The Role of Credit Score in Car Insurance Pricing

Understanding Credit Scores and Car Insurance Premiums The Connection Explained

Okay, let's talk about something that might feel a little unfair: how your credit score can affect how much you pay for car insurance. You might be thinking, "Wait, what? My credit has nothing to do with my driving!" And you're right, in a direct sense. But insurance companies use credit scores as a predictor of risk. Basically, they've found that people with lower credit scores are statistically more likely to file claims. So, they charge them more to offset that perceived risk. It sucks, I know. But understanding why they do it is the first step in figuring out how to navigate it.

Think of it this way: insurance companies are all about assessing risk. They look at your driving record, your age, the type of car you drive, and even where you live. All of these factors contribute to their calculation of how likely you are to get into an accident and file a claim. Your credit score is just another piece of that puzzle, a data point that they believe helps them predict your future behavior. It's not personal, it's just business... albeit frustrating business.

How Credit Scores Impact Car Insurance Rates A State-by-State Breakdown

The impact of credit scores on car insurance rates isn't uniform across the country. Some states have actually banned the practice of using credit scores to determine premiums. These states include California, Hawaii, Massachusetts, and Michigan. If you live in one of these states, you can breathe a sigh of relief – your credit score won't be a factor in your car insurance rates. However, if you live in any other state, it's definitely something you need to be aware of.

Even within states that allow the use of credit scores, the impact can vary. Insurance companies have different algorithms and weighting systems, so the same credit score might result in different rates from different insurers. That's why it's so important to shop around and compare quotes from multiple companies. Don't just assume that the first quote you get is the best one. Take the time to do your research and see what's out there.

Improving Your Credit Score for Lower Car Insurance Premiums Actionable Steps

So, what can you do if your credit score is dragging down your car insurance rates? The good news is that you can improve your credit score over time. It takes effort and discipline, but it's definitely achievable. Here are some key steps you can take:

- Pay your bills on time, every time. This is the single most important thing you can do to improve your credit score. Late payments can have a significant negative impact. Set up reminders, automate payments – whatever it takes to make sure you're paying your bills on time.

- Keep your credit utilization low. Credit utilization is the amount of credit you're using compared to your total available credit. Ideally, you want to keep it below 30%. So, if you have a credit card with a $1,000 limit, try to keep your balance below $300.

- Check your credit report regularly. You're entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Take advantage of this and review your report for any errors or inaccuracies. If you find something that's wrong, dispute it with the credit bureau.

- Avoid opening too many new credit accounts at once. Opening multiple new accounts in a short period of time can lower your credit score. It makes you look like you're desperate for credit, which can be a red flag to lenders.

- Consider becoming an authorized user on someone else's credit card. If you have a friend or family member with good credit and a long history of responsible credit use, ask if you can become an authorized user on their credit card. Their positive credit history will be reflected on your credit report, which can help boost your score.

Car Insurance Products for People with Low Credit Scores Finding Affordable Options

Even if you're working on improving your credit score, you still need car insurance in the meantime. Fortunately, there are some companies that specialize in providing coverage to people with less-than-perfect credit. These companies often offer more flexible payment options and may be more willing to work with you to find a policy that fits your budget. Here are a few examples (remember, these are just examples, and availability and pricing can vary):

- The General: The General is known for insuring drivers who are considered high-risk, including those with poor credit. They often have higher premiums than mainstream insurers, but they can be a good option if you're struggling to find coverage elsewhere. They offer basic liability coverage and other standard options. Expect to pay a premium due to the higher risk they take on. For example, liability coverage might start around $150/month for someone with a very low credit score.

- Direct Auto Insurance: Similar to The General, Direct Auto specializes in insuring drivers who may have difficulty getting coverage from other companies. They offer a range of coverage options and payment plans. Prices can be similar to The General, depending on your specific circumstances. They might also offer discounts for things like safe driving or taking a defensive driving course.

- Gainsco Auto Insurance: Gainsco is another option for high-risk drivers. They focus on providing affordable coverage to drivers who may have a history of accidents or tickets, or who have poor credit. Again, expect to pay more than you would with a mainstream insurer.

Disclaimer: I am an AI and cannot provide financial advice. Always consult with a qualified insurance professional to determine the best coverage for your specific needs and budget. These are examples and prices vary wildly on location, driving history and coverage needs.

Comparing High-Risk Car Insurance Providers Factors to Consider

When comparing high-risk car insurance providers, it's important to look beyond just the price. Here are some other factors to consider:

- Coverage options: Make sure the company offers the types of coverage you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Don't skimp on coverage just to save a few bucks.

- Deductibles: A deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically mean lower premiums, but you'll have to pay more if you have an accident.

- Customer service: Read online reviews and see what other customers have to say about the company's customer service. You want to choose a company that's responsive and helpful when you need them.

- Financial stability: Make sure the company is financially stable and has a good rating from independent rating agencies like A.M. Best. You want to be sure they'll be able to pay out claims if you have an accident.

- Discounts: Ask about any discounts that may be available, such as discounts for safe driving, taking a defensive driving course, or bundling your car insurance with other policies.

Understanding Usage-Based Insurance Programs A Potential Alternative

If you're struggling to find affordable car insurance due to your credit score, you might want to consider usage-based insurance (UBI) programs. These programs use telematics technology to track your driving habits and reward safe drivers with lower rates. Instead of relying solely on your credit score, UBI programs focus on how you actually drive. This can be a great option if you're a safe driver but have a low credit score.

How it works is usually through a smartphone app or a small device plugged into your car. The app or device tracks things like your speed, acceleration, braking, and mileage. The insurance company then uses this data to calculate your premium. If you drive safely, you'll earn discounts. If you drive aggressively, you might pay more. Here are a few examples of UBI programs:

- Progressive Snapshot: Snapshot is one of the most well-known UBI programs. It tracks your driving habits and rewards safe drivers with discounts. You can use the Snapshot app or plug a device into your car.

- State Farm Drive Safe & Save: State Farm's Drive Safe & Save program also uses telematics to track your driving habits and reward safe driving. They offer discounts based on factors like mileage, speed, and time of day.

- Allstate Drivewise: Allstate Drivewise is another UBI program that rewards safe driving. They track your speed, braking, and mileage and offer discounts based on your driving performance.

The downside to UBI programs is that your rates could go up if you're not a safe driver. But if you're confident in your driving skills, it's definitely worth considering.

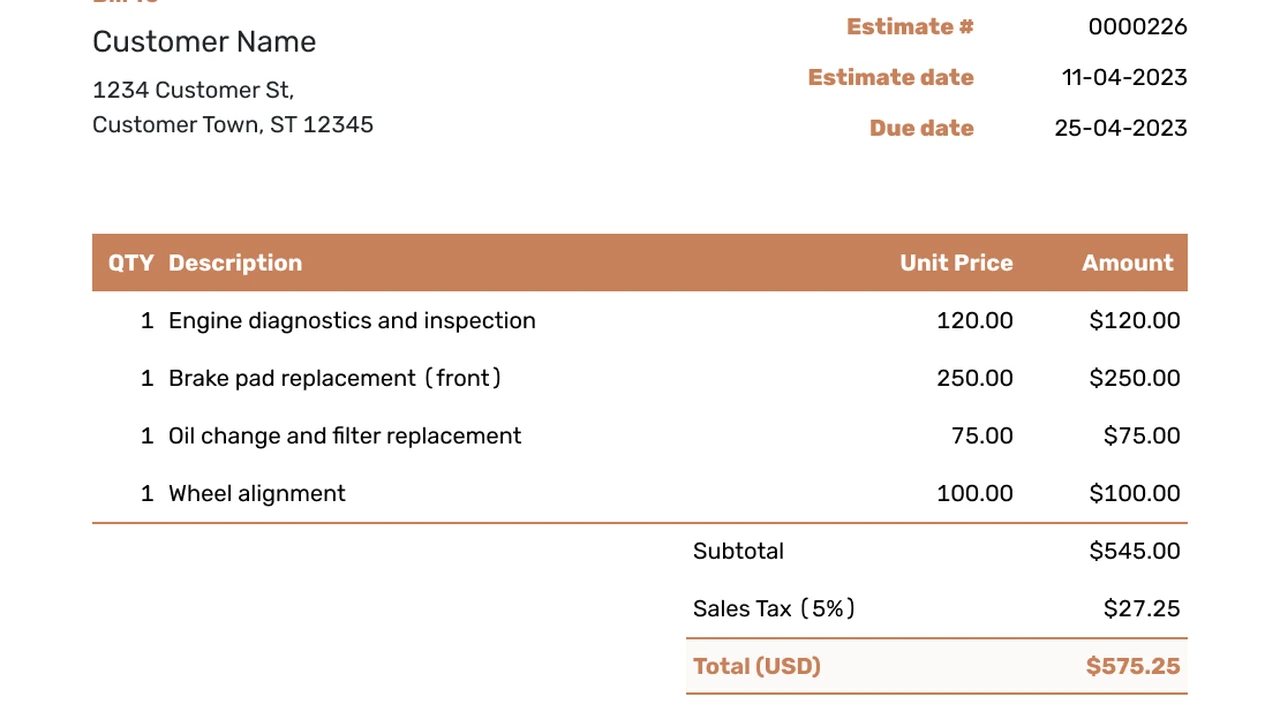

The Cost of Car Insurance for Low Credit Scores Real-World Examples

Let's get real about the costs. It's tough to give exact numbers because insurance rates vary so much based on location, vehicle, driving history, and coverage needs. But let's paint some broad strokes, assuming we're talking about a 30-year-old driver with a clean driving record but a credit score in the "poor" range (typically below 600). We'll compare this to a driver with the same profile but an "excellent" credit score (typically above 750).

Liability Coverage Only:

- Poor Credit: $150 - $300 per month

- Excellent Credit: $75 - $150 per month

Full Coverage (Liability, Collision, Comprehensive):

- Poor Credit: $300 - $600 per month

- Excellent Credit: $150 - $300 per month

As you can see, the difference can be significant. That's why it's so important to shop around, improve your credit score, and explore all available options.

Navigating the Car Insurance Landscape with Bad Credit Expert Tips

Okay, so you've got bad credit and need car insurance. What's the game plan? Here's a quick rundown of my top tips:

- Shop around, shop around, shop around! Get quotes from at least three to five different insurance companies. Don't just settle for the first quote you get.

- Consider raising your deductible. A higher deductible will lower your premium, but make sure you can afford to pay it if you have an accident.

- Look for discounts. Ask about discounts for safe driving, taking a defensive driving course, bundling your insurance, or having anti-theft devices installed in your car.

- Explore usage-based insurance programs. If you're a safe driver, these programs can help you save money on your car insurance.

- Work on improving your credit score. This is a long-term solution, but it will pay off in the long run.

- Don't give up! Finding affordable car insurance with bad credit can be challenging, but it's not impossible. Keep searching and you'll eventually find a policy that fits your needs and budget.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)