Customer Service Ratings: Comparing Car Insurance Companies

Understanding the Importance of Customer Service in Car Insurance (Customer Service, Car Insurance)

Alright, let's talk car insurance. We all need it, right? But it's not just about the price. Think about it: you're in an accident, stressed out, maybe even injured. The last thing you need is a car insurance company that's impossible to reach or unhelpful when you finally do. That’s why customer service is HUGE when choosing a car insurance company. It's about peace of mind knowing they'll be there for you when things go south.

Key Metrics for Evaluating Customer Service (Customer Service Metrics, Car Insurance Reviews)

So, how do we actually *measure* good customer service? Well, a few things come to mind. First off, accessibility. Can you actually get a hold of them? Are there long wait times on the phone? Do they offer online chat or a mobile app? Then there's responsiveness. Do they actually answer your questions clearly and quickly? Are they proactive in resolving your issues? And finally, empathy. Do they understand your situation and treat you with respect? It's not just about following procedures; it's about actually caring.

Top Car Insurance Companies with Excellent Customer Service Ratings (Best Car Insurance Companies, Customer Service Leaders)

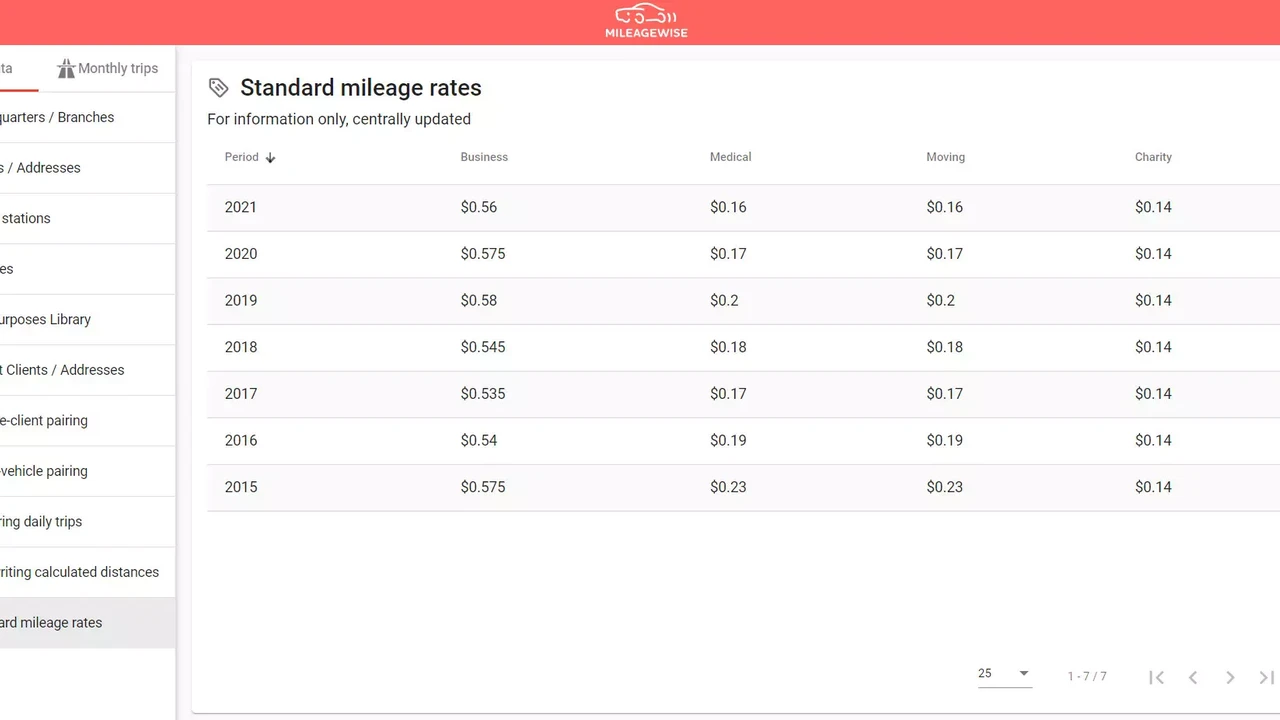

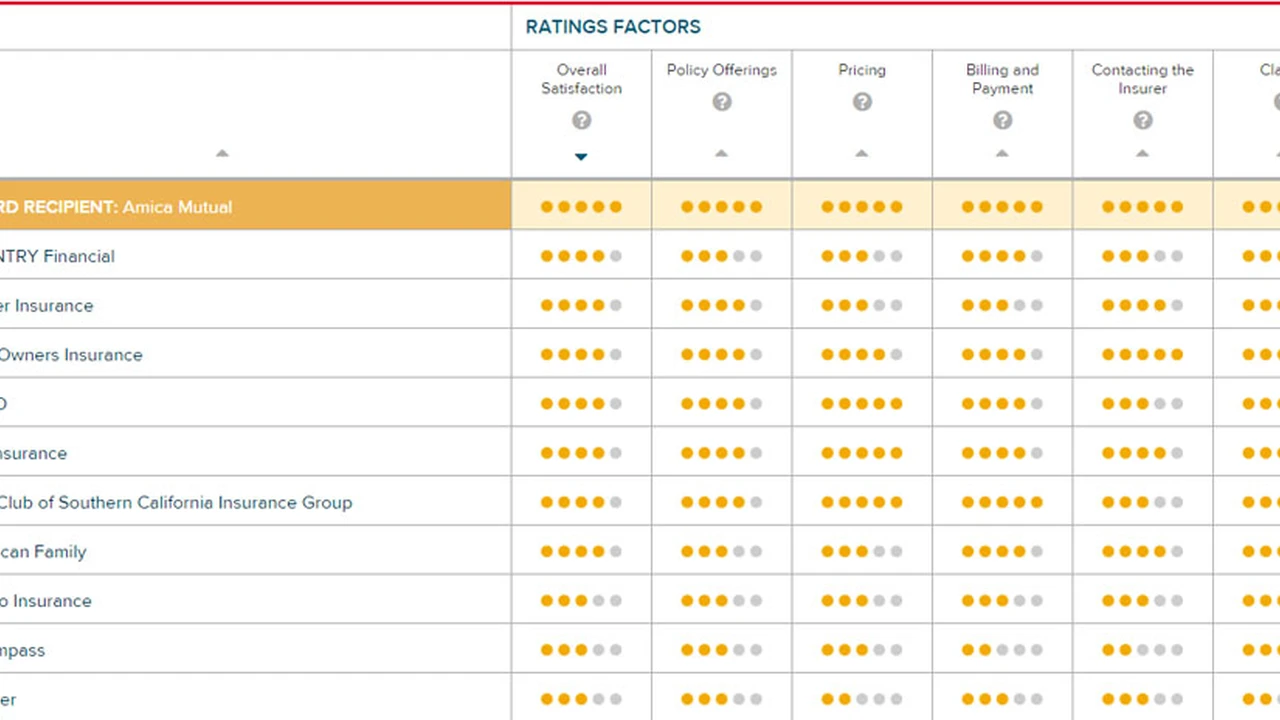

Okay, let's get down to brass tacks. Who's actually doing a good job? Based on various surveys and customer reviews (J.D. Power, Consumer Reports, etc.), a few names consistently pop up. We're talking about companies that prioritize customer satisfaction and go the extra mile.

- Amica Mutual: Often lauded for its excellent customer service and claims handling. They are a mutual company, which means they are owned by their policyholders.

- USAA: Consistently ranked high, but eligibility is generally limited to military members and their families.

- Erie Insurance: Known for its regional focus and strong customer relationships. Unfortunately, they aren't available in every state.

Comparing Amica, USAA, and Erie: A Detailed Look (Car Insurance Comparison, Customer Service Focus)

Let's dive deeper into these three companies. We'll look at their strengths, weaknesses, and what makes them stand out.

Amica Mutual (Amica Customer Service, Amica Insurance Review)

Amica is a solid choice if you value personal attention and a company that prioritizes its customers. They are a bit pricier than some of the bigger national companies, but many people feel the extra cost is worth it for the superior service.

Pros: Excellent customer service ratings, mutual ownership (meaning they're owned by policyholders, not shareholders), strong financial stability.

Cons: Can be more expensive than other options, not available in every state.

USAA (USAA Customer Service, USAA Insurance Review)

If you're eligible for USAA, it's almost always a no-brainer. They consistently top customer satisfaction surveys and offer competitive rates.

Pros: Exceptional customer service, competitive rates, wide range of financial services.

Cons: Eligibility restricted to military members and their families.

Erie Insurance (Erie Customer Service, Erie Insurance Review)

Erie is a regional powerhouse, known for its personalized service and commitment to its customers. They often have local agents who are deeply involved in their communities.

Pros: Strong local presence, personalized service, good claims handling.

Cons: Limited availability (not in every state).

Beyond the Big Names: Other Companies to Consider (Alternative Car Insurance, Smaller Insurance Companies)

While Amica, USAA, and Erie are often at the top of the list, there are other companies worth checking out, especially if you're looking for a specific type of coverage or a more budget-friendly option. Think about regional insurers or companies that focus on specific demographics (e.g., drivers with good records).

The Role of Online Reviews and Ratings (Car Insurance Reviews, Online Ratings)

Don't just take the companies' word for it! Check out online reviews and ratings from sites like J.D. Power, Consumer Reports, and even the Better Business Bureau. Pay attention to the trends. Are people consistently complaining about the same issues? Also, remember to take reviews with a grain of salt. A single bad review doesn't necessarily mean a company is terrible, but a pattern of complaints should raise a red flag.

Understanding the Claims Process and Its Impact on Customer Satisfaction (Car Insurance Claims, Claims Satisfaction)

The claims process is often where the rubber meets the road when it comes to customer service. A smooth, efficient claims process can make all the difference in your overall satisfaction. Look for companies that offer easy ways to file a claim (online, phone, app) and that communicate clearly and frequently throughout the process. Also, find out how long it typically takes them to resolve claims.

The Impact of Technology on Customer Service (Car Insurance Apps, Online Customer Service)

Technology is playing an increasingly important role in car insurance customer service. Many companies now offer mobile apps that allow you to file claims, pay your bills, and even request roadside assistance. Online chat is also becoming more common, providing a quick and convenient way to get your questions answered. Consider companies that embrace technology to improve the customer experience.

Price vs. Customer Service: Finding the Right Balance (Affordable Car Insurance, Best Value Car Insurance)

Of course, price is a factor. But don't let it be the *only* factor. It's important to find a balance between affordability and good customer service. Sometimes, paying a little more for a company with a reputation for excellent service can save you headaches (and money) in the long run.

Real-Life Scenarios: How Customer Service Can Make or Break Your Experience (Car Accident Claims, Customer Service Examples)

Let's imagine a couple of scenarios. First, you're in a minor fender bender. With a company that has great customer service, you can easily file a claim online, get a quick estimate for repairs, and have the issue resolved within a few days. Now, imagine the same scenario with a company that has poor customer service. You spend hours on the phone trying to reach someone, the claims process is confusing and slow, and you end up feeling frustrated and stressed out.

Another scenario: your car is totaled in an accident. A good company will help you navigate the process of getting a rental car, assessing the value of your vehicle, and receiving a fair settlement. A bad company will drag its feet, offer you a lowball settlement, and make the whole experience a nightmare.

Specific Product Recommendations and Usage Scenarios (Recommended Car Insurance Products, Insurance Product Comparison)

Okay, let's talk specifics. Here are a few product recommendations based on different needs and scenarios:

- For the Budget-Conscious Driver: Consider a company like **GEICO**. While their customer service might not be *quite* as stellar as Amica or USAA, they often offer competitive rates, especially for drivers with good records. They also have a user-friendly mobile app. **Usage Scenario:** You're a safe driver looking for basic coverage at an affordable price.

- For the Family with Multiple Vehicles: **State Farm** is a good option. They offer discounts for insuring multiple vehicles and bundling your car insurance with other policies, like homeowners insurance. They also have a large network of local agents. **Usage Scenario:** You have two or more cars and want to simplify your insurance and save money.

- For the High-Risk Driver: Finding affordable insurance can be tough if you have a history of accidents or tickets. Look into companies that specialize in high-risk drivers, like **The General** or **Direct Auto Insurance**. Be prepared to pay higher premiums, but it's better than driving uninsured. **Usage Scenario:** You have a less-than-perfect driving record and need to find coverage.

- For the Tech-Savvy Driver: **Root Insurance** uses your smartphone to track your driving habits and offers personalized rates based on your performance. If you're a safe driver, you could save a lot of money. **Usage Scenario:** You're comfortable with technology and confident in your driving skills.

Detailed Product Comparisons: Features, Pricing, and Customer Feedback (Car Insurance Product Comparison, Price Comparison)

Let's compare a few of these options head-to-head:

| Company | Average Price (Annual) | Customer Service Rating (out of 5) | Key Features | Pros | Cons |

|---|---|---|---|---|---|

| GEICO | $1200 | 3.5 | Mobile app, discounts for safe driving | Affordable, user-friendly | Customer service can be inconsistent |

| State Farm | $1400 | 4.0 | Local agents, multi-policy discounts | Strong local presence, good for families | Can be more expensive than GEICO |

| Root Insurance | Variable (based on driving) | 4.2 | Personalized rates based on driving habits | Potential for significant savings, innovative approach | Requires tracking driving, not available in all states |

Important Note: These prices are just averages. Your actual rate will depend on your individual circumstances, such as your age, driving record, and the type of car you drive. Always get quotes from multiple companies to find the best deal.

Understanding Policy Coverage Options and How They Relate to Customer Service (Car Insurance Coverage, Policy Options)

Beyond customer service, it's crucial to understand the different types of coverage available and how they can protect you. Here's a quick rundown:

- Liability Coverage: This covers damages you cause to other people or property in an accident. It's usually required by law.

- Collision Coverage: This covers damage to your own vehicle if you're in an accident, regardless of who's at fault.

- Comprehensive Coverage: This covers damage to your vehicle from things like theft, vandalism, hail, or fire.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by someone who doesn't have insurance or doesn't have enough insurance to cover your damages.

A good customer service representative can help you understand these different options and choose the coverage that's right for you.

Tips for Improving Your Own Customer Service Experience (Improving Customer Service, Dealing with Insurance Companies)

Here are a few tips to help you get the best possible customer service experience:

- Be prepared: Before you call, gather all the relevant information, such as your policy number, the date of the accident, and the names and contact information of any other parties involved.

- Be polite: Even if you're frustrated, try to remain calm and respectful. It's more likely that you'll get better service if you're polite.

- Be clear: Clearly explain your issue and what you're hoping to achieve.

- Take notes: Keep a record of your conversations, including the date, time, and the name of the person you spoke with.

- Follow up: If you don't hear back from the company within a reasonable timeframe, follow up to check on the status of your claim.

The Future of Customer Service in the Car Insurance Industry (Future of Insurance, Customer Service Trends)

The car insurance industry is constantly evolving, and customer service is no exception. We can expect to see even more emphasis on technology, personalization, and proactive communication in the years to come. Companies that prioritize customer satisfaction will be the ones that thrive.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)