Shopping Around: Compare Car Insurance Quotes Online

Understanding the Importance of Comparing Car Insurance Quotes Online

Alright, let's talk car insurance. Nobody loves thinking about it, but trust me, spending a little time comparing quotes online can save you a serious chunk of change. Think of it like this: you wouldn't buy the first car you see, right? You'd shop around, compare features, and haggle on price. Car insurance is the same deal! Different companies use different formulas to calculate your premium, so the price for the exact same coverage can vary wildly.

Why Online Comparison is Your Best Bet for Cheap Car Insurance

Back in the day, you'd have to call a bunch of agents, answer the same questions over and over, and wait for them to get back to you with quotes. Ugh! Online comparison tools are a lifesaver. They let you enter your information once and get quotes from multiple companies almost instantly. Plus, you can do it from the comfort of your couch, wearing your pajamas. What's not to love?

Key Factors Influencing Car Insurance Quotes Online

Okay, so what actually affects how much you pay? Here's the lowdown:

- Your Driving Record: This is a biggie. Clean driving record? You're golden. Accidents and tickets? Expect to pay more. Think of it as a reward for being a responsible driver.

- Your Age and Gender: Sorry, but statistics play a role. Younger drivers (especially males) tend to pay more because they're statistically more likely to get into accidents.

- Your Location: City driving is riskier than rural driving. So, living in a bustling metropolis usually means higher premiums.

- The Car You Drive: A flashy sports car is going to cost more to insure than a sensible sedan. The more expensive the car is to repair or replace, the higher your premium.

- Your Coverage Limits and Deductibles: The more coverage you have, the more you'll pay. Choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) can lower your premium.

- Your Credit Score: In many states, insurance companies use your credit score to help determine your risk. A good credit score can translate to lower premiums.

Step-by-Step Guide to Comparing Car Insurance Quotes Online

Ready to dive in? Here's how to do it:

- Gather Your Information: You'll need your driver's license, vehicle information (make, model, year), and social security number (for identification purposes). Have this handy before you start.

- Choose a Reputable Comparison Site: There are tons of sites out there, but not all are created equal. Look for well-known, established sites with good reviews. We'll recommend a few later.

- Enter Your Information Carefully: Accuracy is key! Double-check everything you enter. Even a small mistake can affect your quote.

- Compare the Quotes: Don't just look at the price! Pay attention to the coverage limits, deductibles, and any additional features.

- Read the Fine Print: Before you commit, read the policy details carefully. Make sure you understand what's covered and what's not.

- Contact the Insurance Company: If you have any questions, don't hesitate to call the insurance company directly.

Recommended Online Car Insurance Comparison Tools and Websites

Okay, let's get down to brass tacks. Here are a few online comparison tools that are worth checking out:

- NerdWallet: NerdWallet is a great resource for all things personal finance, including car insurance. They offer a comprehensive comparison tool that lets you see quotes from multiple companies side-by-side.

Pros: User-friendly interface, lots of helpful information and resources, unbiased reviews.

Cons: Can be a bit overwhelming with all the information available.

- The Zebra: The Zebra is specifically focused on car insurance comparison. They claim to offer the most accurate and comprehensive quotes.

Pros: Specializes in car insurance, offers a wide range of quotes, easy to use.

Cons: Some users have reported issues with inaccurate quotes in certain situations.

- QuoteWizard: QuoteWizard is another popular option that provides quotes from multiple insurance companies.

Pros: Fast and easy to use, offers a variety of coverage options.

Cons: Can be a bit aggressive with follow-up emails and phone calls.

Comparing Specific Car Insurance Products and Coverage Options

Beyond just finding the cheapest quote, it's crucial to understand what you're actually getting. Here's a breakdown of some common coverage options:

- Liability Coverage: This is the bare minimum required in most states. It covers damages you cause to others if you're at fault in an accident.

Usage Scenario: You rear-end another car. Liability coverage pays for the damage to their car and any injuries they sustain.

Comparison: Minimum liability coverage is usually cheaper, but it might not be enough to cover all the damages in a serious accident. Consider higher limits for better protection.

Pricing: Varies widely based on location and coverage limits. Minimum coverage might cost $50-$100 per month, while higher limits could be $150-$300 per month.

- Collision Coverage: This covers damage to your car if you're involved in an accident, regardless of who's at fault.

Usage Scenario: You hit a tree while driving in bad weather. Collision coverage pays for the repairs to your car.

Comparison: Collision coverage is optional but highly recommended, especially for newer cars. The higher your deductible, the lower your premium.

Pricing: Typically costs $50-$200 per month, depending on your car's value and your deductible.

- Comprehensive Coverage: This covers damage to your car from things other than collisions, such as theft, vandalism, fire, or natural disasters.

Usage Scenario: Your car is stolen. Comprehensive coverage pays for the replacement of your car (minus your deductible).

Comparison: Like collision coverage, comprehensive coverage is optional but a good idea, especially if you live in an area prone to theft or natural disasters.

Pricing: Usually costs $20-$100 per month, depending on your car's value and your deductible.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by someone who doesn't have insurance or doesn't have enough insurance to cover your damages.

Usage Scenario: You're hit by a driver who only has the minimum liability coverage, which isn't enough to cover your medical bills. Uninsured/underinsured motorist coverage kicks in to help.

Comparison: This is a valuable coverage to have, as it protects you from irresponsible drivers.

Pricing: Typically costs $10-$50 per month.

Tips and Tricks for Lowering Your Car Insurance Premiums Online

Want to save even more money? Here are a few extra tips:

- Increase Your Deductible: As mentioned earlier, a higher deductible means a lower premium. Just make sure you can afford to pay that deductible if you need to file a claim.

- Bundle Your Insurance: If you have homeowners or renters insurance, consider bundling it with your car insurance. Many companies offer discounts for bundling.

- Maintain a Good Credit Score: Keep your credit score high by paying your bills on time and keeping your credit utilization low.

- Take a Defensive Driving Course: Some insurance companies offer discounts for completing a defensive driving course.

- Shop Around Regularly: Don't just set it and forget it! Car insurance rates change frequently. Shop around every year or two to make sure you're still getting the best deal.

- Ask About Discounts: Don't be afraid to ask about discounts! Many companies offer discounts for things like being a student, being a member of a certain organization, or having safety features on your car.

Real-World Examples of Car Insurance Savings Using Online Comparison Tools

Let's look at a couple of hypothetical scenarios:

Scenario 1: Sarah, a 25-year-old living in Chicago, drives a Honda Civic. She has a clean driving record but a mediocre credit score. By comparing quotes online, she was able to save $300 per year by switching from a major national insurer to a smaller, regional company that offered better rates for her demographic.

Scenario 2: John, a 40-year-old living in a rural area, drives a pickup truck. He had a minor accident a few years ago. By increasing his deductible from $500 to $1000 and shopping around online, he was able to lower his premium by $200 per year.

The Future of Car Insurance Shopping Online and Technological Advancements

The car insurance landscape is constantly evolving, with new technologies and innovations emerging all the time. Here are a few things to keep an eye on:

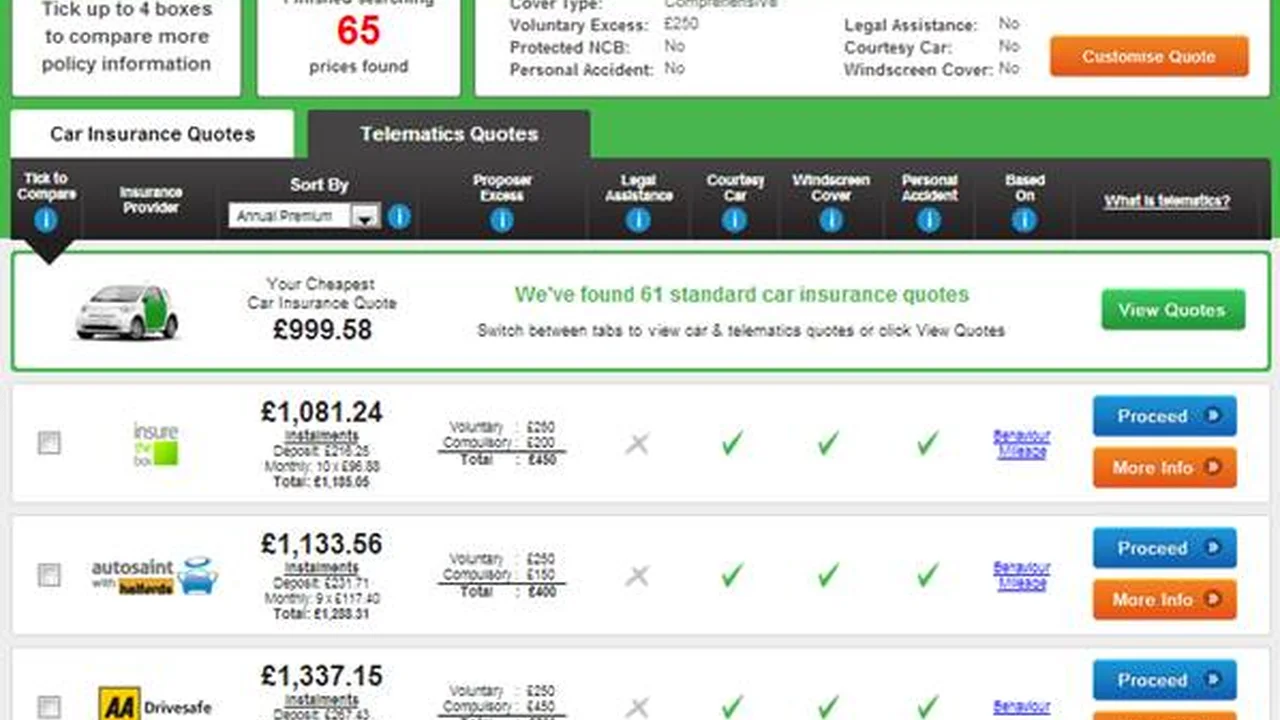

- Telematics: Telematics devices (like those offered by Progressive's Snapshot program) track your driving habits and offer discounts based on your performance.

- Usage-Based Insurance: Similar to telematics, usage-based insurance charges you based on how much you drive. This can be a good option if you don't drive very often.

- AI-Powered Claims Processing: Some insurance companies are using AI to automate and speed up the claims process.

- Autonomous Vehicles: As self-driving cars become more prevalent, the car insurance industry will need to adapt to new risks and liabilities.

Potential Pitfalls and How to Avoid Car Insurance Scams Online

While shopping for car insurance online is generally safe, it's important to be aware of potential scams. Here are a few red flags to watch out for:

- Unsolicited Emails or Phone Calls: Be wary of unsolicited emails or phone calls offering unbelievably low rates.

- Requests for Personal Information Upfront: Legitimate insurance companies won't ask for your social security number or bank account information until you're ready to purchase a policy.

- High-Pressure Sales Tactics: If someone is trying to pressure you into buying a policy immediately, it's probably a scam.

- Typos and Grammatical Errors: Scam websites often have typos and grammatical errors.

- No Contact Information: Legitimate insurance companies will have clear contact information on their website.

If you suspect you've encountered a car insurance scam, report it to the Federal Trade Commission (FTC).

The Importance of Regularly Reviewing and Updating Your Car Insurance Policy

Life changes, and so should your car insurance policy. Make sure to review and update your policy whenever you experience a major life event, such as:

- Moving to a New Location: Your rates will likely change if you move to a different city or state.

- Buying a New Car: You'll need to update your policy to reflect your new vehicle.

- Getting Married or Divorced: Your marital status can affect your rates.

- Adding or Removing Drivers: If you add a new driver to your policy (like a teenage child), your rates will increase. If you remove a driver, your rates may decrease.

- Experiencing a Change in Your Driving Record: Accidents and tickets will affect your rates.

By regularly reviewing and updating your policy, you can ensure that you have the right coverage at the best possible price.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)