Driving Less: Lower Mileage, Lower Rates

How Lower Mileage Impacts Your Car Insurance Rates Saving Money on Car Insurance

Okay, let's talk about something super practical: driving less and how it can seriously slash your car insurance costs. We all know car insurance can be a real drain on your wallet, but did you know that simply reducing the number of miles you drive each year can make a huge difference? It’s true! Insurance companies see lower mileage as lower risk. Think about it – the less you're on the road, the less likely you are to be in an accident. Makes sense, right?

So, how does this actually work? Well, when you're getting a car insurance quote, one of the first things they'll ask you is your estimated annual mileage. Be honest! Don't just guess wildly. Try to actually calculate how much you drive each week or month and then multiply it out. The more accurate you are, the better the quote will be. If you significantly underestimate, you could run into problems later on. If your driving habits have changed recently, maybe you started working from home or carpooling, update your insurance company!

And it's not just about getting a lower initial quote. Many insurance companies offer discounts specifically for low-mileage drivers. These discounts can range from a few percentage points to a significant chunk of your premium. It's definitely worth asking about!

Calculating Your Mileage for Lower Car Insurance Premiums Car Insurance Tips

Alright, let's get down to the nitty-gritty of calculating your mileage. Don't just pull a number out of thin air! Here's a few ways to get a more accurate estimate:

- Check Your Odometer: This is the most straightforward way. Note your current mileage, then track it again after a week or a month. Multiply that number to get your annual estimate.

- Use a Mileage Tracking App: There are tons of apps out there that can automatically track your mileage using your phone's GPS. These are super handy if you drive a lot for work or errands. Some popular ones include MileIQ, TripLog, and Everlance. They often have features to categorize trips (business vs. personal) which is great for tax purposes too!

- Review Past Records: Look back at your maintenance records or previous insurance policies. They might have your annual mileage listed.

- Consider Your Commute: If you commute to work, factor in the round-trip distance and the number of days you work each week. This is a big chunk of most people's mileage. Don't forget to account for occasional trips outside of your regular commute.

Once you have a good estimate, be honest with your insurance company. They might ask for proof of your mileage, so be prepared to provide it. Some companies use telematics devices (small devices that plug into your car) to track your actual driving habits. This can be a great way to get an even more accurate rate, especially if you're a truly low-mileage driver.

Strategies for Driving Less and Saving Money on Car Insurance Low Mileage Discounts

Okay, so you know that driving less can save you money. But how do you actually *drive less*? Here are a few practical strategies:

- Carpooling: Team up with coworkers or neighbors who live nearby. Not only will you save on gas and insurance, but you'll also have some company on your commute! Plus, you might get to use the HOV lane!

- Public Transportation: If you live in an area with good public transportation, take advantage of it! Buses, trains, and subways can be a convenient and affordable way to get around.

- Biking and Walking: For short trips, consider biking or walking. It's great exercise and good for the environment. Plus, you'll save on gas and wear and tear on your car.

- Working From Home: If possible, talk to your employer about working from home, even just a few days a week. This can drastically reduce your mileage.

- Combining Errands: Plan your errands strategically so you can accomplish multiple tasks in one trip. This will save you time and gas.

- Online Shopping: Instead of driving to the store, order your groceries and other essentials online. It's convenient and can save you money on impulse purchases too!

- Ride Sharing: Use ride sharing apps like Uber or Lyft for occasional trips when you don't want to drive.

Think creatively about how you can reduce your reliance on your car. Even small changes can add up over time.

Specific Car Insurance Products for Low Mileage Drivers Usage Based Insurance

Now, let's talk about some specific insurance products that are designed for low-mileage drivers. These policies often use telematics to track your driving habits and adjust your rates accordingly.

- Usage-Based Insurance (UBI): This is the most common type of low-mileage insurance. UBI programs use a device (either plugged into your car or an app on your phone) to track your driving behavior, including mileage, speed, braking habits, and time of day. The insurance company then uses this data to calculate your premium. If you're a safe driver who doesn't drive much, you can save a lot of money with UBI. Some popular UBI programs include:

- Allstate Drivewise: Tracks your driving habits and rewards safe driving with discounts.

- State Farm Drive Safe & Save: Similar to Drivewise, but offered by State Farm.

- Progressive Snapshot: One of the original UBI programs, Snapshot tracks your mileage, braking, and time of day.

- Liberty Mutual RightTrack: Rewards safe driving with discounts based on your driving data.

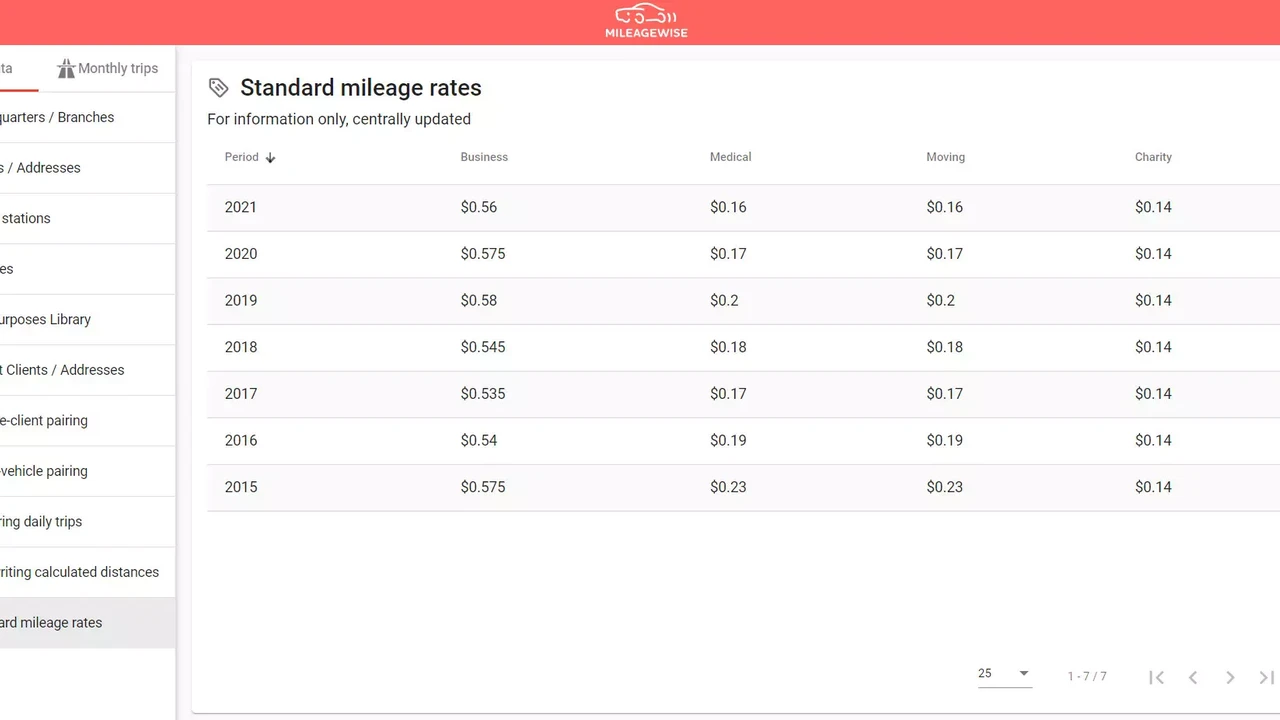

- Pay-Per-Mile Insurance: This type of insurance charges you a base rate plus a per-mile fee. The fee is usually quite low (a few cents per mile), so if you don't drive much, you can save a significant amount of money. A popular pay-per-mile insurance company is Metromile.

Before signing up for a UBI or pay-per-mile policy, be sure to read the fine print. Some programs may penalize you for certain driving behaviors, such as hard braking or driving late at night. Also, make sure you're comfortable with the insurance company tracking your driving data.

Comparing Low Mileage Car Insurance Options Costs and Benefits

Okay, let's compare some of the low-mileage car insurance options in more detail. We'll look at the pros and cons of each, as well as their average costs.

| Insurance Type | Pros | Cons | Average Cost | Usage Scenario |

|---|---|---|---|---|

| Usage-Based Insurance (UBI) | Potential for significant savings, rewards safe driving habits, can provide valuable feedback on your driving behavior. | Requires tracking of your driving data, potential for penalties for certain driving behaviors, rates can increase if you're not a safe driver. | Varies widely, but can be 10-30% lower than traditional insurance. | Ideal for drivers who drive less than average and are confident in their safe driving habits. |

| Pay-Per-Mile Insurance | Simple and transparent pricing, only pay for the miles you drive, can be very affordable for low-mileage drivers. | May not be the best option for drivers who drive a lot, can be more expensive than traditional insurance if you exceed a certain mileage threshold. | Base rate plus a few cents per mile. | Ideal for drivers who drive very little, such as those who work from home or use public transportation. |

| Traditional Insurance with Low-Mileage Discount | No need to track your driving data, familiar and established insurance companies, may be a good option if you're not comfortable with telematics. | Savings may not be as significant as with UBI or pay-per-mile insurance, requires accurate estimation of your annual mileage. | Varies depending on the insurance company and your driving history. | Ideal for drivers who are not comfortable with telematics but still want to save money by driving less. |

As you can see, each type of insurance has its own advantages and disadvantages. The best option for you will depend on your individual driving habits and preferences.

Product Recommendations for Saving Money on Car Insurance Through Mileage Reduction

Let's dive into some specific product recommendations that can help you reduce your mileage and potentially save money on car insurance:

- MileIQ: (Mileage Tracking App)

- Description: A popular mileage tracking app that automatically tracks your trips using GPS. It can categorize trips as business or personal and generate detailed reports for tax purposes.

- Usage Scenario: Ideal for freelancers, small business owners, and anyone who needs to track their mileage for tax deductions or expense reimbursement.

- Comparison: Compared to other mileage tracking apps, MileIQ is known for its ease of use and accurate tracking.

- Price: Free for a limited number of trips, paid subscription for unlimited trips. Around $5.99/month or $59.99/year.

- Garmin eLog: (Electronic Logging Device)

- Description: An electronic logging device (ELD) that plugs into your vehicle's diagnostic port and automatically records your driving time.

- Usage Scenario: Primarily used by commercial truck drivers to comply with federal regulations, but can also be used by anyone who wants to track their driving time accurately.

- Comparison: Compared to other ELDs, the Garmin eLog is known for its reliability and user-friendly interface.

- Price: Around $200-$300.

- Electric Bikes (Various Brands):

- Description: Electric bikes provide pedal assistance, making it easier to cycle longer distances and tackle hills.

- Usage Scenario: Ideal for commuting to work, running errands, or simply enjoying a leisurely ride.

- Comparison: Brands like Trek, Specialized, and Rad Power Bikes offer a wide range of electric bikes with varying features and price points.

- Price: Range from $1,000 to $5,000+.

- Folding Bikes (Various Brands):

- Description: Folding bikes are compact and portable, making them easy to store and transport.

- Usage Scenario: Ideal for commuters who need to combine biking with public transportation, or for anyone who has limited storage space.

- Comparison: Brands like Brompton and Dahon offer high-quality folding bikes with varying features and price points.

- Price: Range from $800 to $3,000+.

These are just a few examples of products that can help you reduce your mileage and potentially save money on car insurance. Do your research and choose the products that best fit your needs and budget.

Maintaining Accurate Mileage Records for Car Insurance Lower Rates

It's crucial to maintain accurate mileage records, not just for getting a lower initial quote, but also for keeping your insurance company informed of any significant changes. If you start driving more than you initially estimated, let your insurance company know. They may adjust your rate, but it's better to be honest than to risk having your claim denied later on.

Keep records of your mileage using one of the methods we discussed earlier, such as your odometer, a mileage tracking app, or your maintenance records. Be prepared to provide proof of your mileage if your insurance company asks for it.

Reviewing and Adjusting Your Car Insurance Policy Regularly Saving Money

Don't just set it and forget it! Review your car insurance policy at least once a year, or whenever your driving habits change. Make sure your estimated annual mileage is still accurate, and ask about any available discounts. You might be surprised at how much you can save just by making a few simple adjustments.

Also, shop around for quotes from other insurance companies. You might be able to find a better rate with a different company, even if you're happy with your current insurance provider.

The Future of Car Insurance and Mileage Based Pricing

The future of car insurance is likely to be even more closely tied to mileage and driving behavior. As technology advances, insurance companies will have access to more and more data about how we drive. This will allow them to create more personalized insurance policies that are tailored to individual drivers.

We can expect to see more widespread adoption of UBI programs and pay-per-mile insurance. We may also see new types of insurance products that are based on factors such as the time of day you drive, the roads you drive on, and even your emotional state while driving (using sensors in your car to detect stress or fatigue).

The key takeaway is that driving less is not just good for the environment and your wallet, it's also likely to become an increasingly important factor in determining your car insurance rates in the future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)