The Impact of Weather on Car Insurance Claims

Understanding Weather-Related Car Insurance Claims: A Comprehensive Guide

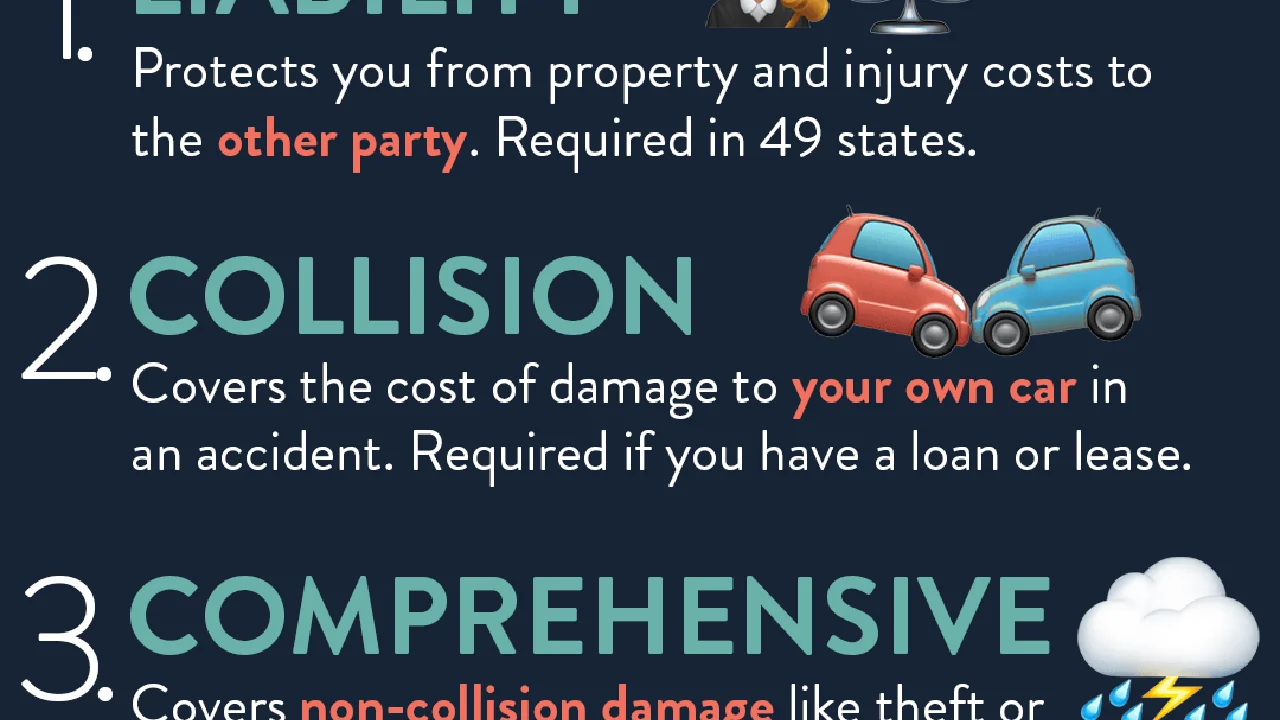

Okay, let's talk weather and car insurance. You might think sunshine and rainbows mean smooth sailing for your car, but Mother Nature has a way of throwing curveballs. We're diving deep into how different weather conditions can affect your car insurance claims and what you can do to protect yourself. From fender-benders in fog to hail-damaged hoods, we'll cover it all. Think of this as your weather-related car insurance survival guide!

Rain and Car Accidents: Navigating Wet Roads and Insurance Claims

Rain, rain, go away… unless you're trying to understand how it affects car insurance! Wet roads are a recipe for accidents. Hydroplaning, reduced visibility – it's a dangerous combination. When rain contributes to an accident, insurance companies investigate to determine fault. Was someone speeding? Were the tires worn? These factors play a big role. Remember, driving slower and increasing your following distance in the rain can save you from a headache (and a higher insurance premium!).

Snow and Ice: Winter Driving Woes and Insurance Coverage

Snow and ice bring a whole new level of challenges. Black ice is the bane of every driver's existence! Winter accidents are often attributed to loss of control due to slippery conditions. Insurance companies will look at whether winter tires were used, the driver's experience in winter conditions, and if they followed safe driving practices. Investing in snow tires can be a game-changer, not just for safety, but also potentially for your insurance rates (some companies offer discounts!).

Hail Damage: When Nature Attacks Your Car

Hailstorms can turn your car into a golf ball overnight! Hail damage is typically covered under comprehensive car insurance. This covers damage from events outside of collisions, like weather, vandalism, and theft. The insurance company will assess the damage and either repair the dents or declare the car a total loss if the damage is too extensive. Pro Tip: Document the damage with photos and videos as soon as possible after the hailstorm. This will make the claims process smoother.

Flooding and Water Damage: Submerged Cars and Insurance Policies

Flooding is a nightmare scenario for car owners. If your car gets flooded, it's usually covered under comprehensive insurance. However, there's a catch: the flood needs to be an external event. If you drive into a flooded area knowingly, your claim might be denied. Flood-damaged cars can be a real problem, with potential electrical issues and mold growth. If your car is declared a total loss due to flooding, the insurance company will pay you the actual cash value of the car before the flood.

Wind Damage: Flying Debris and Insurance Claims

High winds can send debris flying, causing damage to your car. Whether it's a fallen tree branch or a rogue garbage can, wind damage is generally covered under comprehensive insurance. Make sure to take pictures of the damage and any contributing factors, like a fallen tree. Also, check your policy for any specific exclusions related to wind damage.

Specific Product Recommendations for Weather Preparedness

Michelin CrossClimate2 Tires: All-Weather Performance

Tired of switching between summer and winter tires? The Michelin CrossClimate2 tires are a fantastic all-weather option. They offer excellent grip in both wet and dry conditions, and they're even rated for light snow. Usage Scenario: Perfect for drivers who experience moderate winters and want the convenience of a single set of tires year-round. Comparison: Compared to traditional all-season tires, the CrossClimate2 offers superior snow and ice performance. Compared to dedicated winter tires, they offer better dry road handling and longer tread life. Price: Expect to pay around $200-$300 per tire, depending on the size.

Rain-X Original Water Repellent: Improved Visibility in the Rain

Rain-X is a classic for a reason. This water repellent creates a hydrophobic coating on your windshield, causing water to bead up and roll away. This dramatically improves visibility in the rain, making driving safer. Usage Scenario: Ideal for anyone who drives in rainy conditions. Simply apply it to your windshield and watch the water disappear! Comparison: Compared to other water repellents, Rain-X is known for its long-lasting performance and ease of application. Price: Around $10 for a bottle.

NOCO Boost Plus GB40 Jump Starter: A Lifesaver in Cold Weather

Cold weather can wreak havoc on car batteries. The NOCO Boost Plus GB40 is a portable jump starter that can get you back on the road quickly. Usage Scenario: Keep it in your car for emergencies, especially during winter. It can jump-start most vehicles up to 6 liters. Comparison: Compared to traditional jump starters, the NOCO Boost Plus is lightweight, compact, and easy to use. It also has a built-in flashlight and USB power bank. Price: Around $100.

Covercraft Weathershield HP Car Cover: Protection from the Elements

If you park your car outdoors, a car cover can protect it from hail, sun, rain, and snow. The Covercraft Weathershield HP is a highly rated car cover that's breathable and water-resistant. Usage Scenario: Ideal for protecting your car from the elements when parked outdoors. Comparison: Compared to other car covers, the Weathershield HP is known for its durability and excellent weather protection. Price: Around $300-$500, depending on the size and vehicle.

Anker Roav Dash Cam Pro: Documenting Weather-Related Accidents

A dash cam can be invaluable in the event of a weather-related accident. The Anker Roav Dash Cam Pro records high-quality video of your drives, providing evidence in case of a collision. Usage Scenario: Mount it on your windshield and let it record automatically while you drive. Comparison: Compared to other dash cams, the Anker Roav Dash Cam Pro offers excellent video quality, night vision, and a user-friendly interface. Price: Around $80.

Understanding Comprehensive Coverage: Your Weather Protection

Comprehensive coverage is your best friend when it comes to weather-related damage. It covers damage to your car from events other than collisions, such as hail, flooding, wind, and vandalism. It's important to understand what your comprehensive coverage includes and what your deductible is. A lower deductible means you'll pay less out-of-pocket if you file a claim, but it also means you'll pay a higher premium.

Tips for Driving Safely in Different Weather Conditions

No insurance policy can replace safe driving habits. Here are some tips for driving safely in different weather conditions:

- Rain: Slow down, increase your following distance, and use your headlights.

- Snow and Ice: Use winter tires, drive slowly and carefully, and avoid sudden movements.

- Hail: If possible, pull over to a safe location and wait for the hailstorm to pass.

- Flooding: Avoid driving through flooded areas. If you have to, drive slowly and be aware of the depth of the water.

- Wind: Be aware of falling debris and avoid parking under trees or power lines.

Negotiating with Insurance Companies After Weather Damage

Dealing with insurance companies can be tricky. Here are some tips for negotiating your claim:

- Document the damage thoroughly with photos and videos.

- Get multiple estimates for repairs.

- Know your policy and your rights.

- Don't be afraid to negotiate.

- If you're not satisfied with the insurance company's offer, consider hiring a public adjuster.

The Future of Car Insurance and Weather Prediction

Technology is playing an increasingly important role in car insurance and weather prediction. Some insurance companies are using weather data to predict the likelihood of accidents and adjust premiums accordingly. Advanced driver-assistance systems (ADAS) can also help prevent accidents in adverse weather conditions. As technology continues to evolve, we can expect to see even more sophisticated ways to mitigate the risks associated with weather-related car accidents.

Staying Informed: Resources for Weather-Related Car Insurance Information

Staying informed is key to protecting yourself and your car. Here are some resources for weather-related car insurance information:

- Your car insurance policy

- Your state's Department of Insurance

- The National Weather Service

- Consumer Reports

- Insurance industry websites

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)