State Car Insurance Laws: A Comprehensive Overview

Understanding Mandatory Car Insurance Requirements by State

Okay, let's dive into the nitty-gritty of state car insurance laws. You know that feeling when you're driving and a little voice in the back of your head reminds you about insurance? Yeah, that's your responsible side kicking in. But what exactly *are* the requirements? Well, it varies a LOT from state to state. Some states are super chill, only requiring liability coverage, while others are more strict, demanding uninsured/underinsured motorist coverage or even personal injury protection (PIP).

Liability insurance is the biggie in most places. It covers damages you cause to *other* people and their property if you're at fault in an accident. Think of it as your "oops, I bumped into you" coverage. The amount of coverage required is usually expressed as three numbers, like 25/50/25. This means $25,000 for injury to one person, $50,000 for injury to all persons in an accident, and $25,000 for property damage. Make sure you're covered adequately! Skimping here can lead to serious financial trouble if you cause a significant accident.

Then there's Uninsured/Underinsured Motorist (UM/UIM) coverage. This is your safety net if you're hit by someone who doesn't have insurance or doesn't have *enough* insurance to cover your damages. It's a lifesaver, especially in states with a high percentage of uninsured drivers. Think of it as protection against irresponsible drivers. It covers your medical bills, lost wages, and sometimes even pain and suffering.

And finally, there's Personal Injury Protection (PIP), also known as "no-fault" insurance. This covers your medical expenses and lost wages, regardless of who was at fault in the accident. It's designed to speed up the claims process and reduce lawsuits. PIP is mandatory in some states and optional in others. It's a great option because it provides quick access to funds after an accident.

Navigating Minimum Liability Coverage Amounts and State Regulations

So, how do you figure out what the minimum liability coverage amounts are in your state? The easiest way is to check your state's Department of Motor Vehicles (DMV) website. They'll have all the details laid out for you, usually in plain English (or as close to it as government websites get!). You can also talk to an insurance agent. They're experts at this stuff and can walk you through the specific requirements in your area.

It's also important to stay up-to-date on any changes to state regulations. Insurance laws can change, so what was true last year might not be true this year. Subscribe to newsletters from your state's DMV or insurance commissioner, or follow insurance news websites. Knowledge is power, especially when it comes to protecting yourself financially!

Exploring Full Coverage Options Beyond State Minimums

While meeting the state minimum is a must, it's often not enough. Think of the minimums as the bare minimum – just enough to keep you legal. Full coverage, on the other hand, offers much broader protection. It typically includes collision and comprehensive coverage, in addition to liability.

Collision coverage pays for damage to your car if you hit another vehicle or object, regardless of who was at fault. Comprehensive coverage, on the other hand, covers damage from things like theft, vandalism, fire, hail, and even hitting a deer! It's the "everything else" coverage. Imagine your car gets totaled in a hailstorm. Comprehensive coverage would help you replace it.

Getting full coverage gives you serious peace of mind. It protects you from a wide range of potential disasters. While it's more expensive than just liability, the added protection can be well worth the cost, especially if you have a newer car or live in an area prone to accidents or natural disasters.

Comparing Car Insurance Products: GEICO vs. State Farm vs. Progressive

Alright, let's talk about some specific insurance companies. Three big players in the car insurance game are GEICO, State Farm, and Progressive. They all offer a variety of coverage options and discounts, but they also have their own strengths and weaknesses.

GEICO is known for its competitive prices, especially for drivers with good driving records. They also have a user-friendly website and mobile app, making it easy to manage your policy. GEICO's customer service is generally well-regarded, although some customers have reported long wait times on the phone. They're a great option if you're looking for affordable coverage and a convenient online experience.

State Farm, on the other hand, is known for its strong local presence and personalized service. They have a network of agents across the country who can provide face-to-face support. State Farm also offers a wide range of insurance products, including home, life, and health insurance, making it easy to bundle your policies. They're a good choice if you value personal relationships and comprehensive coverage.

Progressive is known for its innovative products and services, such as Snapshot, a program that tracks your driving habits and rewards safe drivers with discounts. They also offer a variety of online tools and resources, including a rate comparison tool that lets you compare quotes from other insurance companies. Progressive is a good option if you're looking for cutting-edge technology and personalized pricing.

Real-World Car Insurance Scenarios and Coverage Recommendations

Let's run through some scenarios to see how these different companies and coverages would play out.

Scenario 1: You're a young, single driver with a clean driving record living in a city with high traffic congestion. You're primarily concerned about getting the cheapest possible coverage. In this case, GEICO might be a good fit. Their competitive rates and user-friendly online platform could save you money and time.

Scenario 2: You're a family with two teenagers and two cars. You want to bundle your auto and home insurance policies for a discount and prefer to work with a local agent. State Farm's strong local presence and wide range of insurance products make them a good choice.

Scenario 3: You're a safe driver who's willing to let your insurance company track your driving habits in exchange for a discount. Progressive's Snapshot program could save you money if you consistently drive safely.

Remember, the best car insurance company for you depends on your individual needs and circumstances. Take the time to shop around and compare quotes from multiple companies before making a decision.

Understanding Deductibles, Premiums, and Policy Costs

Okay, let's break down the cost of car insurance. Two key terms you need to understand are deductibles and premiums.

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and your car is damaged in an accident, you'll pay the first $500, and your insurance company will pay the rest (up to your coverage limits). A higher deductible typically means a lower premium, and vice versa.

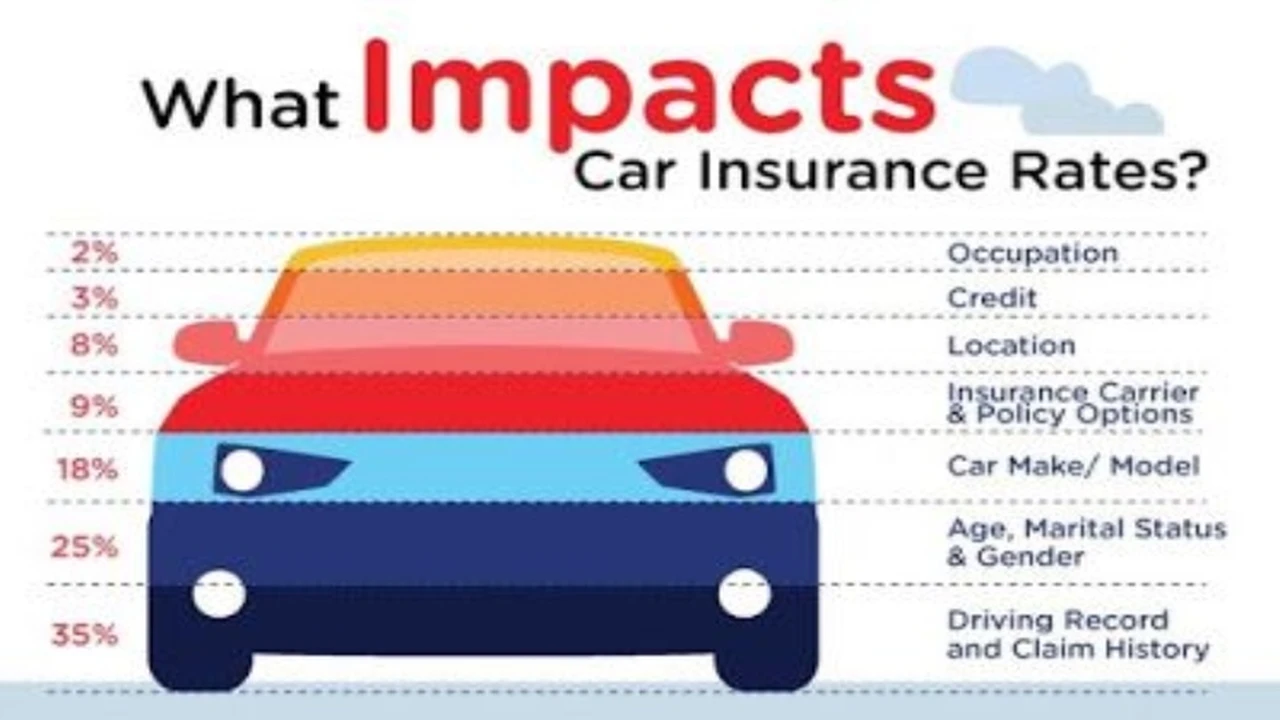

A premium is the amount you pay each month (or year) for your insurance coverage. It's essentially the price you pay to have insurance protection. Your premium is influenced by a variety of factors, including your age, driving record, type of car, and coverage limits.

Choosing the right deductible is a balancing act. A higher deductible can save you money on your premium, but you'll need to be prepared to pay more out-of-pocket if you have an accident. A lower deductible will result in a higher premium, but you'll have less to pay if you need to file a claim.

Decoding Car Insurance Jargon and Policy Documents

Car insurance policies can be confusing. They're full of jargon and legal language that can be difficult to understand. But don't worry, we're here to help you decode it!

Here are a few common terms you should know:

- Policy Limit: The maximum amount your insurance company will pay for a covered loss.

- Exclusion: A specific situation or event that is not covered by your policy.

- Endorsement: An addition or modification to your policy that changes the coverage.

- Claim: A request for payment from your insurance company for a covered loss.

When you receive your policy documents, take the time to read them carefully. Pay attention to the coverage limits, exclusions, and deductibles. If you have any questions, don't hesitate to contact your insurance agent or company. They're there to help you understand your policy and make sure you have the right coverage.

Recommended Car Insurance Products and Pricing

Let's get down to specific product recommendations and pricing. Keep in mind that prices can vary significantly depending on your location, driving record, and other factors. These are just examples to give you a general idea.

GEICO Basic Liability Policy: Starting at around $50 per month. Provides state-minimum liability coverage. Good for budget-conscious drivers with older cars.

State Farm Full Coverage Policy: Starting at around $120 per month. Includes liability, collision, and comprehensive coverage, as well as roadside assistance. A good option for families with newer cars.

Progressive Snapshot Discount: Potential savings of up to 30% on your premium. Requires using the Snapshot device or app to track your driving habits.

Liberty Mutual RightTrack Program: Similar to Progressive's Snapshot, offering potential discounts for safe driving.

Comparing Usage-Based Insurance and Traditional Policies

Usage-based insurance (UBI) is a relatively new type of car insurance that uses technology to track your driving habits and adjust your premium accordingly. It's often called "pay-as-you-drive" insurance.

UBI programs typically use a device or app to monitor things like your speed, braking habits, mileage, and time of day you drive. The data collected is then used to calculate your premium. If you're a safe driver who doesn't drive much, you could save a significant amount of money with UBI.

Traditional car insurance policies, on the other hand, base your premium on factors like your age, driving record, and type of car. They don't take into account your actual driving habits.

UBI is a good option for drivers who are confident in their driving skills and don't drive much. It can be a great way to save money if you're a safe driver. However, if you have a history of speeding or hard braking, UBI might not be the best choice for you.

Finding Discounts and Saving Money on Car Insurance

Who doesn't want to save money on car insurance? Here are a few tips to help you find discounts and lower your premium:

- Shop around: Get quotes from multiple insurance companies to compare prices.

- Increase your deductible: A higher deductible will lower your premium.

- Bundle your policies: Get discounts for bundling your auto and home insurance.

- Maintain a good driving record: Avoid accidents and traffic violations.

- Take a defensive driving course: Some insurance companies offer discounts for completing a defensive driving course.

- Ask about discounts: Inquire about discounts for students, seniors, military personnel, and other groups.

Future Trends in Car Insurance: Autonomous Vehicles and Beyond

The car insurance industry is constantly evolving. With the rise of autonomous vehicles and other technological advancements, the future of car insurance is likely to look very different.

Autonomous vehicles have the potential to significantly reduce accidents, which could lead to lower insurance rates. However, they also raise new questions about liability. Who is responsible if an autonomous vehicle causes an accident? The owner? The manufacturer? The software developer?

Other trends that are shaping the future of car insurance include the increasing use of telematics, the growing popularity of ride-sharing services, and the rise of electric vehicles. As these trends continue to evolve, the car insurance industry will need to adapt to meet the changing needs of drivers.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)