What to Do After a Car Accident: A Step-by-Step Guide

Immediate Actions After a Car Accident Ensuring Safety and Reporting

Okay, you've just been in a car accident. First things first: stay calm. I know, easier said than done, right? But panicking won't help anyone. Assess the situation quickly. Are you injured? Are your passengers injured? Is anyone else involved hurt? Your safety is the top priority.

1. Check for Injuries: Before you do anything else, make sure you and everyone else involved are okay. If anyone is seriously injured, call 911 (or your local emergency number) immediately. Don't try to move someone who is seriously injured unless they are in immediate danger (like a burning car).

2. Move to Safety (If Possible): If your car is drivable and it's safe to do so, move it to the side of the road, out of the flow of traffic. Turn on your hazard lights. If your car isn't drivable or it's not safe to move it, stay inside with your seatbelt on and hazard lights flashing. If you can safely exit the vehicle, move to a safe location away from the road, like the shoulder or a grassy area.

3. Call the Police: In most cases, it's a good idea to call the police after a car accident, especially if there are injuries, significant property damage, or if the other driver is uncooperative. The police will create an official accident report, which can be helpful when filing insurance claims. Even if the accident seems minor, it's better to err on the side of caution. When you call, be prepared to give your location, a brief description of the accident, and whether anyone is injured.

4. Exchange Information: If it's safe to do so, exchange information with the other driver(s) involved. This includes: * Full name * Address * Phone number * Driver's license number * Insurance company name and policy number * Vehicle make, model, and license plate number

It's also a good idea to get the names and contact information of any witnesses to the accident.

Important Note: Avoid admitting fault at the scene of the accident. Even if you think you might be partially responsible, let the police and insurance companies investigate and determine fault. Saying "I'm sorry" can be interpreted as an admission of guilt. Stick to the facts when talking to the other driver and the police.

Documenting the Scene Essential Evidence Collection for Your Claim

Once you've taken care of the immediate safety concerns, it's time to document the scene. This is crucial for building a strong insurance claim.

1. Take Photos: Use your phone to take as many photos as possible. Capture the following: * Damage to all vehicles involved (close-ups and wide shots) * The position of the vehicles before they are moved * License plates of all vehicles * The overall accident scene (including road conditions, traffic signals, and any relevant landmarks) * Any visible injuries to yourself or your passengers * Damage to any personal property inside the car

2. Write Down Details: Don't rely solely on your memory. Write down as many details as you can remember about the accident, including: * The date, time, and location of the accident * Weather conditions (rain, snow, fog, etc.) * Road conditions (wet, icy, dry, etc.) * A description of what happened, in your own words * Any statements made by the other driver(s) * The names and badge numbers of the police officers who responded to the scene

3. Get a Copy of the Police Report: The police report contains valuable information about the accident, including the officer's opinion on who was at fault. You can usually obtain a copy of the report from the police department a few days after the accident. There might be a small fee for the report.

Filing a Car Insurance Claim Navigating the Process and Protecting Your Rights

Now that you've gathered all the necessary information, it's time to file a car insurance claim.

1. Notify Your Insurance Company: Contact your insurance company as soon as possible after the accident. Most insurance companies have a 24/7 claims hotline. Be prepared to provide them with the details of the accident, including the date, time, location, and a brief description of what happened. They will likely ask for the other driver's information as well.

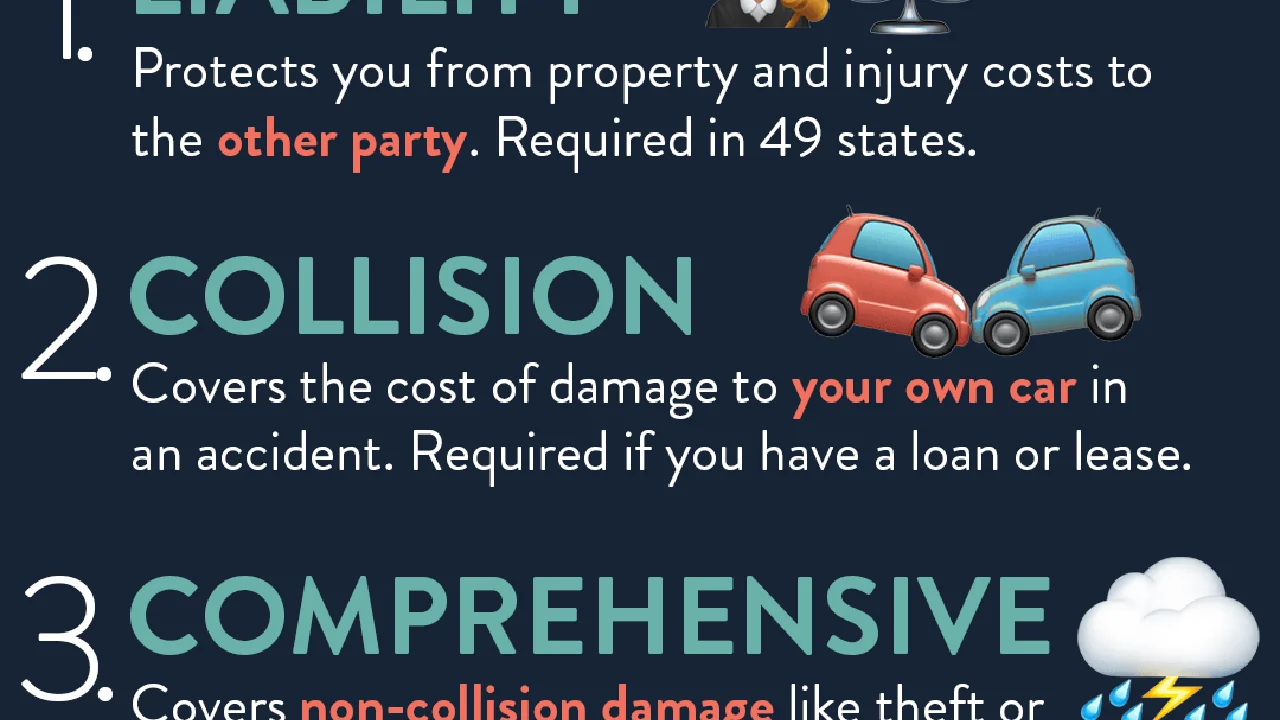

2. Understand Your Policy: Review your car insurance policy to understand your coverage limits, deductibles, and any other relevant information. Pay close attention to your liability coverage, collision coverage, and uninsured/underinsured motorist coverage.

3. Cooperate with the Insurance Adjuster: An insurance adjuster will be assigned to your claim. They will investigate the accident, gather information, and determine who was at fault. Cooperate with the adjuster, but be careful not to say anything that could be used against you. Stick to the facts and avoid speculating or admitting fault.

4. Document All Communication: Keep a record of all communication with the insurance company, including the date, time, and a summary of the conversation. It's also a good idea to send all important documents to the insurance company via certified mail with return receipt requested, so you have proof that they received them.

5. Get an Estimate for Repairs: Get estimates from several reputable auto body shops for the cost of repairing your vehicle. The insurance company may have a preferred body shop, but you are generally free to choose your own. Make sure the body shop provides a detailed estimate that includes all necessary repairs and parts.

6. Consider Hiring an Attorney: If you are seriously injured in the accident, or if the insurance company is denying your claim or offering you an unfair settlement, you should consider hiring an attorney. An attorney can help you protect your rights and negotiate a fair settlement with the insurance company.

Dealing with Injuries and Medical Bills Seeking Proper Treatment and Compensation

If you were injured in the car accident, it's important to seek medical attention as soon as possible.

1. See a Doctor: Even if you don't think you're seriously injured, it's a good idea to see a doctor after a car accident. Some injuries, like whiplash, may not be immediately apparent. A doctor can properly diagnose your injuries and recommend a treatment plan.

2. Follow Your Doctor's Orders: Follow your doctor's orders carefully and attend all scheduled appointments. This is important for your recovery and for documenting your injuries for your insurance claim.

3. Keep Track of Your Medical Bills: Keep track of all your medical bills and other expenses related to your injuries, such as prescription costs, physical therapy, and lost wages. You will need this information when filing your insurance claim.

4. Understand Your Medical Payments Coverage: If you have medical payments coverage (MedPay) on your car insurance policy, it can help pay for your medical bills, regardless of who was at fault for the accident. MedPay coverage is typically limited to a certain amount, such as $5,000 or $10,000.

5. Consider a Personal Injury Claim: If the other driver was at fault for the accident, you may be able to file a personal injury claim against their insurance company to recover compensation for your medical bills, lost wages, pain and suffering, and other damages.

Product Recommendations for Car Accident Preparedness and Safety Practical Tools and Their Benefits

Being prepared can make a huge difference after a car accident. Here are some recommended products that can help you stay safe and organized:

1. Dash Cam: A dash cam records video of the road while you're driving. This can be invaluable evidence in the event of an accident. * Product Recommendation: Garmin Dash Cam 67W. This dash cam offers a wide 180-degree field of view, excellent video quality (1440p), and voice control. It also has automatic incident detection, which means it will automatically save footage if it detects a collision. * Use Case: Record your daily commute and road trips. In the event of an accident, the footage can be used to prove who was at fault. * Comparison: Compared to cheaper models, the Garmin 67W offers superior video quality, a wider field of view, and more advanced features like voice control and automatic incident detection. Cheaper models may have lower video quality and lack these features. * Price: Around $250.

2. First Aid Kit: A well-stocked first aid kit is essential for treating minor injuries at the scene of an accident. * Product Recommendation: First Aid Only All-Purpose First Aid Kit. This kit contains a variety of supplies, including bandages, antiseptic wipes, pain relievers, and gloves. * Use Case: Treat minor cuts, scrapes, and burns at the scene of an accident. * Comparison: Compared to basic first aid kits, the First Aid Only All-Purpose kit contains a wider range of supplies and is more suitable for dealing with a variety of injuries. * Price: Around $20.

3. Car Emergency Kit: A car emergency kit contains essential items for dealing with roadside emergencies, including a flat tire, a dead battery, or being stranded in cold weather. * Product Recommendation: Lifeline AAA Excursion Road Kit. This kit includes jumper cables, a tow rope, a flashlight, a first aid kit, and other essential items. * Use Case: Jump-start a dead battery, change a flat tire, or provide warmth and light in case of a roadside emergency. * Comparison: Compared to homemade kits, the Lifeline AAA Excursion Road Kit contains high-quality tools and supplies that are specifically designed for roadside emergencies. * Price: Around $50.

4. Window Breaker and Seatbelt Cutter: In the event of a serious accident, you may need to quickly escape from your vehicle. A window breaker and seatbelt cutter can help you do this. * Product Recommendation: Resqme Car Escape Tool. This small, lightweight tool can be easily attached to your keychain. It has a spring-loaded window breaker and a razor-sharp seatbelt cutter. * Use Case: Break a window or cut a seatbelt in the event of an emergency. * Comparison: Compared to other escape tools, the Resqme is small, lightweight, and easy to use. It's also relatively inexpensive. * Price: Around $20.

5. Portable Jump Starter: Avoid being stranded with a dead battery by keeping a portable jump starter in your car. * Product Recommendation: NOCO Boost Plus GB40 1000 Amp 12-Volt UltraSafe Lithium Jump Starter Box. This powerful jump starter can jump-start most vehicles multiple times on a single charge. It also has a built-in flashlight and USB power bank. * Use Case: Jump-start a dead battery without needing another vehicle. * Comparison: Compared to traditional jumper cables, the NOCO Boost Plus is safer and easier to use. It also doesn't require another vehicle to jump-start your car. * Price: Around $100.

Navigating Insurance Settlements and Legal Options Understanding Your Rights and Seeking Fair Compensation

Dealing with insurance companies after a car accident can be frustrating. Here's what you need to know about navigating insurance settlements and your legal options:

1. Understanding Your Policy Limits: Know the limits of your own insurance policy, as well as the policy limits of the other driver(s) involved in the accident. This will give you a better understanding of the potential compensation you may be entitled to.

2. Negotiating with the Insurance Company: The insurance company may offer you a settlement that is less than what you deserve. Don't be afraid to negotiate. Present your evidence and explain why you believe you are entitled to more compensation.

3. Uninsured/Underinsured Motorist Coverage: If the other driver is uninsured or underinsured, your own uninsured/underinsured motorist coverage can help pay for your damages.

4. Statute of Limitations: Be aware of the statute of limitations for filing a personal injury lawsuit in your state. This is the deadline by which you must file a lawsuit, or you will lose your right to sue.

5. Hiring an Attorney: If you are having trouble negotiating with the insurance company, or if you are seriously injured, you should consider hiring an attorney. An attorney can help you protect your rights and negotiate a fair settlement.

6. Demand Letter: Your attorney will likely send a demand letter to the insurance company, outlining your damages and demanding a specific amount of compensation.

7. Mediation: If the insurance company doesn't respond to the demand letter with a reasonable offer, your attorney may recommend mediation. Mediation is a process where a neutral third party helps you and the insurance company reach a settlement.

8. Filing a Lawsuit: If mediation is unsuccessful, your attorney may recommend filing a lawsuit.

Preventing Future Accidents Safe Driving Practices and Proactive Measures

The best way to deal with a car accident is to prevent one from happening in the first place. Here are some safe driving practices and proactive measures you can take:

1. Avoid Distractions: Don't text, talk on the phone, or eat while driving. Keep your eyes on the road and your mind on the task at hand.

2. Drive Defensively: Be aware of your surroundings and anticipate the actions of other drivers.

3. Obey Traffic Laws: Follow all traffic laws, including speed limits, stop signs, and traffic signals.

4. Maintain Your Vehicle: Keep your vehicle in good working condition by regularly checking the tires, brakes, lights, and other essential components.

5. Drive Sober: Never drive under the influence of alcohol or drugs.

6. Get Enough Sleep: Driving while tired can be just as dangerous as driving drunk. Get enough sleep before getting behind the wheel.

7. Adjust to Weather Conditions: Slow down and increase your following distance in bad weather, such as rain, snow, or fog.

8. Take a Defensive Driving Course: Consider taking a defensive driving course to improve your driving skills and learn how to avoid accidents.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)