Online Car Insurance Companies: Are They Worth It?

The Rise of Online Car Insurance Companies and What It Means for You

Okay, so you're thinking about car insurance, right? And you've probably seen all these ads for online car insurance companies. They promise lower rates, faster quotes, and the convenience of doing everything from your couch. Sounds pretty sweet, doesn't it? But are they actually worth it? Let's dive in and figure this out.

The world is going digital, and car insurance is no exception. Traditional brick-and-mortar insurance agencies are facing some serious competition from these online players. Think about it: no more awkward phone calls, no more pushy salespeople. Just you, your computer, and a whole lot of policy options. But with so many choices, how do you know where to start?

Understanding the Benefits of Online Car Insurance Quotes and Policies

Let's break down why so many people are switching to online car insurance. One of the biggest draws is the potential for **lower rates**. Online companies often have lower overhead costs than traditional agencies, which means they can pass those savings on to you. Plus, comparing quotes is a breeze. You can get multiple quotes from different companies in minutes, without ever leaving your house. Think about all the time you save! Time is money, friend.

Another benefit is the **convenience**. You can get a quote, purchase a policy, and even file a claim online, 24/7. No more waiting on hold or trying to schedule appointments. It's all right there at your fingertips. Got a question at 3 AM? Many online companies offer customer support through chat or email, so you're never truly alone (insurance-wise, at least).

Potential Drawbacks of Online Car Insurance and How to Avoid Them

Now, let's be real, it's not all sunshine and rainbows. There are some potential downsides to consider. One is the lack of personal interaction. You're not building a relationship with an agent who knows you and your driving history. This can sometimes make it harder to get personalized advice or navigate complex claims.

Another concern is the potential for scams. There are some shady online companies out there that are just looking to take your money. That's why it's crucial to do your research and only work with reputable insurers. Check their ratings with the Better Business Bureau and read online reviews before you commit to anything.

Comparing Top Online Car Insurance Companies: Features, Pricing, and User Reviews

Alright, let's get to the good stuff: specific companies. I'm going to give you a rundown of a few popular options, but remember, this is just a starting point. Always do your own research and compare quotes from multiple companies before making a decision.

GEICO: The Established Player with Competitive Rates

GEICO is a household name for a reason. They've been around for ages and have a solid reputation for offering competitive rates, especially for drivers with good records. Their website and app are user-friendly, and they offer a variety of discounts, including discounts for military personnel, students, and federal employees.

Use Case: GEICO is a great option for drivers who are looking for a reliable insurer with a strong track record and a wide range of coverage options. They're also a good choice if you're eligible for any of their discounts.

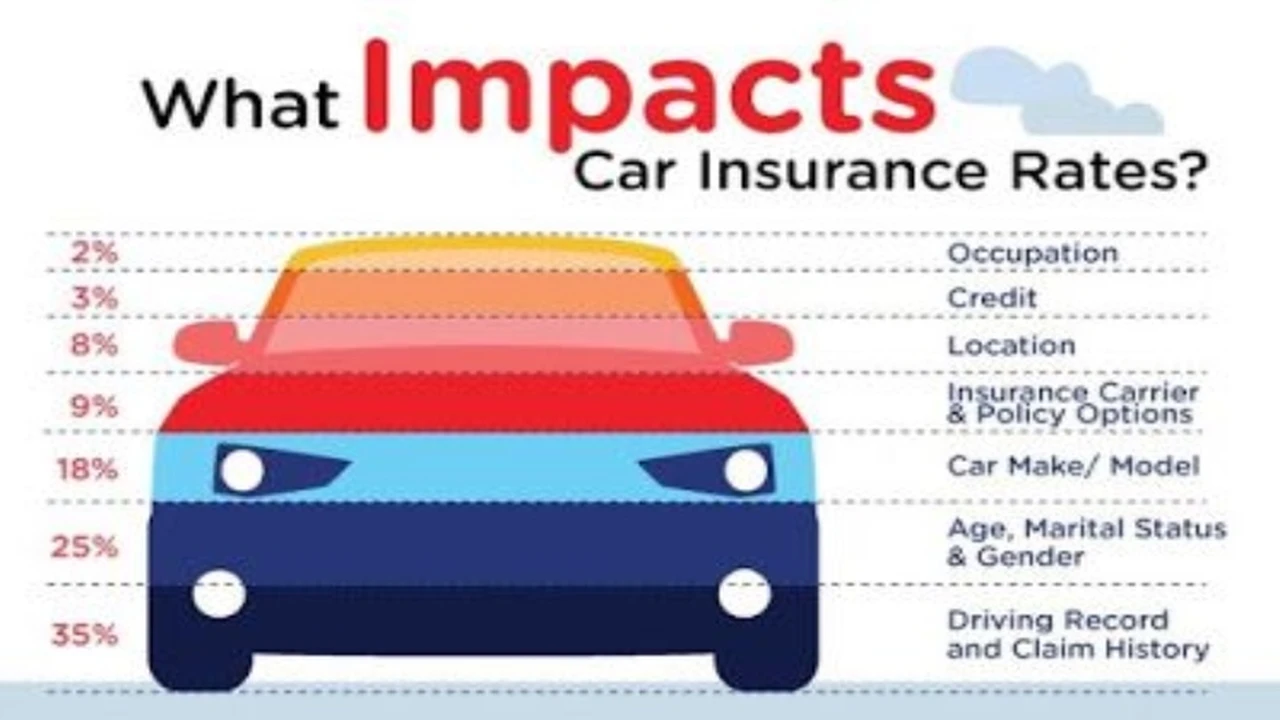

Pricing: GEICO's rates vary depending on your driving history, location, and other factors. However, they are generally considered to be among the most affordable insurers on the market.

Progressive: The Innovator with Name Your Price Tool

Progressive is known for its innovative approach to insurance. Their "Name Your Price" tool allows you to set your budget and then see what coverage options are available within that range. This can be a great way to find affordable coverage that fits your needs.

Use Case: Progressive is a good option for drivers who are on a tight budget or who want to customize their coverage to fit their specific needs. Their "Name Your Price" tool can be especially helpful for finding affordable coverage.

Pricing: Progressive's rates are generally competitive, but they can be higher for drivers with poor driving records. However, their "Name Your Price" tool can help you find affordable coverage even if you have a less-than-perfect driving history.

Lemonade: The Tech-Savvy Insurer with a Focus on Social Good

Lemonade is a relatively new player in the car insurance market, but they've quickly gained popularity with their tech-savvy approach and focus on social good. They use AI and chatbots to streamline the insurance process, and they donate unclaimed premiums to charity.

Use Case: Lemonade is a good option for drivers who are comfortable using technology and who want to support a company that gives back to the community. Their AI-powered claims process can be especially appealing to those who want a fast and efficient experience.

Pricing: Lemonade's rates are generally competitive, but they may not be the cheapest option for all drivers. However, their focus on social good and their innovative approach to insurance may make them worth the extra cost for some.

Product Comparison Table

| Company | Key Features | Pros | Cons | Estimated Price (Sample Driver) |

|---|---|---|---|---|

| GEICO | Competitive rates, wide range of coverage options, user-friendly website and app | Established reputation, strong financial stability, numerous discounts | May not be the cheapest option for all drivers | $1200/year |

| Progressive | "Name Your Price" tool, customizable coverage options, 24/7 customer support | Good for budget-conscious drivers, innovative features, easy to compare quotes | Rates can be higher for drivers with poor driving records | $1100/year |

| Lemonade | AI-powered claims process, focus on social good, user-friendly app | Fast and efficient claims process, supports charitable causes, modern approach to insurance | Newer company, may not be as widely available as other insurers | $1300/year |

Tips for Choosing the Right Online Car Insurance Policy for Your Needs

Okay, you've got some companies in mind, now what? Here are a few tips to help you choose the right policy:

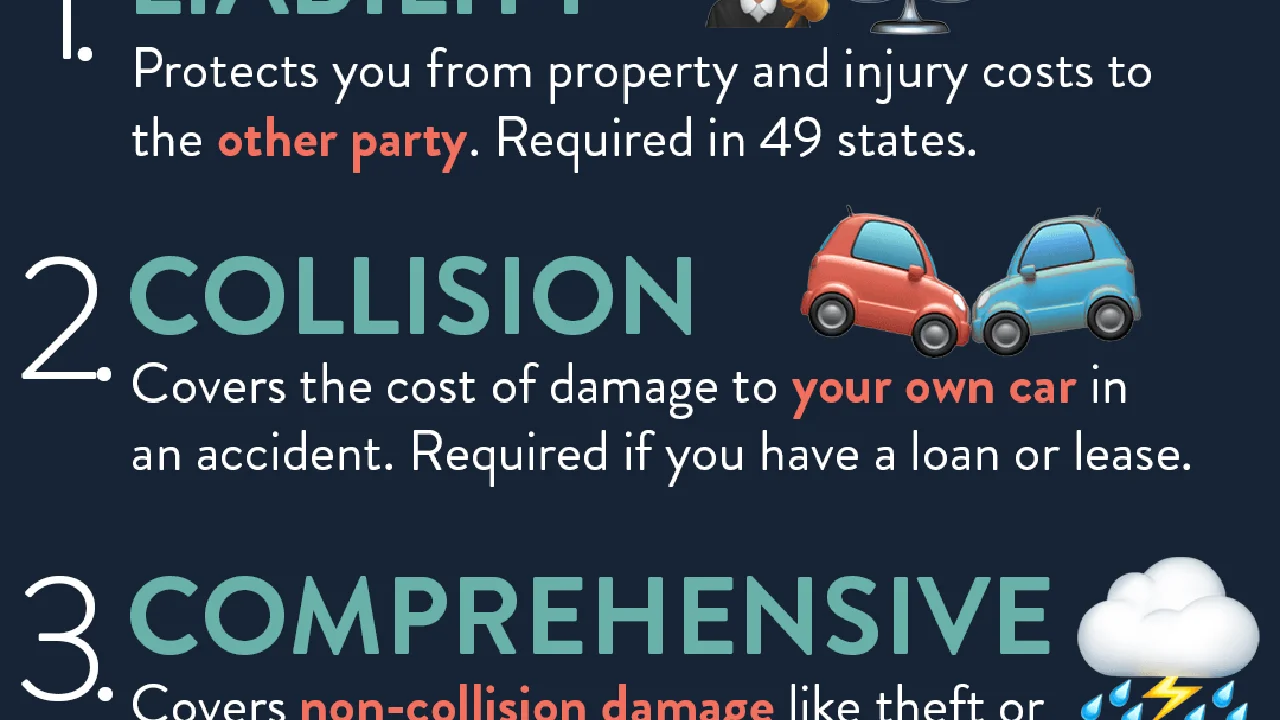

* **Determine your coverage needs:** How much liability coverage do you need? Do you want collision and comprehensive coverage? Think about your assets and your risk tolerance. * **Compare quotes from multiple companies:** Don't just settle for the first quote you get. Shop around and compare rates from several different insurers. * **Read the fine print:** Make sure you understand the terms and conditions of the policy before you buy it. Pay attention to exclusions, deductibles, and coverage limits. * **Check customer reviews:** See what other people are saying about the company's customer service and claims process. * **Consider bundling:** If you have other insurance needs, such as home insurance or renters insurance, you may be able to save money by bundling your policies with the same company.Online Car Insurance and Discounts: How to Save Even More Money

Speaking of saving money, let's talk about discounts! Online car insurance companies offer a variety of discounts, so be sure to ask about them when you're getting a quote. Some common discounts include:

* **Safe driver discount:** If you have a clean driving record, you may be eligible for a discount. * **Good student discount:** If you're a student with good grades, you may be able to save money on your car insurance. * **Multi-car discount:** If you insure multiple vehicles with the same company, you may be eligible for a discount. * **Homeowner discount:** If you own a home, you may be able to save money on your car insurance. * **Military discount:** If you're a member of the military, you may be eligible for a discount. * **Bundling Discount:** Combining car and home insurance can lead to significant savings. * **Anti-theft device discount:** Having an alarm system or LoJack can lower your premium.Don't be afraid to ask about any discounts that you think you might be eligible for. Every little bit helps!

The Future of Car Insurance: What to Expect from Online Platforms

The world of car insurance is constantly evolving, and online platforms are at the forefront of that change. We can expect to see even more innovation in the years to come, including:

* **Usage-based insurance:** This type of insurance uses telematics to track your driving habits and adjust your rates accordingly. If you're a safe driver, you could save a lot of money. * **Autonomous vehicle insurance:** As self-driving cars become more common, we'll need new types of insurance to cover them. * **More personalized coverage:** Online platforms will be able to use data to create more personalized coverage options that fit your specific needs.The future of car insurance is bright, and online platforms are leading the way. So, are online car insurance companies worth it? For many people, the answer is a resounding yes. Just be sure to do your research, compare quotes, and choose a reputable insurer that meets your needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)