7 Best Car Insurance Companies of 2024

Finding the Right Car Insurance A Guide to Top Providers in 2024

Shopping for car insurance can feel like navigating a maze. There are so many companies, coverages, and prices to consider! Don't worry, we're here to help. This guide breaks down some of the best car insurance companies of 2024, highlighting their strengths, weaknesses, and specific scenarios where they shine. We'll also dive into some real-world examples and compare different policies to help you make an informed decision.

Top 7 Car Insurance Companies Ranked for 2024 Understanding Coverage Options

Okay, let's get to the list! Keep in mind that "best" is subjective and depends on your individual needs and circumstances. What works for your neighbor might not work for you.

- Progressive: Great for online shoppers and those looking for name-your-price tools.

- State Farm: Excellent customer service and a wide network of agents.

- GEICO: Known for its affordability and discounts.

- Allstate: Offers a variety of coverage options and accident forgiveness.

- USAA: (Eligibility Required - Military Members & Families) Consistently ranked high for customer satisfaction and competitive rates.

- Liberty Mutual: Good for bundling options and customizable policies.

- Travelers: Offers responsible driver discounts and Intellidrive program.

Progressive Car Insurance Review Name Your Price and Online Convenience

Progressive is a giant in the car insurance world, and for good reason. They're known for their innovative online tools, including the "Name Your Price" tool, which allows you to see coverage options within your budget. This is super helpful if you're trying to stick to a specific spending limit. They also have a great mobile app and a user-friendly website.

Pros:

- Excellent online tools and mobile app

- "Name Your Price" tool

- 24/7 customer service

- Snapshot program (telematics) for potential discounts

Cons:

- Customer service ratings can be inconsistent

- Rates might not be the lowest for everyone

Progressive Auto Insurance Product Spotlight: Snapshot Program

Progressive's Snapshot program is a telematics program that tracks your driving habits (speed, braking, time of day) and rewards safe drivers with discounts. It's a great way to potentially lower your premium if you're a careful driver. However, keep in mind that it could also *increase* your premium if you're not.

Progressive Insurance Pricing Examples and Coverage Details

A basic liability-only policy with Progressive could start around $50-$75 per month, depending on your location, driving history, and vehicle. Full coverage policies, including collision and comprehensive, could range from $120-$250+ per month. Progressive also offers add-ons like rental car reimbursement and roadside assistance.

State Farm Car Insurance Review Local Agents and Reliable Service

State Farm is a well-established insurance company with a huge network of local agents. This makes them a great choice if you prefer face-to-face interaction and personalized service. Their agents can help you understand your coverage options and answer any questions you might have.

Pros:

- Large network of local agents

- Excellent customer service reputation

- Wide range of coverage options

- Drive Safe & Save program (telematics)

Cons:

- Rates might be higher than some online-only companies

- Online experience not as cutting-edge as some competitors

State Farm Car Insurance Product Spotlight: Drive Safe & Save Program

Similar to Progressive's Snapshot, State Farm's Drive Safe & Save program tracks your driving habits and offers discounts to safe drivers. It uses a mobile app to monitor your driving and provide feedback.

State Farm Insurance Pricing Examples and Coverage Details

State Farm's rates tend to be slightly higher than GEICO's, but their customer service often justifies the higher price for many people. A basic liability-only policy could start around $60-$90 per month, while full coverage could range from $140-$280+ per month.

GEICO Car Insurance Review Affordable Rates and Easy Claims

GEICO is famous for its catchy commercials and its commitment to offering affordable rates. They're a great option if you're on a budget and looking for basic coverage. They also have a relatively easy claims process.

Pros:

- Competitive rates

- Easy online quote process

- Mobile app for claims and policy management

- Numerous discounts available

Cons:

- Customer service can be inconsistent

- Fewer local agents than State Farm

GEICO Car Insurance Product Spotlight: DriveEasy Program

GEICO's DriveEasy program uses your smartphone to monitor your driving habits and potentially reward you with discounts for safe driving. Similar to other telematics programs, aggressive driving can lead to higher premiums.

GEICO Insurance Pricing Examples and Coverage Details

GEICO is generally one of the most affordable options. A basic liability-only policy could start as low as $40-$60 per month, while full coverage could range from $100-$200+ per month. Your actual rates will vary based on your individual factors.

Allstate Car Insurance Review Accident Forgiveness and Coverage Options

Allstate offers a wide range of coverage options, including accident forgiveness, which can prevent your rates from increasing after your first at-fault accident. They also have a good reputation for handling claims fairly.

Pros:

- Accident forgiveness (in some states)

- Wide range of coverage options

- Good claims handling reputation

- Drivewise program (telematics)

Cons:

- Rates can be higher than some competitors

- Customer service ratings can be mixed

Allstate Car Insurance Product Spotlight: Accident Forgiveness

Allstate's Accident Forgiveness is a valuable feature that prevents your insurance rates from increasing after your first at-fault accident. This can save you a significant amount of money in the long run. Eligibility requirements vary by state.

Allstate Insurance Pricing Examples and Coverage Details

Allstate's rates tend to be in the mid-range. A basic liability-only policy could start around $55-$85 per month, while full coverage could range from $130-$260+ per month. Accident Forgiveness may add to the premium.

USAA Car Insurance Review Military Members and Families Exclusive Benefits

USAA is exclusively for military members and their families. They consistently rank high for customer satisfaction and offer competitive rates and excellent benefits. If you're eligible, USAA is definitely worth considering.

Pros:

- Consistently high customer satisfaction ratings

- Competitive rates

- Excellent benefits and discounts for military members

- Superior claims handling

Cons:

- Eligibility is limited to military members and their families

USAA Car Insurance Product Spotlight: Total Loss Protection

USAA's Total Loss Protection is a valuable benefit that can help you replace your vehicle if it's totaled in an accident. This coverage can help you avoid being upside down on your loan if you owe more than the vehicle's market value.

USAA Insurance Pricing Examples and Coverage Details

USAA typically offers some of the best rates available, particularly for military members. Pricing varies greatly depending on rank, service history, and other factors. Contact USAA directly for a personalized quote.

Liberty Mutual Car Insurance Review Bundling Options and Customizable Policies

Liberty Mutual offers a variety of coverage options and discounts, making them a good choice for those who want a customizable policy. They also offer bundling options, allowing you to save money by insuring your home and car with the same company.

Pros:

- Customizable policies

- Bundling options for home and auto insurance

- RightTrack program (telematics)

- 24-hour roadside assistance

Cons:

- Rates can be higher than some competitors

- Customer service ratings can be inconsistent

Liberty Mutual Car Insurance Product Spotlight: RightTrack Program

Liberty Mutual's RightTrack program monitors your driving habits and offers discounts to safe drivers. Like other telematics programs, it uses a mobile app to track your driving and provide feedback.

Liberty Mutual Insurance Pricing Examples and Coverage Details

Liberty Mutual's rates can vary significantly depending on your individual circumstances. A basic liability-only policy could start around $65-$95 per month, while full coverage could range from $150-$300+ per month. Bundling discounts can help lower your overall cost.

Travelers Car Insurance Review Responsible Driver Discounts and Intellidrive Program

Travelers offers responsible driver discounts and the Intellidrive program, rewarding safe driving habits. They are a solid, reliable option for those looking for standard coverage.

Pros:

- Responsible driver discounts

- Intellidrive program (telematics)

- Good financial stability

- Optional Premier New Car Replacement

Cons:

- May not be the cheapest option for all drivers

- Online tools are not as advanced as some competitors

Travelers Car Insurance Product Spotlight: Intellidrive Program

Travelers' Intellidrive program tracks your driving habits through a mobile app and provides feedback. Safe driving can lead to significant discounts on your car insurance premium.

Travelers Insurance Pricing Examples and Coverage Details

Travelers' rates are generally competitive, especially for responsible drivers. Expect to pay around $55-$80 for basic liability-only coverage and $120-$250+ for full coverage, depending on your driving record and other factors.

Comparing Car Insurance Coverage Types and Policy Features

Beyond the company itself, it's crucial to understand the different types of coverage available. Here's a quick rundown:

- Liability Coverage: Covers damages you cause to others in an accident.

- Collision Coverage: Covers damages to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle from non-accident events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers your injuries and damages if you're hit by an uninsured or underinsured driver.

- Personal Injury Protection (PIP): (In some states) Covers your medical expenses and lost wages after an accident, regardless of fault.

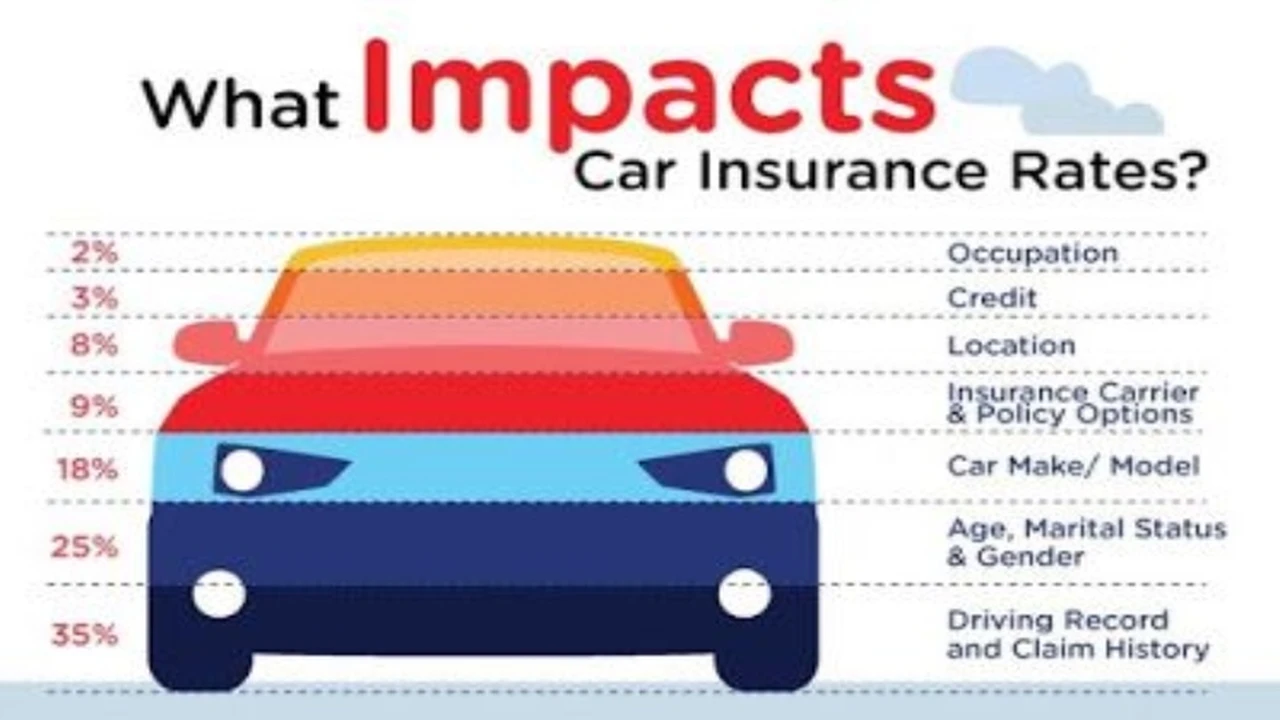

Choosing the Right Car Insurance Policy Factors to Consider

So, how do you choose the right car insurance policy for you? Here are some factors to consider:

- Your Budget: How much can you afford to spend on car insurance each month?

- Your Driving History: Do you have any tickets or accidents on your record?

- Your Vehicle: What kind of car do you drive?

- Your Location: Car insurance rates vary by state and even by zip code.

- Your Coverage Needs: What level of coverage do you need?

Car Insurance Discounts Exploring Ways to Save Money

Don't forget to ask about discounts! Many car insurance companies offer discounts for things like:

- Safe driving

- Good grades (for students)

- Bundling policies

- Military service

- Anti-theft devices

- Paying your premium in full

Getting Car Insurance Quotes Comparing Prices and Coverage Options

The best way to find the right car insurance policy is to get quotes from multiple companies. You can do this online or by contacting an agent directly. Be sure to compare prices, coverage options, and customer service ratings before making a decision.

Understanding Car Insurance Deductibles How They Impact Your Premium

Your deductible is the amount you pay out of pocket before your insurance company pays for a claim. A higher deductible typically means a lower premium, but it also means you'll have to pay more if you have an accident.

Navigating the Car Insurance Claims Process Tips and Best Practices

Knowing what to do after an accident can make the claims process smoother. Document everything, take pictures, and contact your insurance company as soon as possible. Be honest and provide accurate information.

Future Trends in Car Insurance Telematics and Usage-Based Pricing

The future of car insurance is likely to be heavily influenced by telematics and usage-based pricing. As technology advances, insurance companies will be able to gather more data about your driving habits and offer more personalized rates.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)