Bundling Car and Home Insurance: Is It Worth It?

Understanding the Basics of Bundling Car and Home Insurance Policies

So, you're thinking about bundling your car and home insurance? Smart move! It's a pretty common strategy to save some dough. Basically, bundling means buying multiple insurance policies from the same company. The two most popular policies to bundle are auto and home (or renters) insurance. Why? Because most people need both! But is it *really* worth it? Let's dive in and see.

Why Insurance Companies Offer Discounts for Bundling Car and Home Insurance

Insurance companies aren't just being nice offering you a discount. It's a win-win situation for them. Think about it: acquiring a new customer is expensive. Marketing, sales, all that jazz. By bundling, they keep you as a customer for multiple policies, increasing customer lifetime value and reducing churn. Plus, it simplifies their own internal processes. Less paperwork, less marketing spend, more happy shareholders. So, the discount they give you is often less than what they would have spent acquiring a new customer.

Potential Savings When You Bundle Car Insurance and Home Insurance

Okay, let's get down to the nitty-gritty: the savings. How much can you *actually* save? It varies wildly. Some insurers offer a flat percentage off each policy (like 5-15%), while others have a tiered discount that increases with the number of policies you bundle. I've seen people save anywhere from $100 to over $1000 per year by bundling. The biggest factor is your individual circumstances: your driving record, your home's value, where you live, and the specific insurance company. Don't just assume you're getting the best deal; always shop around!

The Downsides of Bundling Car and Home Insurance: Are There Any?

Bundling sounds great, right? Cheaper insurance! But it's not *always* the best option. Here's the thing: sometimes, you can get a better individual rate on your car insurance from one company and a better rate on your home insurance from another. Don't automatically assume the bundled rate is the cheapest. Do your homework! Also, bundling can make it harder to switch insurers later. If you're unhappy with one policy, you might be hesitant to switch because it would affect the discount on your other policy. It’s a bit like being stuck in a bad relationship just because it's convenient.

Comparing Insurance Companies for Car and Home Bundling: A Detailed Guide

Alright, let's talk about some specific companies and what they offer. Remember that these are just examples, and you should always get personalized quotes based on your own situation.

State Farm Car and Home Insurance Bundling Options

State Farm is a giant in the insurance world, known for its local agents and strong customer service. They often offer competitive bundling discounts. State Farm is a good choice if you prefer face-to-face interaction and want a reliable, well-established insurer. They offer a variety of coverage options and are generally considered to be a good all-around choice.

Allstate Car and Home Insurance Bundling Options

Allstate is another major player, with a wide range of products and services. They're known for their "good hands" slogan and often have innovative online tools. Allstate is worth considering if you value convenience and want a company with a strong online presence. They also offer a variety of discounts, including safe driver discounts and discounts for new cars.

Progressive Car and Home Insurance Bundling Options

Progressive is known for its aggressive pricing and online quoting tools. They often have the cheapest rates for certain demographics, particularly younger drivers. Progressive is a good choice if you're primarily focused on price and don't mind managing your policy online. They offer a "Name Your Price" tool that allows you to customize your coverage and see how it affects your premium.

USAA Car and Home Insurance Bundling Options (Military Exclusive)

If you're a member of the military or a veteran, USAA is almost always the best option. They consistently have the highest customer satisfaction ratings and offer incredibly competitive rates. USAA is known for its exceptional customer service and commitment to serving the military community. However, you must be eligible to join.

Specific Product Recommendations and Use Cases: Car and Home Insurance

Let's get into some specifics. Imagine you're a young professional living in an apartment in a city and you also own a reliable, but older, sedan.

Scenario 1: Young Professional in the City

In this case, you might consider bundling your auto insurance with a renters insurance policy. Renters insurance is crucial for protecting your belongings in case of theft, fire, or other covered perils. Progressive might be a good option here, as they often have competitive rates for younger drivers and offer easy online policy management. You could get basic liability coverage for your car and a renters policy that covers your personal property.

Scenario 2: Family with a House and Two Cars

Now, imagine you're a family with a house in the suburbs and two cars. You need more comprehensive coverage. State Farm or Allstate might be better choices, as they offer a wider range of coverage options and can provide personalized advice through local agents. You might want to consider higher liability limits on your auto insurance and a homeowners policy that includes coverage for your home, personal property, and liability.

Scenario 3: Retired Couple with a Paid-Off Home and One Car

Finally, imagine you're a retired couple with a paid-off home and one car. You might be looking for the most affordable option. USAA (if eligible) is always a great choice. Otherwise, you might want to shop around and compare quotes from several different insurers. Look for discounts for being a senior citizen and for having a good driving record.

Detailed Product Comparisons: Auto and Home Insurance

Let's compare some common features of auto and home insurance policies across different providers.

Auto Insurance Comparison: State Farm vs. Progressive

State Farm generally offers more comprehensive coverage options and better customer service, but Progressive often has cheaper rates. State Farm might be better if you want a local agent and personalized advice, while Progressive might be better if you're comfortable managing your policy online and are primarily focused on price.

Home Insurance Comparison: Allstate vs. USAA

Allstate offers a wide range of discounts and coverage options, while USAA is known for its exceptional customer service and competitive rates (for eligible members). Allstate might be better if you want a lot of flexibility in your coverage, while USAA might be better if you value customer service and are eligible to join.

Pricing Considerations: How Bundling Affects Your Premiums

The price of bundling depends on several factors, including your location, your driving record, the value of your home, and the specific insurance company. Always get quotes from multiple insurers and compare the bundled rate to the individual rates. Don't be afraid to negotiate! Sometimes, simply asking for a better price can result in significant savings.

Beyond the Basics: Additional Insurance Policies to Consider Bundling

While auto and home are the most common policies to bundle, you can often bundle other types of insurance as well. Consider these:

Life Insurance

Some insurers offer discounts for bundling life insurance with other policies. This can be a good option if you're looking to protect your family's financial future.

Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of your auto and home insurance policies. This can be a good option if you have significant assets to protect.

Motorcycle Insurance

If you own a motorcycle, you can often bundle it with your auto and home insurance policies.

Real-Life Examples of Bundling Savings: Case Studies

Let's look at some anonymized case studies to illustrate the potential savings from bundling.

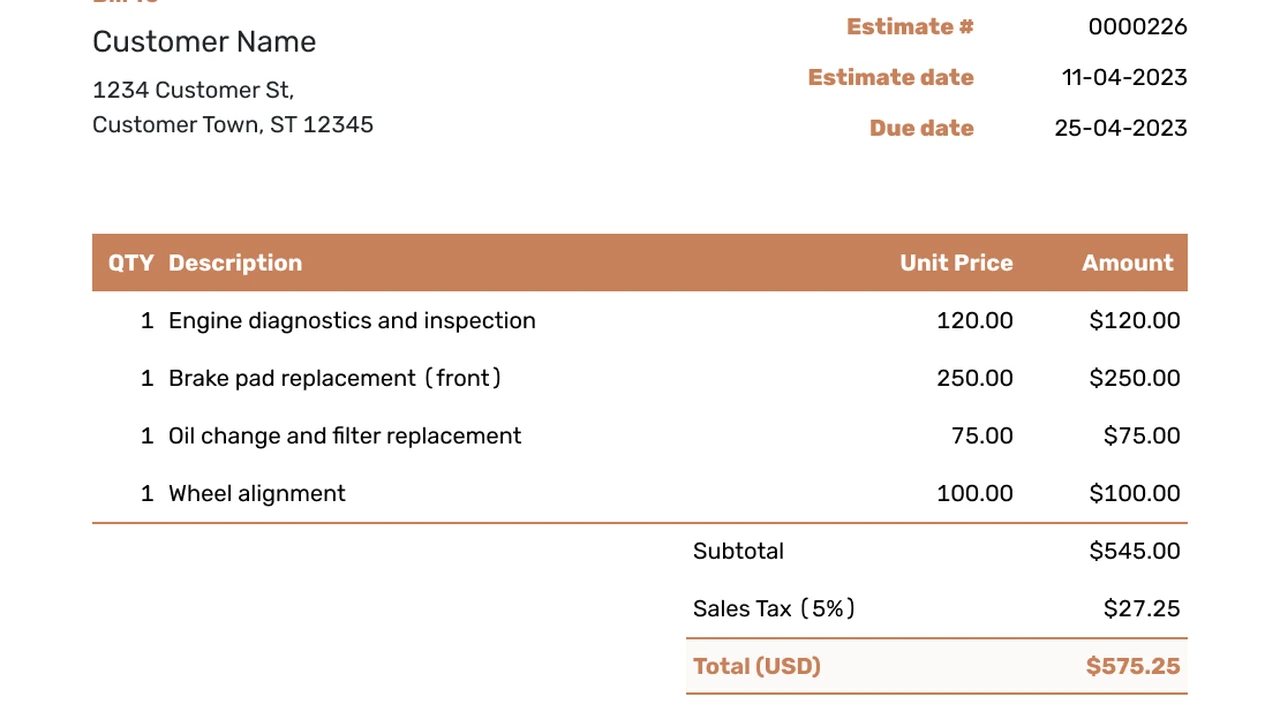

Case Study 1: John, a 30-Year-Old Renter

John was paying $1200 per year for auto insurance and $150 per year for renters insurance. By bundling with Progressive, he was able to save $200 per year.

Case Study 2: Mary and Tom, a Family with a House and Two Cars

Mary and Tom were paying $2000 per year for auto insurance and $1000 per year for homeowners insurance. By bundling with State Farm, they were able to save $400 per year.

Tips for Getting the Best Bundling Deals on Car and Home Insurance

Here are some tips to help you get the best possible bundling deals:

* **Shop around:** Get quotes from multiple insurers and compare the bundled rate to the individual rates. * **Ask for discounts:** Don't be afraid to negotiate! * **Increase your deductibles:** This can lower your premiums. * **Improve your credit score:** A good credit score can help you get better rates. * **Maintain a clean driving record:** Avoid accidents and traffic tickets. * **Review your coverage annually:** Make sure you have the right amount of coverage for your needs.Navigating the Fine Print: What to Watch Out for in Bundled Insurance Policies

Before you sign on the dotted line, be sure to read the fine print carefully. Pay attention to the following:

* **Coverage limits:** Make sure you have enough coverage to protect your assets. * **Deductibles:** Understand how much you'll have to pay out of pocket before your insurance kicks in. * **Exclusions:** Be aware of what your policies don't cover. * **Cancellation policies:** Understand how to cancel your policies if you need to.The Future of Bundling: Trends and Innovations in Insurance

The insurance industry is constantly evolving, and bundling is no exception. Here are some trends to watch out for:

* **Personalized pricing:** Insurers are increasingly using data analytics to personalize pricing based on individual risk profiles. * **Usage-based insurance:** Some insurers offer discounts for safe driving habits, tracked through mobile apps or telematics devices. * **Subscription-based insurance:** A few companies are experimenting with subscription-based insurance models, where you pay a flat monthly fee for coverage.Is Bundling Car and Home Insurance Right for You? A Personalized Approach

Ultimately, the decision of whether or not to bundle your car and home insurance depends on your individual circumstances. Consider your needs, your budget, and your risk tolerance. Shop around, compare quotes, and don't be afraid to ask questions. With a little research, you can find the best insurance solution for you.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)