The Future of Car Ownership: Impact on Insurance Needs

The Shifting Landscape of Car Ownership and Insurance Demands

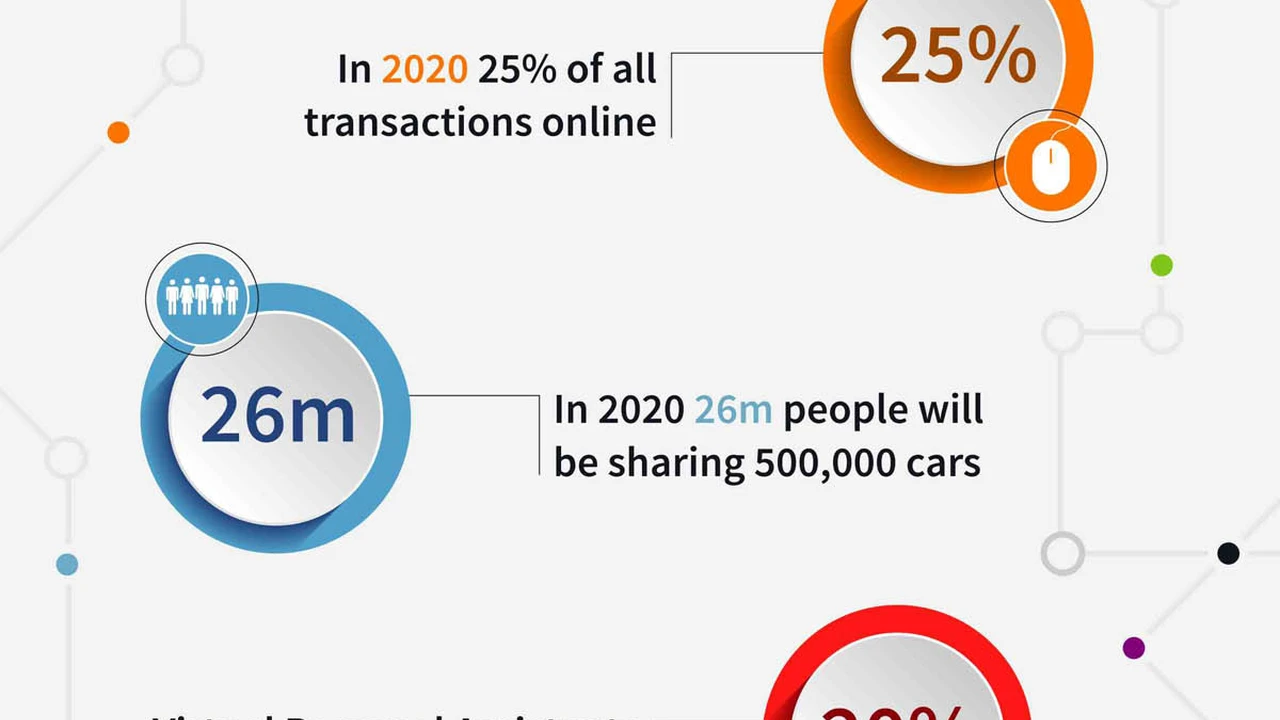

Okay, so let's talk about cars. Not just any cars, but the *future* of car ownership. Things are changing, and changing fast. We're talking ride-sharing, autonomous vehicles, electric everything. And guess what? All this techy goodness is going to seriously mess with the car insurance game. We gotta figure out how these trends impact what you need to be covered for. Think about it: less personal ownership, more shared rides – the traditional insurance model is gonna need a serious upgrade.

Ride-Sharing Revolution Car Insurance Implications

Ride-sharing apps like Uber and Lyft have already shaken things up. Suddenly, your personal car is also a potential money-making machine. But here's the catch: your standard personal auto insurance probably doesn't cover you when you're driving for profit. Most companies require a commercial policy or a ride-sharing endorsement. This is where things get tricky. You've got three phases: when the app is off, when the app is on but you haven't accepted a ride, and when you're actively transporting a passenger. Coverage gaps can exist, leaving you vulnerable if an accident happens during those in-between times. Companies like Allstate and Geico offer ride-sharing endorsements that bridge those gaps. For example, Allstate's Ride for Hire coverage adds protection during periods 1 and 2, where your personal policy might not fully cover you. Geico also offers a similar product, but it's important to compare the specifics as coverage and pricing can vary significantly. The cost can range from an extra $20 to $50 per month, depending on your location and driving history. Ignoring this can be a huge mistake, trust me.

Autonomous Vehicles and the Autonomous Car Insurance Debate

Now, let's crank it up a notch. Self-driving cars. The Jetsons are officially here (almost). But who's responsible when a self-driving car crashes? Is it the owner? The manufacturer? The software developer? It's a legal and ethical minefield. Traditional fault-based insurance might become obsolete. We might see a shift to product liability, where the car manufacturer is responsible for accidents caused by defects in the vehicle's autonomous system. Or maybe a no-fault system, where your own insurance covers your damages regardless of who's at fault. Companies are already starting to think about this. Volvo, for example, has publicly stated that they will accept liability if their self-driving technology is at fault in an accident. This puts pressure on other manufacturers to follow suit. However, the insurance implications are still being worked out. Expect to see new insurance products emerge specifically designed for autonomous vehicles, potentially focusing on data logging and cybersecurity risks.

Electric Vehicle Adoption and the Impact on Car Insurance Costs

Electric vehicles (EVs) are becoming more mainstream, and that's awesome for the environment. But they also come with their own insurance quirks. EVs tend to be more expensive to repair than traditional gasoline-powered cars, mainly because of the specialized components and the high cost of battery replacement. This can translate into higher insurance premiums. However, EVs also often have advanced safety features that can lower the risk of accidents, which could potentially offset the higher repair costs. The Tesla Model 3, for example, tends to have higher insurance premiums than a comparable gasoline-powered sedan due to its expensive battery pack and complex repair procedures. However, its advanced driver-assistance systems (ADAS) can reduce the likelihood of certain accidents. Other EVs, like the Nissan Leaf, might have more comparable insurance rates due to their simpler design and lower repair costs. It's crucial to shop around and compare quotes from different insurers, as pricing can vary widely based on the specific EV model and your driving profile.

Usage-Based Insurance UBI and the Future of Personalized Premiums

Think about this: your insurance premium is based on *how* you drive, not just *who* you are. That's the idea behind usage-based insurance (UBI). UBI programs use telematics devices or smartphone apps to track your driving habits, such as speed, acceleration, braking, and mileage. If you're a safe driver, you get rewarded with lower premiums. It's like having a personal driving coach in your car, except the reward is cheaper insurance. Progressive's Snapshot program is a popular example of UBI. It tracks your driving habits for a set period, and if you demonstrate safe driving, you can earn a discount on your policy. Another option is Allstate's Drivewise, which offers similar benefits. The potential savings can be significant, ranging from 5% to 30% or even more, depending on your driving score. However, be aware that some programs might also increase your premiums if you exhibit risky driving behavior. It's important to understand the terms and conditions before enrolling in a UBI program.

The Subscription Model Car Insurance and the Netflix-ification of Mobility

What if you could subscribe to a car instead of buying one? Car subscription services are popping up, offering all-inclusive access to a vehicle for a monthly fee. This often includes insurance, maintenance, and roadside assistance. It's like Netflix for cars. These services are still relatively new, but they offer a convenient and flexible alternative to traditional car ownership. Companies like Fair and Flexdrive offer car subscription options. Fair allows you to choose a car from a local dealership and pay a monthly fee that includes insurance, maintenance, and roadside assistance. Flexdrive partners with dealerships and rental car companies to provide similar subscription services. The monthly cost can vary depending on the vehicle and the subscription terms, but it typically ranges from $400 to $1000 or more. The insurance coverage is usually included in the subscription fee, but it's important to understand the details of the policy, such as the deductible and liability limits.

Cybersecurity Risks and Car Insurance Protection in a Connected World

With cars becoming increasingly connected, they're also vulnerable to cyberattacks. Hackers could potentially take control of your vehicle, steal your personal data, or even demand a ransom. Car insurance is starting to address these risks, with some policies offering coverage for cyber incidents. This could include protection against financial losses resulting from identity theft, data breaches, or even the cost of repairing or replacing compromised vehicle systems. This is a relatively new area of insurance, but it's expected to become more important as cars become more connected. Currently, specific cybersecurity coverage is often bundled within broader comprehensive or personal liability policies. However, as the risk grows, insurers may start offering standalone cyber insurance policies for vehicles. It's important to inquire about cybersecurity coverage when shopping for car insurance, especially if you own a vehicle with advanced connectivity features.

Micro-Mobility and the Rise of E-Scooters Insurance Considerations

E-scooters and other forms of micro-mobility are becoming increasingly popular, especially in urban areas. But riding an e-scooter can be risky, and accidents are common. Your car insurance might not cover you if you're injured while riding an e-scooter. You might need to rely on your health insurance or a separate personal liability policy. Some companies are starting to offer specific insurance coverage for e-scooters and other micro-mobility devices. For example, Lime, a popular e-scooter rental company, provides liability insurance for its riders. However, the coverage is often limited and may not cover all potential damages. If you frequently ride e-scooters, it's worth considering purchasing a separate personal liability policy or exploring options for specific micro-mobility insurance coverage. The cost of such coverage can vary depending on the provider and the level of protection, but it's typically relatively affordable, ranging from $50 to $200 per year.

Product Recommendations for Future Car Insurance Needs

Okay, so you're thinking about the future, right? Here are a few products and services to keep on your radar:

* **Allstate Ride for Hire:** Perfect if you're driving for Uber or Lyft. Bridges the coverage gap between your personal policy and commercial needs. Price: Varies by location and driving history, typically $20-$50 extra per month. * **Progressive Snapshot:** Usage-based insurance that rewards safe driving. Plug in the device, drive normally, and potentially save up to 30% or more. * **Tesla Insurance:** Specifically designed for Tesla vehicles, taking into account their unique technology and repair costs. Offers competitive rates and convenient claims processing. Price: Varies by model and driving history, but often competitive with other insurers for Tesla vehicles. * **Fair Car Subscription:** Subscribe to a car instead of buying one. Includes insurance, maintenance, and roadside assistance in one monthly fee. Price: Varies by vehicle and subscription term, typically $400-$1000+ per month.Remember to shop around, compare quotes, and read the fine print before making any decisions. The future of car insurance is coming, and it's important to be prepared!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)