The Role of Actuaries in Car Insurance Pricing

Understanding Actuarial Science and Car Insurance Premiums

So, you're probably wondering, what in the world do actuaries have to do with car insurance? Well, let me tell you, they're the unsung heroes behind those seemingly random numbers you see on your insurance bill. Actuaries are basically math wizards. They use statistics, probability, and financial theory to assess risk. In the context of car insurance, they're the ones who figure out how likely you are to get into an accident, and how much that accident is likely to cost the insurance company.

They analyze tons of data, like your age, driving history, the type of car you drive, and even where you live. All of this information goes into complex models that help them predict future claims. The more likely you are to file a claim, the higher your premium will be. It's all about risk assessment, and actuaries are the masters of it.

Key Factors Actuaries Consider in Car Insurance Pricing: A Deep Dive

Okay, let's break down some of the key factors actuaries mull over when setting those car insurance prices. It's not just pulling numbers out of thin air, I promise!

- Age & Driving Experience: This is a big one. Younger drivers, especially those with less experience, are statistically more likely to get into accidents. Think about it - less time behind the wheel, less experience navigating tricky situations. As you age and gain more experience, your rates typically go down (assuming you have a clean driving record!).

- Driving Record: Duh, right? Tickets, accidents, DUIs – these are all red flags to insurance companies. Each incident adds to your risk profile, and that translates to higher premiums. A clean driving record is your golden ticket to lower rates. Seriously, drive safely!

- Vehicle Type: The kind of car you drive plays a huge role. Expensive cars are more costly to repair or replace, so insurance is generally higher. Sports cars are often pricier due to their higher performance and increased risk of speeding or reckless driving. Even the safety features of your car are factored in. Cars with advanced safety technologies, like automatic emergency braking, can sometimes qualify for discounts.

- Location, Location, Location: Where you live matters. If you live in a densely populated urban area with high rates of theft or accidents, your premiums will likely be higher than someone living in a quiet rural area. Actuaries look at things like traffic density, crime rates, and even weather patterns in your area.

- Coverage Levels: This is where you have some control. The amount of coverage you choose affects your premium. Minimum liability coverage will be cheaper, but it may not be enough to protect you in a serious accident. Higher coverage limits and adding comprehensive or collision coverage will increase your premium, but they also offer more financial protection.

- Credit Score: In many states, insurance companies use your credit score as a factor in determining your rates. Studies have shown a correlation between credit scores and the likelihood of filing a claim. A good credit score can help you get lower rates, while a poor credit score can increase them.

Statistical Modeling Techniques Used by Insurance Actuaries: Predicting the Future

So how do actuaries actually predict the future? They use a variety of statistical modeling techniques. These aren't just simple spreadsheets; we're talking sophisticated algorithms and data analysis tools.

- Regression Analysis: This is a common technique used to identify the relationship between different variables. For example, actuaries might use regression analysis to determine how much a driver's age and driving record affect their likelihood of getting into an accident.

- Generalized Linear Models (GLMs): GLMs are a more advanced type of regression analysis that can handle different types of data. They're often used to model the frequency and severity of claims.

- Time Series Analysis: This technique is used to analyze data that changes over time. Actuaries might use time series analysis to predict future claim trends based on historical data.

- Machine Learning: This is the new kid on the block, but it's quickly becoming a powerful tool for actuaries. Machine learning algorithms can identify patterns in data that humans might miss, allowing for more accurate predictions. For example, machine learning can be used to predict which drivers are most likely to commit insurance fraud.

The Impact of Actuarial Assumptions on Car Insurance Profitability

Actuaries make assumptions about the future when they're pricing car insurance. These assumptions can have a big impact on the profitability of insurance companies. If the actuaries underestimate the risk, the insurance company could lose money. If they overestimate the risk, the insurance company might lose customers to competitors.

For example, let's say actuaries assume that the average cost of a car accident is $5,000. But if the actual average cost is $6,000, the insurance company will lose $1,000 for every accident. That can add up quickly!

Actuarial Compliance and Regulatory Requirements in Car Insurance: Staying Legal

Car insurance is heavily regulated, and actuaries play a key role in ensuring that insurance companies comply with these regulations. They need to make sure that the rates they're setting are fair and reasonable, and that the insurance company has enough money to pay out claims.

Actuaries also have to comply with professional standards of practice. These standards are designed to ensure that actuaries are acting ethically and responsibly. Failure to comply with these standards can result in disciplinary action.

Actuarial Software and Tools: The Tech Behind the Numbers

Actuaries don't just do all this math in their heads! They rely on sophisticated software and tools to help them analyze data and build models. Some popular actuarial software includes:

- SAS: A powerful statistical software package that's widely used in the insurance industry.

- R: A free and open-source statistical computing environment.

- Prophet: An actuarial modeling software specifically designed for insurance companies.

- Excel: Yes, even Excel is used! Actuaries use Excel for basic data analysis and reporting.

The Future of Actuarial Science in Car Insurance: AI and Beyond

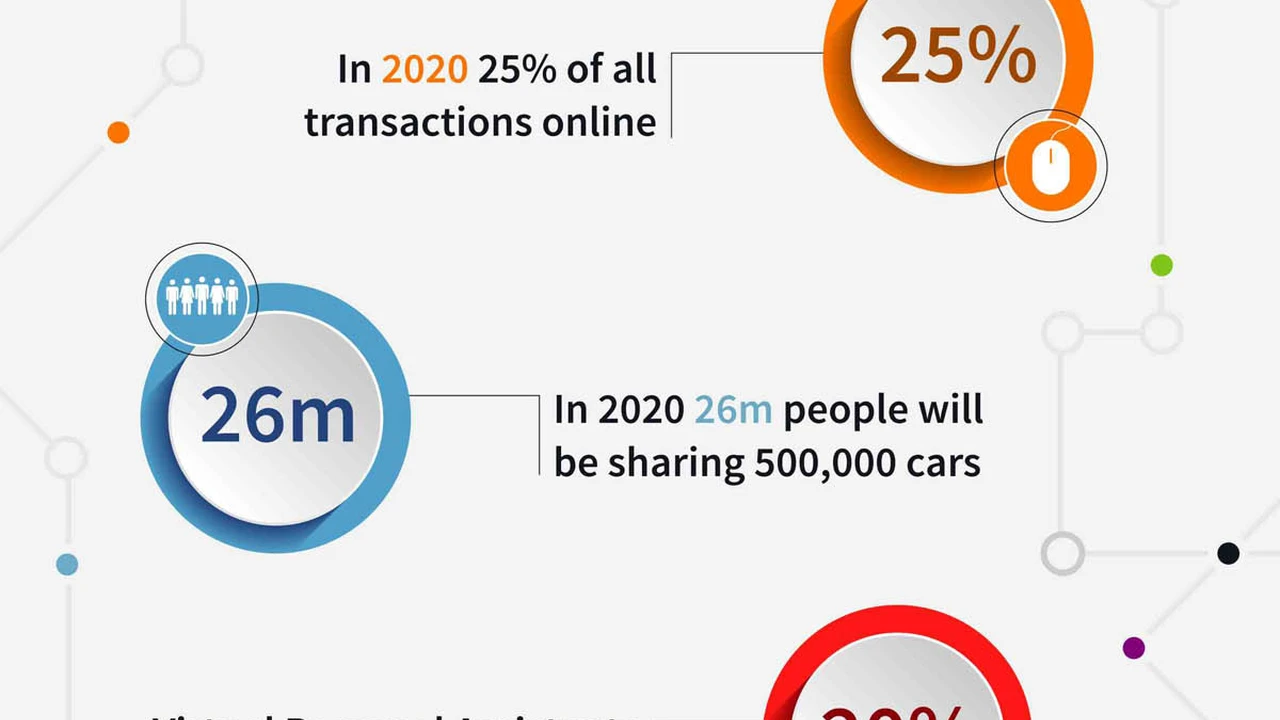

The field of actuarial science is constantly evolving. New technologies, like artificial intelligence (AI) and machine learning, are changing the way actuaries work. AI can be used to automate tasks, improve accuracy, and identify new risk factors. For example, AI can be used to analyze driving behavior in real-time using data from telematics devices. This data can be used to provide personalized insurance rates based on individual driving habits.

Comparing Car Insurance Products: A Guide to Finding the Right Fit

Okay, let's get practical. Understanding the actuarial side is cool, but what about choosing actual car insurance? Here's a breakdown of some common types of car insurance products and when they might be a good fit:

- Liability Insurance: This is the bare minimum required in most states. It covers damages you cause to other people or their property if you're at fault in an accident. When to use it: If you're on a tight budget and just need to meet the legal requirements. Considerations: It doesn't cover your own damages.

- Collision Insurance: This covers damage to your car if you collide with another vehicle or object, regardless of who's at fault. When to use it: If you have a newer car or one that would be expensive to repair. Considerations: It has a deductible, which is the amount you pay out of pocket before insurance kicks in.

- Comprehensive Insurance: This covers damage to your car from things other than collisions, such as theft, vandalism, fire, hail, or hitting an animal. When to use it: If you live in an area prone to theft or severe weather. Considerations: Also has a deductible.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by someone who doesn't have insurance or doesn't have enough insurance to cover your damages. When to use it: A good idea for everyone, as it protects you from the financial consequences of irresponsible drivers. Considerations: Coverage limits vary.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages, regardless of who's at fault in an accident. When to use it: Required in some states (no-fault states). Considerations: May have limitations on the types of medical treatment covered.

Product Recommendations and Pricing: Examples in the Real World

Let's look at some hypothetical examples (prices are estimates and can vary greatly based on individual factors! Always get a personalized quote):

- "SafeDriver Basic" (Liability Only): This product from "InsurifyNow" offers the state minimum liability coverage. Scenario: Ideal for a driver with an older, low-value car who primarily wants to meet legal requirements. Estimated Price: $50-$100 per month. Comparison: Compared to "InsurifyNow Standard", which includes collision and comprehensive, it lacks protection for your own vehicle but is significantly cheaper.

- "InsurifyNow Standard" (Liability, Collision, Comprehensive): This product provides comprehensive coverage. Scenario: Suitable for a driver with a newer car who wants full protection against accidents and other damages. Estimated Price: $150-$300 per month. Comparison: More expensive than "SafeDriver Basic" but offers more peace of mind. It is cheaper than "InsurifyNow Premium".

- "InsurifyNow Premium" (Liability, Collision, Comprehensive, Uninsured Motorist, PIP): This product offers the most comprehensive coverage. Scenario: Best for drivers who want maximum protection and peace of mind, especially those living in areas with high accident rates or uninsured drivers. Estimated Price: $250-$400+ per month. Comparison: The most expensive option, but provides the broadest coverage, including protection against uninsured/underinsured drivers and personal injury.

- "MileageSaver" (Usage-Based Insurance): This product from "DriveSmart" uses a telematics device to track your driving habits. Scenario: A good option for low-mileage drivers who are safe and responsible. Estimated Price: Varies based on mileage and driving behavior, but can be significantly lower than traditional insurance for some drivers. Comparison: Unlike traditional insurance, your rate is directly tied to your driving habits, rewarding safe drivers with lower premiums.

Important Note: These are just examples. Always compare quotes from multiple insurance companies to find the best rates and coverage for your specific needs. Consider factors like deductibles, coverage limits, and customer service ratings when making your decision.

Actuarial Considerations for Usage-Based Insurance (UBI): Pay-As-You-Drive

Usage-Based Insurance (UBI), also known as pay-as-you-drive insurance, is a growing trend in the car insurance industry. UBI uses telematics devices to track your driving habits, such as mileage, speed, braking, and acceleration. This data is then used to calculate your insurance premium. Actuaries play a critical role in developing and pricing UBI products.

They need to analyze the data collected from telematics devices to determine how driving behavior affects the likelihood of accidents. They also need to develop models that can accurately predict future claims based on driving data. UBI has the potential to offer lower rates to safe drivers, but it also raises privacy concerns. Actuaries need to balance the benefits of UBI with the need to protect driver privacy.

The Impact of Autonomous Vehicles on Car Insurance Actuarial Models

Autonomous vehicles (self-driving cars) are poised to revolutionize the car insurance industry. As cars become more autonomous, the risk of accidents caused by human error will decrease. This will have a significant impact on actuarial models. Actuaries need to develop new models that can accurately assess the risk of accidents involving autonomous vehicles.

They also need to consider the legal and ethical implications of autonomous vehicle accidents. For example, who is liable if an autonomous vehicle causes an accident? The car manufacturer? The software developer? The owner of the vehicle? These are complex questions that actuaries will need to address in the coming years.

Advanced Actuarial Techniques for Fraud Detection in Car Insurance

Insurance fraud is a major problem in the car insurance industry. It costs insurance companies billions of dollars each year. Actuaries are increasingly using advanced actuarial techniques to detect and prevent fraud.

These techniques include data mining, machine learning, and social network analysis. Data mining can be used to identify suspicious patterns in claims data. Machine learning can be used to predict which claims are most likely to be fraudulent. Social network analysis can be used to identify individuals who are involved in organized fraud rings.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)