Group Insurance: Employee and Alumni Discounts

Understanding Group Insurance The Key to Car Insurance Savings

Okay, let's talk about saving some serious cash on car insurance. You know how it goes – premiums keep creeping up, and it feels like you're throwing money away every month. But what if I told you there's a way to potentially slash those costs simply by being part of a group? That's where group insurance comes in. It's like a secret weapon for smart shoppers.

Group insurance, in its simplest form, is when a large group of people, like employees of a company or members of an alumni association, get together to negotiate better rates on insurance. Because the insurance company is dealing with a large pool of customers, they can often offer lower premiums than you'd get on your own. Think of it as buying in bulk – you get a better deal!

This isn't just some obscure loophole; it's a legitimate way many people save hundreds, even thousands, of dollars each year. The power of numbers is real, folks.

Employee Discounts Unlocking Car Insurance Savings Through Your Job

So, how does this work in practice? Let's start with employee discounts. Many companies, especially larger ones, have negotiated deals with insurance providers to offer discounted rates to their employees. These discounts can range from a few percentage points to a substantial chunk of your premium, depending on the company, the insurance provider, and the overall agreement.

The best part? It's usually super easy to find out if your employer offers this benefit. Just check your employee benefits package, HR website, or even ask your HR representative directly. They'll be able to tell you if a car insurance discount is available and how to enroll. Don't be shy – it's your money we're talking about!

Even if your company doesn't explicitly advertise a car insurance discount, it's worth asking. Sometimes these deals are hidden or not widely promoted. A simple email or phone call to HR could uncover a hidden gem of savings.

And remember, these discounts aren't just for employees. Often, they extend to family members living in the same household. So, your spouse or children might also be eligible for the same discounted rates. Double win!

Alumni Discounts Tapping Into Your School Network for Car Insurance Savings

Now, let's talk about alumni discounts. Just because you've graduated doesn't mean you have to say goodbye to all the perks of being a student. Many alumni associations have partnered with insurance companies to offer exclusive discounts to their members. This is another fantastic way to leverage your group affiliation for lower car insurance rates.

To find out if your alumni association offers this benefit, check their website, newsletter, or contact their office directly. They'll be able to provide you with information on participating insurance providers and how to access the discounts. It's a great way to stay connected with your alma mater and save money at the same time!

These discounts are often available to graduates of all levels – from community colleges to universities. So, no matter where you went to school, it's worth checking to see if you're eligible.

Pro tip: some alumni associations even offer discounts on other types of insurance, like home insurance or life insurance. So, while you're at it, ask about those too! You might be surprised at the savings you can unlock.

Comparing Group Insurance vs Individual Car Insurance Policies A Detailed Analysis

Okay, so you know about group insurance, but how does it stack up against individual car insurance policies? Let's break it down.

Price: This is the big one. Group insurance often offers lower premiums because the risk is spread across a larger pool of drivers. Insurance companies like the stability of a large, predictable group, which translates to savings for you.

Coverage: The coverage offered through group insurance is typically comparable to individual policies. You'll still have options for liability coverage, collision coverage, comprehensive coverage, and more. The specific details will depend on the insurance provider and the plan you choose.

Convenience: Group insurance can be incredibly convenient. Enrollment is often streamlined through your employer or alumni association, and you might even be able to have your premiums deducted directly from your paycheck. Talk about hassle-free!

Personalization: Individual policies offer more flexibility in terms of customization. You can tailor your coverage to your specific needs and budget. With group insurance, you might have fewer options to choose from.

Portability: This is where individual policies have an edge. If you leave your job or your alumni association membership lapses, you might lose your group insurance coverage. Individual policies are portable, meaning you can take them with you wherever you go.

Ultimately, the best choice for you depends on your individual circumstances. If you're looking for the lowest possible premium and don't mind potentially sacrificing some flexibility, group insurance is definitely worth exploring. But if you value customization and portability, an individual policy might be a better fit.

Specific Car Insurance Products and Usage Scenarios Leveraging Group Discounts

Alright, let's get down to brass tacks. What specific car insurance products can you actually get with these group discounts? Here are a few examples, along with usage scenarios:

- Liability Coverage: This is the most basic type of car insurance, and it's required in most states. It covers damages you cause to other people or property in an accident. With a group discount, you could potentially save significantly on your liability premiums, especially if you're a young or inexperienced driver. Imagine Sarah, a recent college grad, gets a job at a large tech company. She signs up for the company's group insurance plan and saves $500 a year on her liability coverage compared to what she was paying before. That's extra money for rent or student loan payments!

- Collision Coverage: This covers damage to your own car if you're in an accident, regardless of who's at fault. If you have a newer car or a car that's worth a lot, collision coverage is a good idea. Let's say John, a long-time employee at a manufacturing plant, has a fender-bender in the parking lot. Thanks to his company's group insurance plan, his collision coverage kicks in and pays for the repairs, saving him thousands of dollars out of pocket.

- Comprehensive Coverage: This covers damage to your car from things other than accidents, like theft, vandalism, weather events, and even hitting a deer. If you live in an area prone to these types of incidents, comprehensive coverage is a smart investment. Consider Maria, an alumni of a state university, lives in an area with frequent hailstorms. Her alumni association's group insurance plan includes comprehensive coverage, which protects her car from hail damage. When a particularly bad storm hits, her insurance covers the cost of repairs, saving her a major headache.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by someone who doesn't have insurance or doesn't have enough insurance to cover your damages. This is especially important in states with a high percentage of uninsured drivers. David, a teacher and member of his local education association, is hit by an uninsured driver. Thanks to his group insurance plan, his uninsured motorist coverage covers his medical bills and car repairs, preventing him from being stuck with the expenses.

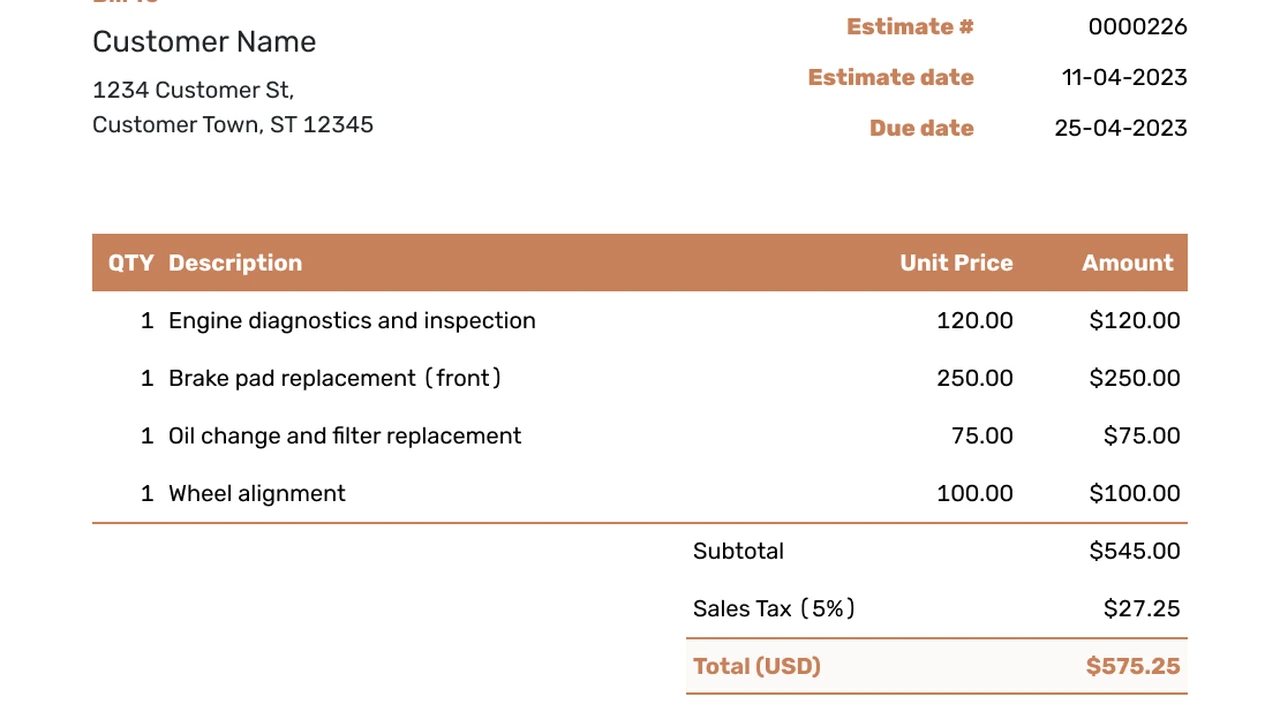

Product Comparison and Pricing Examples of Car Insurance Policies with Group Discounts

Okay, let's get specific about some hypothetical products and prices. Remember, these are just examples, and actual rates will vary depending on your individual circumstances, location, and driving history.

Example 1: The "Safe Driver" Plan

- Provider: Hypothetical "SafeCo Insurance"

- Coverage: Liability, Collision, Comprehensive

- Individual Premium: $1500 per year

- Group Discount (Employee): 15%

- Group Premium (Employee): $1275 per year

- Savings: $225 per year

- Usage Scenario: Ideal for drivers with clean records and newer cars.

Example 2: The "Value" Plan

- Provider: Hypothetical "ValueGuard Insurance"

- Coverage: Liability, Uninsured Motorist

- Individual Premium: $800 per year

- Group Discount (Alumni): 10%

- Group Premium (Alumni): $720 per year

- Savings: $80 per year

- Usage Scenario: Best for drivers on a tight budget who want basic coverage.

Example 3: The "Premium" Plan

- Provider: Hypothetical "PremiumProtect Insurance"

- Coverage: Liability, Collision, Comprehensive, Rental Car Reimbursement

- Individual Premium: $2500 per year

- Group Discount (Employee + Family): 20%

- Group Premium (Employee + Family): $2000 per year

- Savings: $500 per year

- Usage Scenario: Suitable for drivers who want maximum protection and peace of mind. This plan also includes coverage for spouses and dependents, making it a great value for families.

Important Considerations:

- Deductibles: Remember to consider the deductibles associated with each plan. A lower deductible means you'll pay less out-of-pocket in the event of an accident, but your premium will be higher.

- Coverage Limits: Pay attention to the coverage limits. Make sure they're adequate to protect you in case of a serious accident.

- Customer Service: Research the insurance provider's customer service reputation. You want to be sure you can get help quickly and easily if you need it.

Steps to Take to Secure Group Car Insurance Discounts Maximizing Your Savings Potential

Okay, you're convinced. You want to get in on this group insurance action. Here's what you need to do:

- Check with Your Employer: Start by checking your employee benefits package or contacting your HR department. Ask specifically about car insurance discounts.

- Contact Your Alumni Association: Visit your alumni association's website or contact their office to inquire about insurance discounts.

- Gather Information: Once you've identified potential group insurance options, gather information about the coverage, premiums, and deductibles.

- Compare Quotes: Get quotes from multiple insurance providers, both group and individual, to compare your options.

- Read the Fine Print: Before you sign up for any insurance policy, read the fine print carefully. Make sure you understand the coverage, exclusions, and limitations.

- Enroll and Save! Once you've found the best deal, enroll in the group insurance plan and start saving money on your car insurance.

It's also a good idea to review your car insurance policy annually to make sure you're still getting the best rate. Your needs and circumstances may change over time, so it's important to stay on top of your insurance coverage.

Frequently Asked Questions About Group Car Insurance Discounts Addressing Common Concerns

Let's tackle some common questions people have about group car insurance discounts:

- Q: Are group insurance discounts always the best deal? A: Not necessarily. It's always a good idea to compare quotes from multiple insurance providers, both group and individual, to make sure you're getting the best rate.

- Q: Will I lose my discount if I leave my job or alumni association? A: Possibly. Group insurance discounts are typically tied to your affiliation with the group. If you leave the group, you may lose the discount. However, some insurance providers may offer a grace period or allow you to convert to an individual policy.

- Q: Is group insurance coverage as good as individual coverage? A: It depends on the specific policy. Group insurance coverage is typically comparable to individual policies, but it's important to review the details carefully to make sure it meets your needs.

- Q: Can I combine group insurance discounts with other discounts? A: It depends on the insurance provider. Some insurance providers may allow you to combine group insurance discounts with other discounts, such as safe driver discounts or multi-policy discounts.

- Q: How do I know if my employer or alumni association has a group insurance program? A: Check your employee benefits package, HR website, or alumni association website. You can also contact your HR representative or alumni association office directly.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)