Medical Payments Coverage: Paying for Injuries

Understanding Medical Payments Coverage MedPay Basics

So, you've been in a car accident. Ouch! One of the first things you're probably thinking about is how you're going to pay for your medical bills. That's where Medical Payments coverage, often called MedPay, comes in. Think of it as a little safety net for those initial medical expenses, regardless of who was at fault for the accident. It's designed to kick in quickly and help you get the treatment you need without waiting for fault to be determined or insurance companies to bicker. MedPay usually covers things like ambulance rides, doctor visits, hospital stays, X-rays, and even things like chiropractic care. It can even cover funeral expenses in the unfortunate event of a fatality. The specific coverage details and limits will depend on your policy, so it's always a good idea to check your policy documents. For example, you might have a $5,000 MedPay limit, meaning your insurance will pay up to $5,000 in medical bills related to the accident. It's important to note that MedPay is usually secondary to your health insurance, meaning it will pay after your health insurance has paid its share. However, it can be incredibly useful for covering deductibles, co-pays, or services that your health insurance doesn't cover.

What MedPay Covers Injuries and Expenses

Let's dive a little deeper into what MedPay actually covers. As mentioned, it generally includes a wide range of medical expenses related to an accident, including:

- Ambulance Services: Those ambulance rides aren't cheap! MedPay can help cover the cost of getting you to the hospital.

- Doctor Visits: From your initial check-up to follow-up appointments, MedPay can help with the bills.

- Hospital Stays: Hospital stays can be incredibly expensive. MedPay can cover a portion of those costs.

- Surgery: If you need surgery as a result of the accident, MedPay can help cover the surgical costs.

- X-rays and Diagnostic Tests: These tests are crucial for diagnosing injuries, and MedPay can help pay for them.

- Chiropractic Care: Many people find chiropractic care helpful after an accident, and MedPay often covers these treatments.

- Physical Therapy: Recovering from injuries often requires physical therapy, which MedPay can also help with.

- Dental Work: If you damage your teeth in the accident, MedPay can cover the dental work.

- Prosthetic Devices: If you require prosthetic devices as a result of your injuries, MedPay can help cover the cost.

- Funeral Expenses: In the tragic event of a fatality, MedPay can help cover funeral expenses.

One of the key benefits of MedPay is that it covers *you* and your *passengers*, regardless of who was at fault. It can also cover you if you're injured as a pedestrian or cyclist by a vehicle. This makes it a really valuable form of protection. However, remember to check your policy for specific exclusions and limitations. For example, some policies might exclude injuries sustained while committing a crime or while under the influence of alcohol or drugs.

MedPay vs Health Insurance Understanding the Differences

While both MedPay and health insurance help cover medical expenses, there are some key differences. Health insurance is your primary coverage for all your medical needs, while MedPay is specifically designed for injuries sustained in car accidents. Here's a breakdown of the key differences:

- Primary vs. Secondary: Health insurance is usually your primary coverage, meaning it pays first. MedPay typically pays secondary, covering costs after your health insurance has paid its share.

- Fault: MedPay pays regardless of who was at fault for the accident. Health insurance pays regardless of how you were injured.

- Coverage Scope: Health insurance covers a wide range of medical conditions, while MedPay is limited to injuries sustained in car accidents.

- Deductibles and Co-pays: MedPay can help cover your health insurance deductible and co-pays, reducing your out-of-pocket expenses.

- Coverage for Passengers: MedPay typically covers your passengers, while your health insurance only covers you.

Let's say you have a $1,000 deductible on your health insurance policy and you incur $3,000 in medical bills after a car accident. Your health insurance would pay $2,000 (after you pay the $1,000 deductible). If you have a $5,000 MedPay policy, it could cover that $1,000 deductible, meaning you wouldn't have to pay anything out of pocket. This is a huge benefit, especially if you have a high-deductible health insurance plan.

Who Needs MedPay Considering Your Situation

So, who really *needs* MedPay? Well, it depends on your individual circumstances. Here are some situations where MedPay can be particularly valuable:

- High-Deductible Health Insurance: If you have a high-deductible health insurance plan, MedPay can help cover that deductible in the event of a car accident.

- Limited Health Insurance: If you have limited health insurance coverage or no health insurance at all, MedPay can provide essential coverage for medical expenses after an accident.

- Frequent Drivers: If you drive frequently, your risk of being in an accident is higher, making MedPay a worthwhile investment.

- Passengers: If you often have passengers in your car, MedPay can provide coverage for their injuries as well.

- Motorcyclists and Cyclists: If you are a cyclist or motorcyclist, you are at higher risk of serious injuries from accidents, MedPay can offer peace of mind.

- States with "No-Fault" Insurance: In "no-fault" states, MedPay or Personal Injury Protection (PIP) is often required to cover medical expenses, regardless of fault.

Even if you have good health insurance, MedPay can still be beneficial. It can help cover co-pays, services not covered by your health insurance, and provide coverage for your passengers. Ultimately, the decision of whether or not to purchase MedPay is a personal one, based on your individual risk tolerance and financial situation.

MedPay Coverage Limits and Policy Details

Understanding the coverage limits and policy details of your MedPay policy is crucial. Coverage limits typically range from $1,000 to $25,000 or more, depending on the policy and the state. The higher the limit, the more coverage you have, but the higher your premium will likely be. It's important to choose a limit that adequately covers your potential medical expenses.

Here are some key policy details to consider:

- Coverage Limit: The maximum amount your policy will pay per person, per accident.

- Deductible: Some MedPay policies may have a deductible, which is the amount you have to pay out of pocket before the insurance company starts paying.

- Exclusions: Be aware of any exclusions in your policy, such as injuries sustained while committing a crime or while under the influence.

- Time Limit: Most MedPay policies have a time limit for submitting claims, typically one to two years from the date of the accident.

- Subrogation: Subrogation is the right of the insurance company to recover payments they made from the at-fault party. In some cases, your MedPay insurer may seek to recover payments from the at-fault driver's insurance company.

Read your policy documents carefully to understand the specific coverage details and limitations. If you have any questions, don't hesitate to contact your insurance agent or company for clarification.

Filing a MedPay Claim A Step by Step Guide

Okay, so you've been in an accident and you need to file a MedPay claim. Here's a step-by-step guide to help you through the process:

- Seek Medical Attention: Your health is the priority. Get the medical attention you need as soon as possible.

- Report the Accident: Report the accident to your insurance company as soon as possible.

- Gather Information: Collect all relevant information, including the police report, medical records, and bills.

- Contact Your Insurance Company: Contact your insurance company to initiate the MedPay claim process.

- Complete the Claim Form: Fill out the MedPay claim form accurately and completely.

- Submit Documentation: Submit all required documentation, including medical records, bills, and the police report.

- Follow Up: Follow up with your insurance company to check on the status of your claim.

- Appeal if Necessary: If your claim is denied, you have the right to appeal.

Be sure to keep copies of all documents you submit to your insurance company. It's also a good idea to keep a record of all communication with your insurance company, including dates, times, and the names of the people you spoke with.

MedPay and Subrogation What You Need to Know

Subrogation can be a confusing aspect of MedPay. Essentially, it's the right of your insurance company to recover payments they made on your behalf from the at-fault party. Here's how it works:

Let's say you're injured in an accident caused by another driver. Your MedPay policy pays for your medical bills. Your insurance company then has the right to pursue the at-fault driver's insurance company to recover the payments they made to you. If they are successful, they may reimburse you for your deductible or other out-of-pocket expenses.

Subrogation can be beneficial to you because it can help you recover some of the money you spent on medical bills. However, it can also be complicated, so it's important to understand your rights and obligations. Your insurance company will typically handle the subrogation process, but you may need to cooperate with them by providing information or documentation.

MedPay in No Fault States Navigating the System

In "no-fault" states, also known as Personal Injury Protection (PIP) states, the rules regarding medical payments after an accident are different. In these states, your own insurance company pays for your medical bills, regardless of who was at fault for the accident. This is designed to speed up the claims process and reduce the number of lawsuits.

In no-fault states, you're typically required to carry PIP coverage, which includes medical payments coverage. The specific coverage limits and requirements vary by state. Even in no-fault states, you may still be able to sue the at-fault driver for pain and suffering or other damages if your injuries are serious enough. However, there are often limitations on when you can sue.

Navigating the insurance system in a no-fault state can be complex. It's important to understand the specific laws and regulations in your state and to work with an experienced attorney if you have any questions or concerns.

Cost of MedPay Factors Affecting Premiums

The cost of MedPay varies depending on several factors, including:

- Coverage Limit: Higher coverage limits will result in higher premiums.

- Deductible: Policies with a deductible may have lower premiums.

- Location: Premiums may be higher in areas with higher accident rates.

- Driving Record: Drivers with a history of accidents or traffic violations may pay higher premiums.

- Vehicle Type: The type of vehicle you drive can also affect your premiums.

It's important to shop around and compare quotes from different insurance companies to find the best rates. You can also ask about discounts, such as discounts for safe drivers or for bundling your auto insurance with other policies.

Comparing MedPay Insurance Companies and Products

Choosing the right MedPay insurance company and product can be a challenge. Here’s a comparison of some well-regarded providers and their general offerings (note that specific policies and pricing will vary greatly based on individual factors and location):

State Farm MedPay

Overview: State Farm is one of the largest auto insurance providers in the United States, known for its financial stability and comprehensive coverage options. MedPay Features: State Farm’s MedPay coverage is typically available with varying limits, allowing customers to tailor the coverage to their needs. They offer quick claim processing and a user-friendly mobile app for managing policies. Pros:

- Strong customer service reputation.

- Wide range of coverage options.

- Easy-to-use mobile app.

- Premiums can be slightly higher compared to some competitors.

- Availability of specific MedPay features may vary by state.

GEICO MedPay

Overview: GEICO is known for its competitive pricing and straightforward insurance products. MedPay Features: GEICO offers MedPay coverage with flexible limits, often included as part of their standard auto insurance packages. Claims can be filed online or via phone, and they offer 24/7 customer support. Pros:

- Competitive pricing.

- 24/7 customer support.

- Easy online claim filing.

- Customer service can be inconsistent based on region.

- Fewer local agent offices compared to State Farm.

Progressive MedPay

Overview: Progressive is known for its innovative insurance products and online tools, including the “Name Your Price” tool. MedPay Features: Progressive includes MedPay as an optional add-on to their auto insurance policies. They offer a variety of coverage limits and provide online resources for managing policies and filing claims. Pros:

- Innovative online tools and resources.

- Flexible coverage options.

- Competitive pricing.

- Customer service ratings can be mixed.

- Policy terms can be complex, requiring careful review.

USAA MedPay

Overview: USAA is exclusively available to military members and their families, known for exceptional customer service and comprehensive insurance products. MedPay Features: USAA offers MedPay coverage as part of their auto insurance policies with generous limits and competitive pricing. They are consistently ranked high in customer satisfaction surveys. Pros:

- Exceptional customer service.

- Competitive pricing for military members.

- Comprehensive coverage options.

- Eligibility is limited to military members and their families.

- Fewer physical office locations.

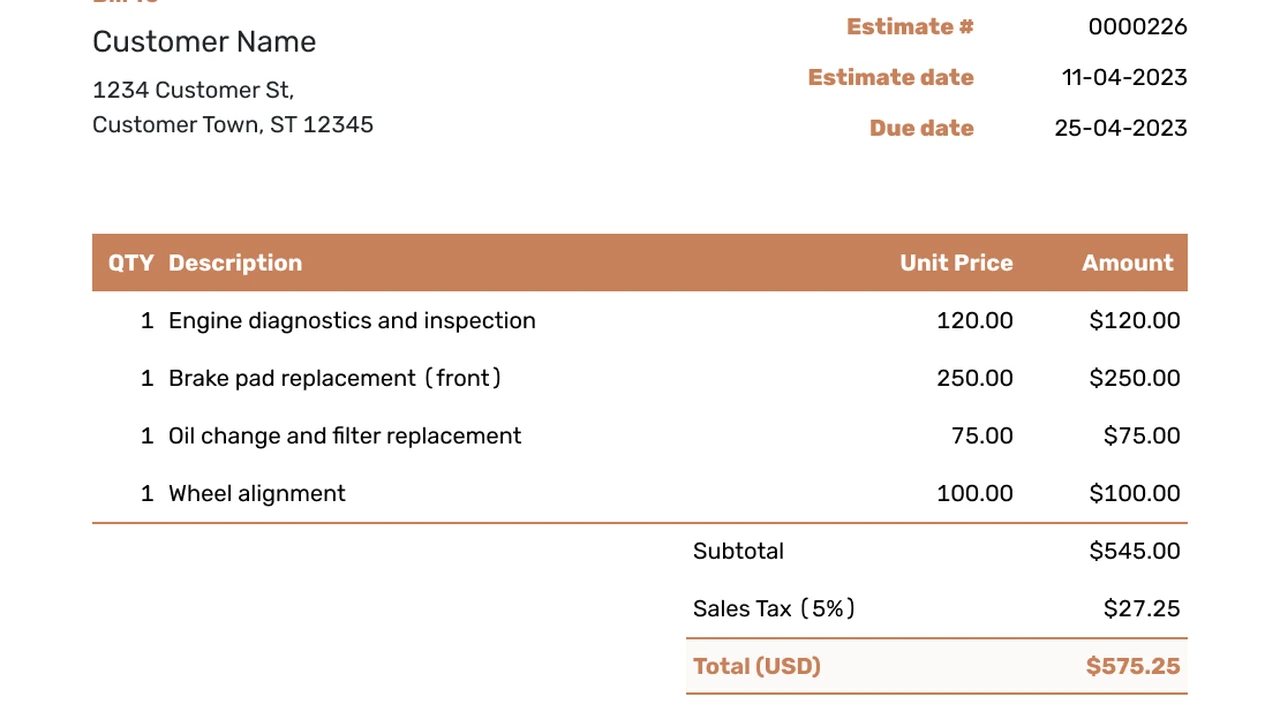

Example MedPay Product Comparison

Let's consider a hypothetical scenario where you are choosing between State Farm and GEICO for MedPay coverage. Assume you live in a state where both providers offer similar coverage options. Scenario: You are a 35-year-old driver with a clean driving record looking for MedPay coverage with a $5,000 limit. State Farm:

- Annual Premium: $1,200

- MedPay Coverage: $5,000

- Additional Benefits: Access to local agents, comprehensive coverage options

- Annual Premium: $1,100

- MedPay Coverage: $5,000

- Additional Benefits: 24/7 customer support, easy online claim filing

Sample MedPay Costs and Considerations

To provide a more concrete understanding, here are a few example MedPay cost scenarios:

- Low-Limit MedPay ($1,000): This is a basic level of coverage and typically adds a minimal amount to your premium, often between $20 to $50 per year. It’s suitable for those with robust health insurance coverage who primarily want MedPay to cover small co-pays or deductibles.

- Mid-Range MedPay ($5,000): A $5,000 limit offers a more substantial safety net. It might add $75 to $150 per year to your premium. This level is ideal for those with average health insurance plans and a need to cover potential out-of-pocket costs.

- High-Limit MedPay ($10,000+): For those with minimal health insurance or who frequently have passengers in their vehicle, a high-limit MedPay policy is beneficial. This could add $150 to $300+ per year to the premium, depending on other factors.

These costs are estimates and can vary significantly based on your driving record, location, and the specific insurance provider. Always get personalized quotes to make an informed decision.

MedPay Alternatives to Consider

While MedPay is a valuable coverage option, it's not the only way to protect yourself financially after a car accident. Here are some alternatives to consider:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're injured by an uninsured or underinsured driver. It can cover medical expenses, lost wages, and pain and suffering.

- Personal Injury Protection (PIP): As mentioned earlier, PIP is a type of no-fault insurance that covers medical expenses and lost wages, regardless of who was at fault for the accident. It's required in some states.

- Umbrella Insurance: Umbrella insurance provides additional liability coverage beyond your auto and homeowners insurance policies. It can protect you if you're sued for damages resulting from an accident.

- Health Insurance: Your health insurance policy will cover medical expenses, but you may have to pay deductibles, co-pays, and co-insurance.

Consider your individual needs and circumstances when choosing the best coverage options for you. It's always a good idea to consult with an insurance professional to get personalized advice.

Making an Informed Decision About MedPay

Ultimately, the decision of whether or not to purchase MedPay is a personal one. Consider your individual circumstances, risk tolerance, and financial situation. If you have good health insurance and a low deductible, MedPay may not be necessary. However, if you have a high-deductible health insurance plan, frequently have passengers in your car, or live in a state with a high accident rate, MedPay can be a valuable investment.

Here are some key questions to ask yourself when making your decision:

- Do I have adequate health insurance coverage?

- What is my health insurance deductible?

- Do I frequently have passengers in my car?

- Do I live in a state with a high accident rate?

- What is my risk tolerance?

- What is my budget?

By carefully considering these factors, you can make an informed decision about whether or not MedPay is right for you. Don't hesitate to reach out to insurance professionals for personalized guidance and quotes. Getting multiple quotes and comparing coverage options is always the best approach to ensure you're making a well-informed choice.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)