SR-22 Insurance: What It Is and Why You Need It

Understanding SR-22 Insurance A Comprehensive Guide

Okay, so you've heard the term "SR-22 insurance" floating around. Maybe you even got a letter saying you need one. Don't panic! It sounds scary, but it's really just a form proving you have car insurance. Think of it as a pinky swear to the DMV that you're financially responsible. This guide breaks down everything you need to know about SR-22 insurance, why you might need it, and how to get it.

Why Do I Need SR-22 Insurance Common Reasons and Situations

So, what lands you in the SR-22 club? Here are some common reasons:

- DUI or DWI: Driving under the influence is a big no-no, and it often results in an SR-22 requirement.

- Driving Without Insurance: Getting caught driving uninsured can trigger the need for an SR-22.

- Suspended License: If your license is suspended for any reason, an SR-22 might be required to reinstate it.

- Multiple Traffic Violations: Rack up too many speeding tickets or other moving violations, and you might be looking at an SR-22.

- At-Fault Accident Without Insurance: Causing an accident without insurance can definitely lead to SR-22 requirements.

Basically, if you've shown a pattern of risky driving behavior, the state wants assurance that you're insured before they let you back on the road.

How SR-22 Insurance Works Filing and Maintaining Compliance

Getting an SR-22 isn't a separate insurance policy. It's a certificate your insurance company files with the state. Here's the process:

- Contact Your Insurance Company: Tell them you need an SR-22 filing. If your current insurer doesn't offer SR-22s, you'll need to find a new one.

- The Insurance Company Files the SR-22: They'll electronically file the SR-22 form with the state's DMV.

- Maintain Continuous Coverage: This is crucial! If your insurance lapses for any reason (non-payment, cancellation, etc.), your insurance company is required to notify the state. This can lead to a license suspension.

- Keep the SR-22 for the Required Period: The length of time you need to maintain the SR-22 varies by state, but it's typically 3 years.

Think of it like this: you're proving to the state that you're consistently insured. Any lapse in coverage breaks that promise, and you'll face consequences.

Finding Affordable SR-22 Insurance Rates and Quotes

SR-22 insurance generally costs more than standard insurance. This is because you're considered a higher-risk driver. However, you can still shop around to find the best rates. Here are some tips:

- Shop Around: Get quotes from multiple insurance companies that offer SR-22 filings. Don't settle for the first quote you get.

- Compare Quotes Carefully: Pay attention to the coverage levels, deductibles, and any other fees.

- Improve Your Driving Record: While you have the SR-22, be extra careful to avoid any traffic violations or accidents. A clean record can help lower your rates in the future.

- Consider a Higher Deductible: A higher deductible can lower your monthly premium, but make sure you can afford to pay it if you have an accident.

SR-22 Insurance Coverage Options Understanding Your Policy

SR-22 isn't a type of coverage itself. It's just a certificate. You still need to choose the right insurance coverage for your needs. Here are some common types of coverage:

- Liability Insurance: This covers damages you cause to others in an accident. It's typically required by law.

- Collision Insurance: This covers damage to your own vehicle in an accident, regardless of who's at fault.

- Comprehensive Insurance: This covers damage to your vehicle from things like theft, vandalism, fire, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages.

Talk to your insurance agent to determine the best coverage options for your situation.

Specific SR-22 Insurance Product Recommendations and Comparisons

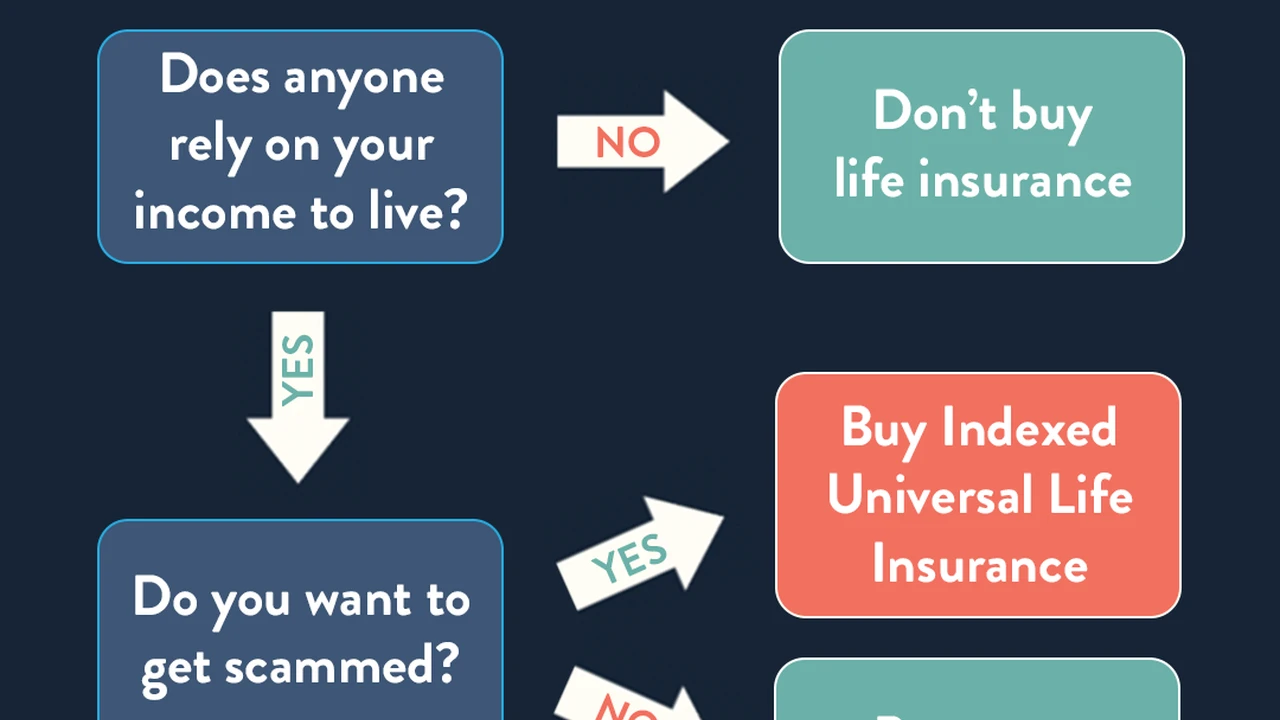

While I can't endorse specific insurance companies (legal reasons!), I can give you some general information about companies that often offer SR-22 filings and some factors to consider when choosing a provider.

Companies to Research:

- Progressive: Known for their online quote tools and wide availability.

- GEICO: Offers competitive rates and a user-friendly mobile app.

- State Farm: A large, well-established company with local agents.

- Allstate: Another major insurer with a variety of coverage options.

- Smaller, Regional Insurers: Don't overlook smaller, regional insurance companies. They may offer more personalized service and competitive rates in your area.

Factors to Consider When Comparing Providers:

- Price: Get quotes from multiple companies and compare the total cost, including premiums, fees, and deductibles.

- Coverage Options: Make sure the company offers the coverage you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Customer Service: Read online reviews and check the company's customer service ratings. You want a company that's responsive and helpful if you have a claim.

- Financial Stability: Choose a company with a strong financial rating. This ensures that they'll be able to pay out claims if you have an accident.

- SR-22 Filing Process: Make sure the company has a straightforward and efficient SR-22 filing process. You don't want any delays or complications.

SR-22 Insurance Pricing and Cost Factors A Detailed Breakdown

Okay, let's talk money. The cost of SR-22 insurance can vary widely depending on several factors:

- Your Driving Record: The more serious your driving violations (DUI, multiple speeding tickets, etc.), the higher your rates will be.

- Your Age: Younger drivers typically pay more for insurance than older drivers.

- Your Location: Insurance rates vary by state and even by zip code.

- Your Vehicle: The type of vehicle you drive can also affect your rates.

- Coverage Levels: Higher coverage limits will result in higher premiums.

- Deductibles: A higher deductible will lower your monthly premium, but you'll have to pay more out of pocket if you have an accident.

- Insurance Company: Different insurance companies have different pricing models, so it's important to shop around.

Example Pricing Scenarios (These are just estimates and can vary significantly):

- Scenario 1: 25-year-old driver with a DUI in California. Estimated annual premium: $2,500 - $4,000.

- Scenario 2: 40-year-old driver with a suspended license for unpaid tickets in Texas. Estimated annual premium: $1,800 - $3,000.

- Scenario 3: 30-year-old driver with multiple speeding tickets in Florida. Estimated annual premium: $2,000 - $3,500.

Remember to get personalized quotes from multiple insurance companies to get an accurate estimate of your SR-22 insurance costs.

SR-22 Insurance and Vehicle Ownership What You Need to Know

Do you need to own a car to get SR-22 insurance? Not necessarily. Here's the breakdown:

- If You Own a Car: You'll need a standard SR-22 policy that covers your vehicle.

- If You Don't Own a Car (Non-Owner SR-22): You can get a non-owner SR-22 policy. This covers you when you're driving someone else's car (with their permission, of course). It doesn't cover the car itself; it only covers your liability if you cause an accident.

A non-owner SR-22 is a good option if you frequently borrow cars or rent cars but don't own your own vehicle.

SR-22 Insurance and License Reinstatement The Process Explained

Getting your license reinstated after a suspension often involves getting an SR-22. Here's the general process:

- Fulfill All Requirements for Reinstatement: This may include paying fines, completing a driver education course, and serving any required suspension period.

- Obtain SR-22 Insurance: Get an SR-22 policy from an insurance company that offers SR-22 filings.

- File the SR-22 with the DMV: Your insurance company will typically file the SR-22 electronically with the state's DMV.

- Pay Reinstatement Fees: You'll likely need to pay a reinstatement fee to the DMV.

- Wait for Approval: The DMV will review your application and, if everything is in order, reinstate your license.

The specific requirements for license reinstatement vary by state, so be sure to check with your local DMV.

Common SR-22 Insurance Mistakes to Avoid Staying Compliant

It's easy to make mistakes with SR-22 insurance, which can lead to further complications. Here are some common mistakes to avoid:

- Letting Your Insurance Lapse: This is the biggest mistake you can make. If your insurance lapses, your insurance company will notify the state, and your license will likely be suspended again.

- Moving to Another State Without Notifying Your Insurer: If you move to another state, you'll need to get an SR-22 policy in that state.

- Failing to Pay Your Premiums: If you don't pay your premiums, your insurance will be canceled, and you'll lose your SR-22.

- Driving Without a Valid License: Even if you have SR-22 insurance, you can't drive without a valid license.

SR-22 Insurance and DUI/DWI Penalties Navigating the Legal Aftermath

Getting a DUI or DWI is a serious offense that can have significant consequences, including the need for SR-22 insurance. Here's how SR-22 insurance fits into the picture:

- Increased Insurance Rates: A DUI/DWI will significantly increase your insurance rates, even after you get an SR-22.

- SR-22 Requirement: Most states require drivers convicted of DUI/DWI to obtain SR-22 insurance for a period of time, typically 3 years.

- License Suspension: Your license will likely be suspended after a DUI/DWI conviction. You'll need to fulfill all requirements for reinstatement, including getting an SR-22.

- Potential Jail Time: Depending on the severity of the offense and your prior record, you may face jail time.

- Legal Fees: You'll likely incur significant legal fees associated with a DUI/DWI charge.

It's important to consult with an attorney if you've been charged with DUI/DWI.

Alternatives to SR-22 Insurance Exploring Your Options

Are there alternatives to SR-22 insurance? In most cases, no. If the state requires you to get an SR-22, you'll need to comply. However, there are a few situations where alternatives might be possible:

- Challenge the Requirement: If you believe you were wrongly required to get an SR-22, you can try to challenge the requirement with the DMV.

- Wait Out the Suspension: In some cases, you may be able to simply wait out the suspension period and then reinstate your license without an SR-22. However, this may not be possible if you've been convicted of DUI/DWI.

- Move to Another State: Some people consider moving to another state with less strict SR-22 requirements. However, this is a drastic measure and may not be practical.

In most cases, the best course of action is to comply with the SR-22 requirement and maintain continuous insurance coverage.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)