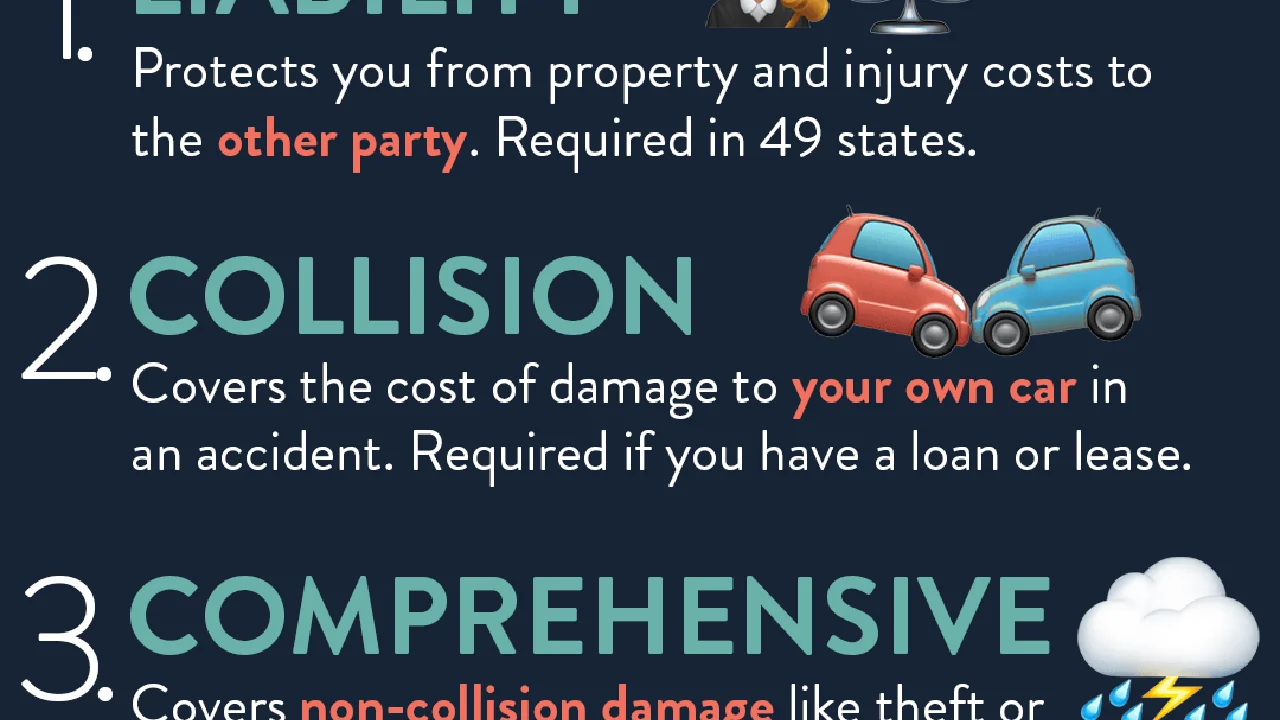

Key Car Insurance Consumer Rights You Should Know About Car Insurance Policy

First things first: transparency. You have the right to a clear and understandable policy. No jargon-filled mumbo jumbo that even a lawyer can't decipher. Your insurance company is legally obligated to provide you with a policy written in plain language. If you find something confusing, ask! Seriously, call them up and demand clarification. Don't be shy. It's *your* money, and *your* protection.

Next up: fair claim handling. This is a big one. After an accident, the insurance company has a responsibility to investigate your claim promptly and fairly. They can't drag their feet, ignore your calls, or make unreasonable demands. Think of it like this: they're on a clock. Each state has specific regulations about how quickly an insurance company must respond to a claim, investigate the accident, and make a settlement offer. Know your state's deadlines! A quick Google search for "[Your State] insurance claim deadlines" will give you the info you need. Keep a meticulous record of every interaction you have with the insurance company – dates, times, names, summaries of conversations. This is your ammo if things go south.

And speaking of fair settlements, you have the right to a settlement that adequately covers your damages. This includes not only the cost of repairing or replacing your vehicle, but also medical expenses, lost wages (if you were injured), and even pain and suffering (depending on the severity of the accident and your state's laws). The insurance company can't lowball you with a ridiculously cheap offer. They need to base their settlement on actual repair costs, medical bills, and lost income. If you think their offer is too low, don't be afraid to negotiate. Gather your evidence – repair estimates, medical records, pay stubs – and present a counter-offer. Be polite but firm.

Finally, you have the right to appeal. If the insurance company denies your claim, or if you're unhappy with their settlement offer, you have the right to appeal their decision. The appeals process varies from state to state, but it typically involves submitting a written appeal to the insurance company, providing additional evidence, and sometimes even attending a hearing. Again, know your state's regulations and deadlines for filing an appeal. Don't let the insurance company bully you into accepting an unfair settlement. If you believe you have a legitimate claim, fight for your rights.

Understanding Policy Exclusions and Limitations in Car Insurance

Now, let's get real about the fine print. Your insurance policy isn't a blank check. It has exclusions and limitations, which are basically things the insurance company *won't* cover. It's crucial to understand these exclusions so you're not caught off guard later.

Common exclusions include intentional acts (like deliberately crashing your car), driving under the influence of drugs or alcohol, using your car for commercial purposes (unless you have commercial auto insurance), and damage caused by wear and tear or lack of maintenance. For example, if your engine blows up because you haven't changed the oil in 50,000 miles, your insurance company probably won't cover it.

Limitations are caps on the amount of coverage you have. For example, your policy might have a $100,000 limit for bodily injury liability, which means the insurance company will only pay up to $100,000 for injuries you cause to another person in an accident. If the other person's medical bills exceed $100,000, you're on the hook for the rest. This is why it's so important to choose policy limits that adequately protect your assets.

Navigating the Claims Process and Dealing with Insurance Adjusters After a Car Accident

The claims process can be a total headache, but knowing what to expect can make it a little less painful. The first step is to report the accident to your insurance company as soon as possible. Even if you don't think you were at fault, it's always a good idea to notify your insurer. They can help you navigate the process and protect your interests.

Next, an insurance adjuster will be assigned to your claim. This is the person who will investigate the accident, assess the damages, and negotiate a settlement with you. Be polite and cooperative with the adjuster, but remember that they work for the insurance company, not for you. Their job is to minimize the amount of money the insurance company has to pay out. Don't be afraid to ask questions, and don't be pressured into accepting a settlement offer that you're not comfortable with.

Document everything. Take photos of the damage to your vehicles, gather all relevant documents (police report, medical bills, repair estimates, etc.), and keep a record of all communication with the insurance company. The more evidence you have, the stronger your case will be.

If you're dealing with a stubborn or uncooperative adjuster, consider hiring a public adjuster. A public adjuster is an independent professional who works on your behalf to negotiate a settlement with the insurance company. They typically charge a percentage of the settlement amount, but they can often get you a significantly larger settlement than you could get on your own. Just be sure to do your research and choose a reputable public adjuster with a proven track record.

When to Seek Legal Counsel Regarding Car Insurance Claims and Consumer Protection

Sometimes, you just can't handle the insurance company on your own. If you've been seriously injured in an accident, if the insurance company is denying your claim without a valid reason, or if you suspect the insurance company is acting in bad faith, it's time to call a lawyer. A qualified personal injury attorney can evaluate your case, advise you on your legal options, and negotiate with the insurance company on your behalf. They can also file a lawsuit if necessary to protect your rights.

Bad faith insurance practices include things like unreasonably delaying or denying a claim, failing to properly investigate a claim, misrepresenting the terms of the policy, or engaging in abusive or coercive tactics. If you believe the insurance company is acting in bad faith, you may be able to sue them for additional damages, including punitive damages, which are designed to punish the insurance company for their misconduct.

Don't be afraid to stand up for your rights. Insurance companies are big corporations with deep pockets, but you're not powerless. By knowing your rights and being prepared to fight for them, you can get the fair settlement you deserve.

Product Recommendations for Car Insurance Policy Holders

Okay, let's get practical. Besides having good insurance, what tools and services can help you protect yourself and advocate for your rights?

Dash Cams for Evidence Collection and Accident Documentation

Product: Vantrue N4 3 Channel Dash Cam

Use Case: Imagine you're in an accident and the other driver claims it was your fault, even though you know it wasn't. A dash cam can provide irrefutable video evidence to prove your innocence. The Vantrue N4 records the front, interior, and rear of your vehicle simultaneously, giving you a complete picture of what happened.

Comparison: Compared to cheaper dash cams that only record the front, the N4 offers much more comprehensive coverage. It also has excellent night vision, which is crucial for accidents that happen in low-light conditions. While pricier than some options, the peace of mind and potential legal benefits are well worth the investment.

Price: Around $280 - $350

Apps for Accident Reporting and Claim Management Regarding Car Insurance

Product: WreckCheck Mobile

Use Case: This app guides you through the process of documenting an accident at the scene. It prompts you to take photos of the damage, collect information from the other driver, and record witness statements. It then generates a professional-looking accident report that you can submit to your insurance company.

Comparison: Compared to relying on memory or scribbling notes on a piece of paper, WreckCheck Mobile provides a structured and organized way to document the accident. It also includes helpful tips and resources for dealing with insurance companies.

Price: Free (with in-app purchases for premium features)

Legal Services for Car Insurance Disputes and Consumer Rights

Product: LegalShield

Use Case: Need to talk to a lawyer about your insurance claim but don't want to pay exorbitant hourly fees? LegalShield provides access to a network of attorneys for a monthly subscription fee. You can get advice on your claim, have an attorney review your policy, or even have them write a letter to the insurance company on your behalf.

Comparison: Compared to hiring a lawyer on an hourly basis, LegalShield can be a much more affordable option, especially if you anticipate needing legal assistance on an ongoing basis. However, it's important to carefully review the terms of the subscription and make sure it meets your specific needs.

Price: Around $30 - $50 per month

DIY Car Repair Manuals for Damage Assessment and Claim Negotiation

Product: Chilton or Haynes Repair Manuals

Use Case: Understanding the extent of the damage to your car can help you negotiate a fairer settlement with the insurance company. Repair manuals provide detailed diagrams and instructions for disassembling and repairing various parts of your vehicle. This knowledge can help you identify hidden damage and challenge lowball repair estimates.

Comparison: While not a substitute for a professional mechanic, a repair manual can give you a better understanding of the repair process and help you advocate for a fair settlement. It's a valuable resource for DIY enthusiasts and anyone who wants to be more informed about their car.

Price: Around $20 - $40

Online Car Valuation Tools for Fair Settlement Evaluation

Product: Kelley Blue Book (KBB) or Edmunds

Use Case: If your car is totaled, the insurance company will offer you a settlement based on its "fair market value." Use KBB or Edmunds to get an independent estimate of your car's value based on its year, make, model, mileage, and condition. This will help you determine if the insurance company's offer is fair.

Comparison: These online valuation tools provide a reliable and unbiased estimate of your car's value. They're a valuable resource for negotiating a fair settlement and ensuring you're not being shortchanged.

Price: Free

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)