Non-Owner Car Insurance: Who Needs It?

Understanding Non Owner Car Insurance Coverage What Is It

Okay, so you're thinking about car insurance, but you don't actually own a car? Sounds weird, right? But it's more common than you think. Non-owner car insurance is exactly what it sounds like: insurance for people who drive cars they don't own. Think rentals, borrowed cars, or even company vehicles. It's not a replacement for the owner's insurance, but rather a supplemental layer of protection.

Why would you need it? Well, imagine borrowing a friend’s car and getting into an accident. Their insurance covers the car, sure, but what if the damages exceed their policy limits? Or what if they only have the state minimum liability coverage, which often isn't enough? That's where non-owner insurance steps in, protecting you from potential lawsuits and hefty out-of-pocket expenses.

Who Benefits From Non Owner Car Insurance Policies

So, who exactly needs this type of insurance? Here's a breakdown:

- Frequent Renters: If you regularly rent cars, especially for work trips or vacations, non-owner insurance can be a lifesaver. It's often cheaper than the rental company's daily insurance, and it provides more comprehensive coverage.

- Borrowers: Do you often borrow cars from friends or family? Non-owner insurance can protect you (and your relationship!) in case of an accident.

- Those with a Suspended License: Believe it or not, some people with suspended licenses need SR-22 forms (proof of financial responsibility) to reinstate their driving privileges. Non-owner insurance can satisfy this requirement, even if you don't own a car.

- Delivery Drivers (Using Personal Vehicles): If you deliver food or packages using your own car, your personal auto insurance might not cover you during work hours. Non-owner insurance can fill this gap, providing liability coverage when you're on the job. (Note: This is usually a more specialized policy called "hired and non-owned auto insurance," but the principle is similar.)

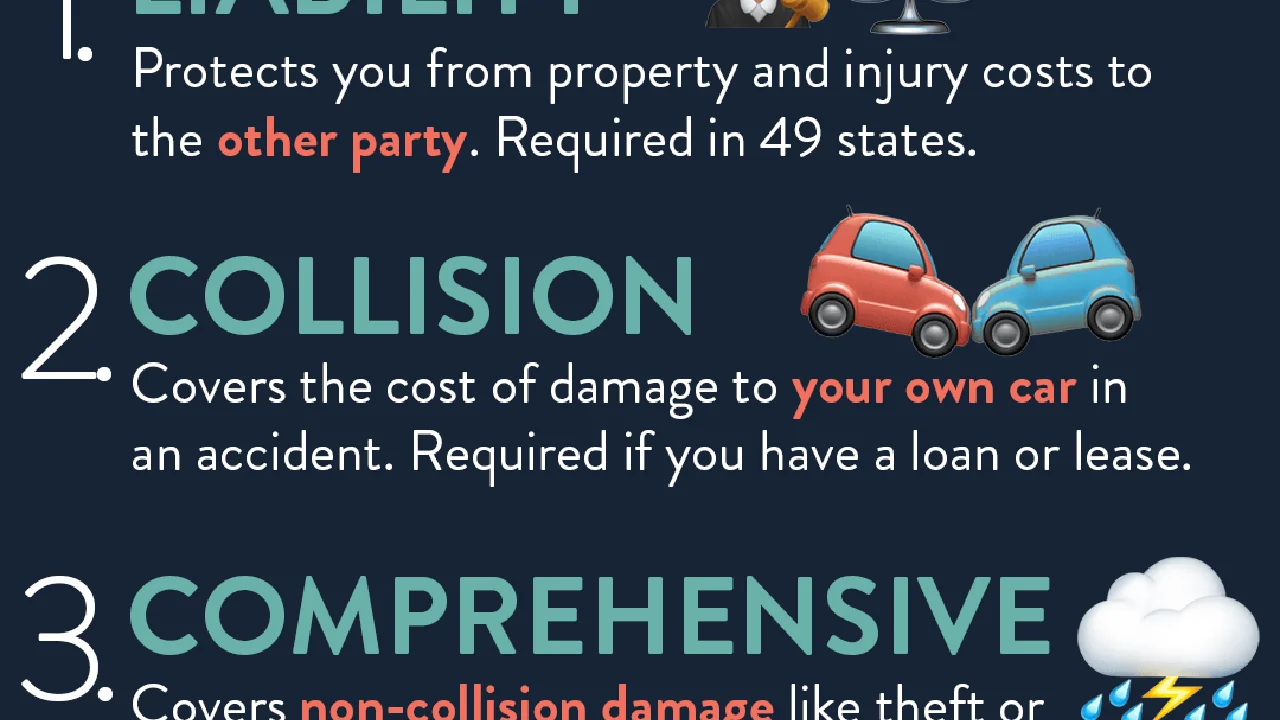

Non Owner Car Insurance Coverage Details What's Included

Typically, non-owner car insurance provides liability coverage. This means it covers bodily injury and property damage that you cause to others in an accident. It doesn't cover damage to the car you're driving or your own injuries. Think of it as protection for your assets if you're sued after an accident.

Here's a closer look at what's usually included:

- Bodily Injury Liability: Pays for medical expenses, lost wages, and pain and suffering if you injure someone in an accident.

- Property Damage Liability: Pays for damage to other people's vehicles or property, like fences or buildings.

It's important to note that non-owner insurance usually *doesn't* include:

- Collision Coverage: This covers damage to the car you're driving. The owner's insurance should cover this.

- Comprehensive Coverage: This covers damage to the car you're driving from things like theft, vandalism, or natural disasters. Again, the owner's insurance should cover this.

- Uninsured/Underinsured Motorist Coverage: This covers your injuries if you're hit by someone who doesn't have insurance or doesn't have enough insurance. Some non-owner policies offer this, but it's not always standard.

Comparing Non Owner Car Insurance Companies and Policies

Alright, let's talk about where to get non-owner insurance. Several major insurance companies offer this type of policy. Here are a few examples (but remember to always get quotes and compare!):

- Progressive: Progressive is a well-known insurer that offers non-owner car insurance. They often have competitive rates and a user-friendly online quote process.

- GEICO: GEICO is another popular option with a strong reputation for customer service and affordable rates.

- State Farm: State Farm is a reliable option, especially if you already have other insurance policies with them. They offer a variety of coverage options and personalized service.

- Smaller, Regional Insurers: Don't forget to check with smaller, regional insurance companies. They might offer more competitive rates or specialized coverage options.

When comparing policies, pay attention to these factors:

- Coverage Limits: How much liability coverage do you need? Higher limits provide more protection but also cost more. Consider your assets and potential risks when choosing your limits.

- Deductibles: Some non-owner policies have deductibles, meaning you'll have to pay a certain amount out-of-pocket before the insurance kicks in. Lower deductibles usually mean higher premiums.

- Exclusions: Read the fine print! Make sure you understand what's *not* covered by the policy. For example, some policies might exclude coverage for certain types of vehicles or certain driving activities.

- Customer Service: Check online reviews and ratings to get a sense of the company's customer service reputation. You want an insurer that's responsive and helpful when you need them.

Non Owner Car Insurance Cost Factors Affecting Premiums

So, how much does non-owner car insurance cost? The price depends on several factors, including:

- Driving Record: A clean driving record will get you the best rates. Accidents and traffic violations will increase your premiums.

- Age: Younger drivers typically pay more for insurance than older drivers.

- Credit Score: In many states, insurance companies use credit scores to assess risk. A good credit score can lower your premiums.

- Coverage Limits: Higher coverage limits will increase your premiums.

- Location: Insurance rates vary by state and even by ZIP code.

Generally, non-owner car insurance is relatively inexpensive compared to standard auto insurance. You can often find policies for less than $50 per month, especially if you have a good driving record and credit score.

Real World Non Owner Car Insurance Scenarios and Examples

Let's look at some real-world scenarios to illustrate how non-owner car insurance can help:

Scenario 1: The Frequent Renter

Sarah travels frequently for work and rents cars several times a month. She's tired of paying for the rental company's daily insurance, which can add up quickly. She gets a non-owner car insurance policy with $100,000/$300,000 in bodily injury liability and $50,000 in property damage liability. This provides her with comprehensive coverage whenever she rents a car, and it's much cheaper than the rental company's insurance.

Scenario 2: The Helpful Friend

John often borrows his neighbor's truck to haul materials for home improvement projects. He doesn't want to risk damaging his neighbor's truck or being sued if he causes an accident. He gets a non-owner car insurance policy to protect himself and his neighbor. One day, he accidentally backs into a mailbox while driving the truck. His non-owner insurance covers the damage to the mailbox.

Scenario 3: The Uber Driver (With Gaps in Coverage)

Maria drives for Uber in her spare time. Uber provides insurance coverage while she's actively transporting passengers, but there are gaps in coverage when she's waiting for a ride request. To fill these gaps, she gets a non-owner car insurance policy that provides liability coverage when she's logged into the Uber app but hasn't yet accepted a ride. (Note: Some insurers offer specific "rideshare insurance" policies for this purpose, which might be a better option than a standard non-owner policy.)

Specific Non Owner Car Insurance Product Recommendations and Pricing

Okay, let's get down to brass tacks. Here are a few specific non-owner car insurance products to consider, along with estimated pricing and usage scenarios:

- Progressive's Non-Owner Auto Insurance:

- Estimated Price: $30-$60 per month (depending on factors mentioned above)

- Usage Scenario: Ideal for frequent renters and borrowers who want a reliable and affordable policy.

- Pros: Competitive rates, user-friendly online quote process, good customer service.

- Cons: Might not be the best option for those with a poor driving record.

- GEICO's Non-Owner Car Insurance:

- Estimated Price: $35-$70 per month

- Usage Scenario: A good choice for those who value customer service and want a well-known and reputable insurer.

- Pros: Strong customer service reputation, affordable rates, easy to understand policy options.

- Cons: Might not be the cheapest option for everyone.

- State Farm's Non-Owner Policy:

- Estimated Price: $40-$80 per month

- Usage Scenario: Best for those who already have other insurance policies with State Farm and want the convenience of bundling.

- Pros: Personalized service, a wide range of coverage options, a strong financial rating.

- Cons: Might be slightly more expensive than other options.

Important Note: These are just estimates! The actual price of your non-owner car insurance will depend on your individual circumstances. Always get quotes from multiple insurers and compare the coverage options before making a decision.

Non Owner Car Insurance vs Standard Car Insurance Key Differences

It's crucial to understand the differences between non-owner car insurance and standard car insurance:

- Ownership: Standard car insurance covers a specific vehicle that you own. Non-owner car insurance covers *you* as a driver, regardless of which car you're driving (with the owner's permission, of course).

- Coverage: Standard car insurance typically includes collision and comprehensive coverage, which cover damage to *your* vehicle. Non-owner car insurance usually only includes liability coverage, which covers damage to *other people's* vehicles or property.

- Cost: Non-owner car insurance is generally less expensive than standard car insurance because it provides less coverage.

Think of it this way: Standard car insurance protects your car. Non-owner car insurance protects your assets if you cause an accident while driving someone else's car.

Non Owner Car Insurance and SR 22 Requirements Explained

As mentioned earlier, non-owner car insurance can be used to satisfy SR-22 requirements in some cases. An SR-22 is a certificate of financial responsibility that some drivers are required to obtain after a serious traffic violation, such as a DUI or driving without insurance. It proves to the state that you have the minimum required liability insurance coverage.

If you're required to file an SR-22 but you don't own a car, you can get a non-owner car insurance policy with an SR-22 endorsement. This will satisfy the state's requirement and allow you to reinstate your driving privileges. However, keep in mind that not all insurance companies offer SR-22 endorsements for non-owner policies, so you'll need to shop around.

Finding the Best Non Owner Car Insurance Policy Tips and Tricks

Finding the right non-owner car insurance policy can seem daunting, but here are a few tips to make the process easier:

- Get Multiple Quotes: Don't just settle for the first quote you get. Shop around and compare rates from multiple insurers.

- Use Online Comparison Tools: Several websites allow you to compare non-owner car insurance quotes from different companies side-by-side.

- Talk to an Insurance Agent: An independent insurance agent can help you find the best policy for your specific needs and budget. They can also answer any questions you have about coverage options and exclusions.

- Read the Fine Print: Before you buy a policy, carefully read the terms and conditions to make sure you understand what's covered and what's not.

- Consider Your Needs: Think about how often you drive borrowed or rented cars, and what level of coverage you need to protect your assets.

Non Owner Car Insurance Alternatives Exploring Other Options

While non-owner car insurance is a great option for many people, it's not the only choice. Here are a few alternatives to consider:

- Rental Car Insurance: If you only rent cars occasionally, you might be better off buying the rental company's daily insurance. However, this can be expensive in the long run if you rent frequently.

- Being Added to the Car Owner's Policy: If you regularly borrow a specific person's car, you might be able to be added as a driver to their insurance policy. This could be a more cost-effective option than getting your own non-owner policy. However, the car owner's rates might increase as a result.

- Increasing Your Own Existing Auto Insurance Coverage: If you own a car and have a standard auto insurance policy, you might be able to increase your liability coverage to protect yourself when driving other people's cars. This might be a good option if you only occasionally borrow cars.

Understanding Non Owner Car Insurance Limitations What to Watch Out For

It's important to be aware of the limitations of non-owner car insurance:

- It Doesn't Cover Damage to the Car You're Driving: As mentioned earlier, non-owner insurance only covers liability. It doesn't cover damage to the car you're driving. The owner's insurance should cover this.

- It Doesn't Cover Your Own Injuries: Non-owner insurance typically doesn't cover your own injuries in an accident. You'll need to rely on your health insurance or other sources of coverage.

- It Might Not Cover Certain Types of Vehicles: Some non-owner policies might exclude coverage for certain types of vehicles, such as commercial vehicles or motorcycles.

- It Might Not Cover Certain Driving Activities: Some policies might exclude coverage for certain driving activities, such as racing or off-roading.

Non Owner Car Insurance Myths Debunked Setting the Record Straight

Let's bust some common myths about non-owner car insurance:

- Myth: Non-owner car insurance is only for people with bad driving records. Fact: Anyone who frequently drives cars they don't own can benefit from non-owner insurance, regardless of their driving record.

- Myth: Non-owner car insurance is expensive. Fact: Non-owner car insurance is generally less expensive than standard auto insurance.

- Myth: Non-owner car insurance is unnecessary if the car owner has insurance. Fact: Non-owner insurance provides an extra layer of protection if the car owner's insurance isn't enough to cover the damages in an accident.

- Myth: Non-owner car insurance covers damage to the car you're driving. Fact: Non-owner car insurance typically only covers liability.

Frequently Asked Questions About Non Owner Car Insurance FAQ

Here are some frequently asked questions about non-owner car insurance:

- Q: How do I get a non-owner car insurance quote?

- A: You can get a non-owner car insurance quote online from most major insurance companies. You'll need to provide some basic information about yourself, such as your age, driving record, and credit score.

- Q: Is non-owner car insurance the same as SR-22 insurance?

- A: No, non-owner car insurance is a type of insurance policy, while an SR-22 is a certificate of financial responsibility. However, you can get a non-owner car insurance policy with an SR-22 endorsement.

- Q: Does non-owner car insurance cover me if I'm driving for Uber or Lyft?

- A: Standard non-owner car insurance might not cover you while driving for Uber or Lyft. You might need a specific "rideshare insurance" policy.

- Q: What happens if I get into an accident while driving someone else's car?

- A: The car owner's insurance will typically cover the initial damages. If the damages exceed their policy limits, your non-owner insurance will kick in.

- Q: Can I get non-owner car insurance if I don't have a driver's license?

- A: No, you typically need a valid driver's license to get non-owner car insurance.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)