Filing a Car Insurance Claim: The Complete Process

Understanding Car Insurance Claim Basics and Accident Reporting

Okay, so you've been in a fender bender, or maybe something a bit more serious. The first thing to remember is: stay calm. Easier said than done, I know, but it's crucial. Your immediate actions after an accident can significantly impact your car insurance claim process. Before we even think about filing a claim, let's make sure everyone's safe. Check yourself and your passengers for injuries. If anyone is hurt, call for medical assistance immediately. That's priority number one. Next, move your vehicle to a safe location, if possible. Turn on your hazard lights to alert other drivers. Now, the not-so-fun part: exchanging information. You'll need the other driver's name, contact information, insurance company, and policy number. Get their license plate number too. Don't forget to document the scene! Take photos or videos of the damage to all vehicles involved, the accident location, and any relevant road conditions. This visual evidence can be incredibly helpful when you file your claim. Finally, report the accident to the police, especially if there are injuries, significant property damage, or if the other driver doesn't have insurance. A police report can be a valuable piece of documentation for your insurance claim.

Step-by-Step Guide to Filing Your Car Insurance Claim with Comprehensive Details

Alright, you've gathered all the necessary information. Now it's time to actually file that car insurance claim. First, contact your insurance company as soon as possible. Most insurance companies have a 24/7 claims hotline or an online portal. The sooner you report the accident, the smoother the process will likely be. When you contact your insurer, be prepared to provide them with all the details of the accident, including the date, time, location, and a description of what happened. You'll also need to provide the other driver's information, the police report number (if applicable), and any photos or videos you took at the scene. Your insurance company will assign a claims adjuster to your case. The adjuster's job is to investigate the accident, assess the damages, and determine who is at fault. Cooperate fully with your adjuster and provide them with any information they request. They may ask you to provide a recorded statement or to submit additional documentation, such as medical records or repair estimates. Speaking of repair estimates, get at least two or three estimates from reputable auto body shops. This will give you a good idea of the cost of repairs and will help you negotiate with your insurance company. Once the adjuster has completed their investigation, they will make a determination about your claim. If your claim is approved, they will issue payment for the damages, minus your deductible. If your claim is denied, you have the right to appeal their decision. The appeals process varies depending on your insurance company and your state, so be sure to research the specific procedures.

Navigating the Car Insurance Claim Process After a Collision and Dealing with the Adjuster

Dealing with a claims adjuster can sometimes feel like navigating a minefield. Remember, the adjuster's job is to protect the insurance company's interests. That doesn't necessarily mean they're trying to cheat you, but it does mean you need to be prepared. First and foremost, be polite and professional. Even if you're frustrated or angry, don't let your emotions get the better of you. Keep a record of all communication with the adjuster, including the date, time, and a summary of the conversation. This will be helpful if you need to refer back to something later. Don't sign anything without reading it carefully and understanding what it means. If you're unsure about something, ask the adjuster to explain it to you. Be wary of accepting a settlement offer too quickly. Make sure the offer adequately covers your damages, including medical expenses, lost wages, and property damage. If you're not happy with the offer, don't be afraid to negotiate. You can also consult with an attorney to get a second opinion. Finally, remember that you have the right to file a complaint with your state's insurance department if you believe your insurance company is acting unfairly. The insurance department can investigate your complaint and help you resolve the issue.

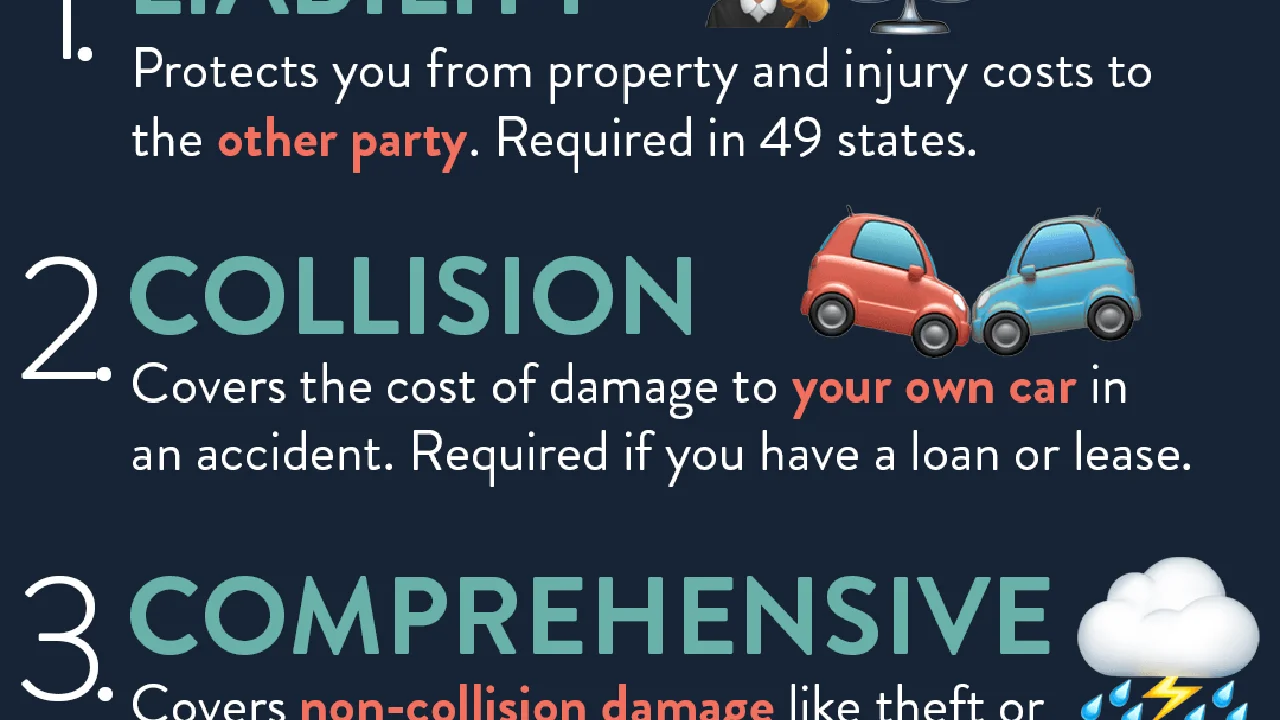

Understanding Car Insurance Coverage Types Relevant to Accident Claims

Car insurance can be confusing, with all those different coverage types. Let's break down the ones that are most relevant to accident claims. First up, we have **liability coverage**. This is the most basic type of coverage, and it's required in most states. Liability coverage protects you if you're at fault in an accident and cause damage to someone else's property or injuries to another person. It covers their medical expenses, lost wages, and property damage. There are two types of liability coverage: bodily injury liability and property damage liability. Bodily injury liability covers injuries to other people, while property damage liability covers damage to their vehicles or other property. Next, we have **collision coverage**. This covers damage to your vehicle if you're involved in an accident, regardless of who is at fault. Collision coverage typically has a deductible, which is the amount you have to pay out of pocket before your insurance company pays the rest. Then there's **comprehensive coverage**. This covers damage to your vehicle that's not caused by a collision, such as damage from theft, vandalism, fire, or natural disasters. Comprehensive coverage also typically has a deductible. Finally, we have **uninsured/underinsured motorist coverage**. This protects you if you're involved in an accident with a driver who doesn't have insurance or who doesn't have enough insurance to cover your damages. Uninsured/underinsured motorist coverage can cover your medical expenses, lost wages, and pain and suffering. Understanding these different coverage types is crucial for protecting yourself financially in the event of an accident.

Product Recommendations for Accident Documentation and Safety Equipment with Pricing and Usage Scenarios

Okay, let's talk about some products that can help you document accidents and stay safe on the road. These aren't just random gadgets; they're tools that can make a real difference in your safety and the ease of filing a claim. First, let's talk about **dash cams**. These are small cameras that mount on your dashboard and record everything that happens in front of your car. They can be invaluable in proving fault in an accident. One popular option is the **Vantrue N4 3 Channel Dash Cam**. It records in 4K resolution and has front, interior, and rear cameras. It costs around $250. Another great option is the **Garmin Dash Cam 67W**. It's smaller and more discreet than the Vantrue, but it still records in high quality and has a wide viewing angle. It's priced around $200. Using a dash cam is simple: just mount it on your windshield, plug it into your car's power outlet, and it will automatically start recording when you start your car. In the event of an accident, you can use the footage to show the police and your insurance company exactly what happened. Next, let's talk about **first aid kits**. Having a well-stocked first aid kit in your car is essential for dealing with minor injuries after an accident. The **First Aid Only All-Purpose First Aid Kit** is a great option. It contains everything you need to treat cuts, scrapes, burns, and other minor injuries. It costs around $20. Another useful product is a **window breaker and seatbelt cutter**. In the event of an accident, you may need to break a window to escape your car or cut your seatbelt if it's jammed. The **Resqme Car Escape Tool** is a small, lightweight tool that can do both. It costs around $15. Finally, consider a **portable jump starter**. If your car battery dies after an accident, a portable jump starter can help you get back on the road quickly. The **NOCO Boost Plus GB40 1000 Amp 12-Volt UltraSafe Lithium Jump Starter Box** is a reliable and powerful option. It costs around $100. These products can significantly improve your safety and make the accident documentation process smoother. Remember to research and choose products that best fit your individual needs and budget.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)