Esurance vs. Farmers: Which One Should You Choose?

Understanding Car Insurance Basics Esurance and Farmers Compared

Okay, so you're in the market for car insurance, and you've narrowed it down to Esurance and Farmers. Smart move! Both are reputable companies, but they cater to slightly different needs and preferences. Let's dive into a head-to-head comparison to help you figure out which one is the better fit for you. First things first, let's cover the basics. Car insurance isn't just a piece of paper you keep in your glove compartment. It's a financial safety net that protects you if you're involved in an accident. It can cover damage to your car, injuries to yourself and others, and even legal fees if you're sued. Different types of coverage exist, like liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Liability is usually mandatory and covers damages you cause to others. Collision covers damage to your car regardless of fault, while comprehensive covers things like theft, vandalism, and natural disasters. Uninsured/underinsured motorist coverage protects you if you're hit by someone without insurance or with insufficient coverage.

Esurance and Farmers both offer these standard coverages, but their approach and the specific features they offer can vary quite a bit. Esurance is known for its online-centric approach and potentially lower premiums, especially for tech-savvy drivers who are comfortable managing their policies online. Farmers, on the other hand, has a strong network of local agents and offers a more personalized, hands-on experience. They often appeal to customers who value face-to-face interaction and comprehensive insurance packages.

Esurance vs Farmers Coverage Options Detailed Comparison

Let's break down the coverage options offered by each company in more detail. Esurance offers all the standard coverages, plus a few extras like loan/lease payoff coverage (also known as gap insurance), which covers the difference between what you owe on your car loan and what the car is worth if it's totaled. They also have rental car coverage, which helps pay for a rental car while your vehicle is being repaired after a covered accident. Another cool feature is their DriveSense program, which tracks your driving habits and rewards safe drivers with discounts.

Farmers also offers a wide range of coverages, including all the standard options. But they stand out with their unique add-ons. For example, they offer a "New Car Pledge," which replaces your brand-new car with a new one of the same make and model if it's totaled within the first two years or 24,000 miles. They also have a "Guaranteed Value" option for classic or antique cars, ensuring you receive the agreed-upon value if the car is totaled. Farmers also provides a "RideShare" option for drivers who work for companies like Uber and Lyft, covering them during the gap between accepting a ride request and picking up the passenger. This is critical coverage that many standard policies don't offer.

A key difference is how these coverages are delivered. Esurance leans heavily on its online platform, making it easy to customize your policy and manage claims through their website or app. Farmers, with its network of local agents, offers a more personal touch. You can sit down with an agent to discuss your specific needs and get help navigating the complexities of insurance.

Esurance and Farmers Discounts Saving Money on Car Insurance

Everyone loves a good discount, right? Both Esurance and Farmers offer a variety of ways to save money on your car insurance. Esurance is known for its online discounts, such as discounts for getting a quote online, paying your bill online, and going paperless. They also offer discounts for safe drivers, good students, and for bundling your car insurance with other policies, like homeowners or renters insurance. Their DriveSense program can also lead to significant savings for drivers who demonstrate safe driving habits.

Farmers also has a robust discount program. They offer discounts for things like having multiple cars insured with them, being a homeowner, having anti-theft devices installed in your car, and being a member of certain professional organizations. They also offer a "Defensive Driver" discount for completing an approved defensive driving course. One of their most popular discounts is the "Signal" program, similar to Esurance's DriveSense, which uses a mobile app to track your driving and reward safe drivers with discounts. Farmers also offers a "Youthful Driver" discount for young drivers who maintain good grades and complete driver's education courses.

When comparing discounts, it's important to remember that the availability and amount of discounts can vary depending on your location and individual circumstances. It's always a good idea to get quotes from both companies and ask about all the available discounts to see which one offers the best overall value.

Esurance vs Farmers Customer Service and Claims Handling An In-Depth Look

Customer service and claims handling are crucial aspects of any insurance company. You want to be able to reach someone easily when you have questions or need to file a claim, and you want the claims process to be smooth and efficient. Esurance, being an online-focused company, relies heavily on its website, app, and phone support for customer service. They offer 24/7 phone support and a comprehensive online help center where you can find answers to common questions. Their claims process is also largely online, allowing you to file a claim, track its progress, and communicate with claims adjusters through their website or app.

Farmers, with its network of local agents, offers a more personal approach to customer service. You can contact your local agent directly for help with your policy, questions, or claims. They also have a 24/7 claims hotline and an online claims portal. Many customers appreciate the ability to speak with a local agent who understands their specific needs and can provide personalized assistance. However, this can also mean longer wait times for less urgent matters, as you are relying on the availability of your agent.

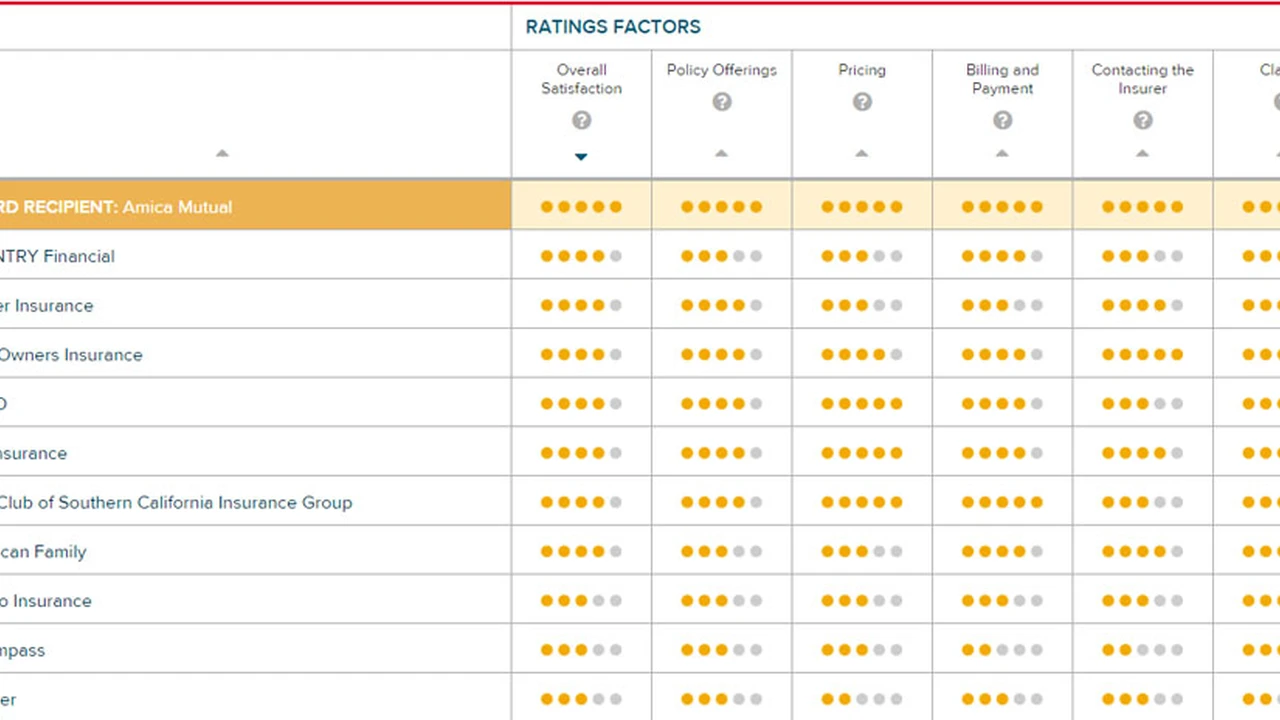

When it comes to claims handling, both companies aim to provide a fair and efficient process. However, customer reviews and industry ratings can provide valuable insights into the actual experience. It's a good idea to check online reviews and ratings from sources like the Better Business Bureau and J.D. Power to get a sense of other customers' experiences with Esurance and Farmers.

Specific Car Insurance Product Recommendations Based on Your Needs

Okay, let's get down to brass tacks. Which company is right for you, and what specific products should you consider? This really depends on your individual needs and circumstances. Here are a few scenarios:

Scenario 1: The Budget-Conscious Driver

If you're primarily concerned with getting the lowest possible premium, Esurance might be a good choice. Their online-centric model often translates to lower overhead costs, which they pass on to customers in the form of lower rates. Consider their basic liability coverage with the addition of uninsured/underinsured motorist coverage. Don't forget to enroll in the DriveSense program to potentially save even more money. A basic policy from Esurance might range from $800 to $1200 per year, depending on your driving record and location.

Scenario 2: The Family with Multiple Cars and a Home

If you have multiple cars and a home to insure, Farmers might be a better option. They offer significant discounts for bundling your policies, which can save you a considerable amount of money. Consider their comprehensive car insurance policy with the addition of umbrella coverage for extra liability protection. The New Car Pledge is also a valuable benefit for families with newer vehicles. A bundled policy with Farmers, covering two cars and a home, could range from $2500 to $4000 per year, but the savings from bundling can be substantial.

Scenario 3: The Rideshare Driver

If you drive for Uber or Lyft, Farmers is the clear winner. Their RideShare coverage is specifically designed to protect you during the gap between accepting a ride request and picking up the passenger, a period that's often not covered by standard policies. This coverage is essential for rideshare drivers and can provide peace of mind knowing you're fully protected. Rideshare coverage added to a standard Farmers policy might increase your premium by $200 to $500 per year, depending on your driving history and the amount of time you spend driving for rideshare companies.

Scenario 4: The Classic Car Enthusiast

If you own a classic or antique car, Farmers' Guaranteed Value option is a must-have. This ensures that you'll receive the agreed-upon value of your car if it's totaled, regardless of its market value at the time of the accident. This is especially important for classic cars, as their value can fluctuate significantly. The cost of Guaranteed Value coverage will depend on the appraised value of your classic car, but it's typically a small percentage of the car's overall value.

Comparing Specific Car Insurance Products Esurance and Farmers

To further illustrate the differences, let's compare some specific products offered by Esurance and Farmers:

Esurance: DriveSense vs Farmers: Signal

Both DriveSense and Signal are usage-based insurance programs that track your driving habits and reward safe drivers with discounts. Esurance's DriveSense uses a mobile app to track things like speeding, hard braking, and distracted driving. Farmers' Signal also uses a mobile app and tracks similar driving behaviors. The main difference is that Esurance offers an upfront discount just for enrolling in DriveSense, while Farmers' Signal rewards you based on your driving score. Both programs can lead to significant savings for safe drivers, but it's important to be aware that they also track your driving behavior and can potentially increase your rates if you're a risky driver. The potential savings from these programs can range from 5% to 30%, depending on your driving habits.

Esurance: Gap Insurance vs Farmers: New Car Pledge

Esurance offers gap insurance (loan/lease payoff coverage), which covers the difference between what you owe on your car loan and what the car is worth if it's totaled. Farmers offers a similar benefit with their New Car Pledge, which replaces your brand-new car with a new one of the same make and model if it's totaled within the first two years or 24,000 miles. While both provide financial protection, the New Car Pledge is arguably more valuable, as it replaces your car with a brand-new one, rather than just covering the loan balance. However, the New Car Pledge is only available for new cars, while gap insurance can be purchased for both new and used cars. The cost of gap insurance from Esurance is typically around $20-$50 per year, while the New Car Pledge is included in Farmers' comprehensive coverage for eligible vehicles.

Pricing Considerations Esurance vs Farmers Which is Cheaper

Ultimately, the best way to determine which company is cheaper is to get quotes from both Esurance and Farmers for your specific situation. However, it's generally accepted that Esurance tends to be more competitive on price, especially for drivers with clean driving records and those who are comfortable managing their policies online. Farmers, while potentially more expensive, offers a more personalized service and a wider range of coverage options, which may be worth the extra cost for some customers. Remember to compare the total cost of the policy, including all coverages and discounts, rather than just focusing on the base premium. Also, consider factors like customer service and claims handling when making your decision. A slightly more expensive policy with better customer service and a smoother claims process might be worth the extra cost in the long run.

To give you a rough idea, a single driver with a clean record might pay $1000 per year for a basic policy with Esurance, while the same policy with Farmers might cost $1200 per year. However, these are just estimates, and your actual rates will vary depending on your individual circumstances.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)