Understanding Subrogation: Recovering Costs After an Accident

What is Subrogation in Car Insurance Claims?

Okay, let's break down subrogation. It sounds complicated, but it's actually a pretty straightforward process. Imagine you're in a car accident, and it's clearly the other driver's fault. Your car's damaged, you've got medical bills piling up, and you're missing work. Your insurance company steps in, pays for your damages (or a portion of them, depending on your coverage), and then... here's the kicker... they go after the at-fault driver's insurance company to get their money back. That, my friend, is subrogation in a nutshell. It's your insurance company essentially "substituting" themselves for you to recover the costs they paid out.

Think of it this way: you're owed money by the other driver (or their insurance company). Your insurance company pays you that money upfront. Now, *they* are owed the money by the other driver. They have the right to pursue that claim – that’s the “subrogation” right. Without subrogation, things would get messy fast. Imagine having to chase down the at-fault driver yourself while dealing with everything else. No thanks!

How Subrogation Works Step by Step: A Detailed Breakdown

Alright, let's dive into the nitty-gritty of how subrogation typically unfolds. Knowing the steps can help you understand the process and what to expect.

-

The Accident Happens: Pretty self-explanatory. Two cars meet in a less-than-ideal way. Make sure you document everything – photos, witness statements, police report – the more evidence you have, the better.

-

You File a Claim: You contact your insurance company and file a claim for the damages. Be honest and thorough in your description of the accident.

-

Your Insurance Pays: Depending on your coverage (collision, comprehensive, uninsured motorist), your insurance company pays for your repairs, medical bills, and other related expenses. This might be subject to your deductible, of course.

-

The Investigation Begins: Your insurance company investigates the accident to determine who was at fault. They'll review the police report, talk to witnesses, and gather evidence.

-

Subrogation Notice: If your insurance company determines the other driver was at fault, they'll send a "subrogation notice" to the at-fault driver's insurance company. This is basically a heads-up that they're going to pursue a claim to recover the money they paid out.

-

Negotiation and Settlement: The two insurance companies will then negotiate the amount to be paid. This might involve some back-and-forth, but the goal is to reach a settlement where the at-fault driver's insurance company reimburses your insurance company.

-

You Might Get Money Back: Here's the good part! If your insurance company successfully recovers the full amount they paid out, you might get your deductible back. Check your policy for the specifics on how deductibles are handled in subrogation cases. It’s not always a guarantee, but it’s a definite possibility.

Understanding Your Role in the Subrogation Process

So, what's your role in all of this? While your insurance company is doing the heavy lifting, there are still things you can do to help the process go smoothly. Think of yourself as a supporting actor in the subrogation play.

-

Cooperate with Your Insurance Company: Be responsive to their requests for information. Provide any documents or statements they need promptly.

-

Don't Sign Anything: Avoid signing any releases or agreements with the at-fault driver or their insurance company without consulting with your insurance company first. This could jeopardize their subrogation rights.

-

Keep Good Records: Maintain copies of all documents related to the accident, including medical bills, repair estimates, and correspondence with your insurance company.

-

Be Patient: Subrogation can take time, so don't expect a quick resolution. Insurance companies have their own processes, and negotiations can be lengthy.

Subrogation and Your Car Insurance Rates: What You Need to Know

One of the biggest concerns people have about accidents is how they'll affect their car insurance rates. The good news is that if you're not at fault, subrogation can help minimize the impact. Since your insurance company is recovering the costs from the at-fault driver's insurance, they might not consider it a claim against you. This can help prevent your rates from going up.

However, it's important to note that every insurance company is different. Some companies might still raise your rates even if you're not at fault, especially if you have a history of accidents. It's always a good idea to talk to your insurance agent and understand their policies regarding rate increases after an accident.

Why Subrogation Matters: Protecting You and the Insurance System

Subrogation isn't just some obscure legal term. It plays a vital role in protecting both you and the overall insurance system. Here's why it matters:

-

It Holds At-Fault Drivers Accountable: Subrogation ensures that the person responsible for the accident ultimately pays for the damages. This discourages reckless driving and promotes responsibility on the road.

-

It Keeps Insurance Premiums Down: By recovering costs from at-fault drivers, insurance companies can keep premiums lower for everyone. Without subrogation, insurance companies would have to absorb these costs, which would likely lead to higher premiums for all policyholders.

-

It Prevents Double Recovery: Subrogation prevents you from receiving compensation from both your insurance company and the at-fault driver's insurance company for the same damages. This prevents unjust enrichment and ensures that you're only compensated for your actual losses.

Subrogation Waivers: What Are They and When Do You Need One?

A subrogation waiver is an agreement where you give up your right to pursue a claim against a third party. In the context of car insurance, this is less common than in other types of insurance (like property insurance related to construction). However, it *can* come up in certain situations, especially if you're involved in a business relationship where you're renting a vehicle or using a vehicle for commercial purposes.

For example, let's say you're renting a truck for your business. The rental agreement might include a subrogation waiver, meaning that if you damage the truck, the rental company's insurance company can't come after *your* business insurance to recover the costs. This protects the rental company's relationship with *their* insurance provider. Read any contract carefully! And get legal advice if you are unsure.

Real-Life Subrogation Examples: Bringing the Concept to Life

Let's look at a couple of real-life scenarios to illustrate how subrogation works in practice:

-

Scenario 1: Rear-End Collision: You're stopped at a red light, and another driver slams into the back of your car. The police report clearly states the other driver was at fault for distracted driving. Your insurance company pays for your car repairs and medical bills. They then pursue a subrogation claim against the at-fault driver's insurance company to recover those costs. If successful, you might get your deductible back.

-

Scenario 2: Uninsured Motorist: You're hit by an uninsured driver. You have uninsured motorist coverage on your policy. Your insurance company pays for your damages, including medical bills and lost wages. They then attempt to locate the uninsured driver and pursue a subrogation claim against them to recover the costs. This can be more challenging, but your insurance company has the resources to investigate and pursue legal action if necessary.

Finding the Right Car Insurance: Key Features and Considerations

Choosing the right car insurance is crucial for protecting yourself financially in the event of an accident. Here are some key features and considerations to keep in mind:

-

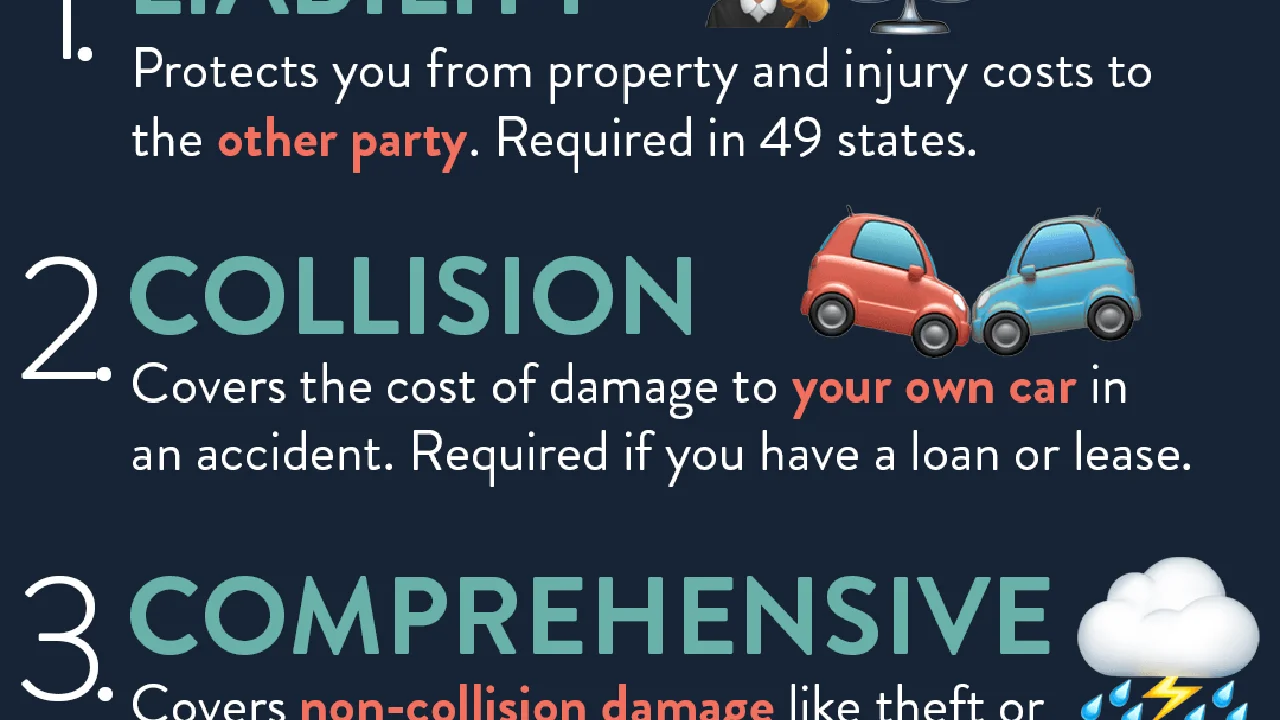

Liability Coverage: This covers damages you cause to others in an accident. Make sure you have enough liability coverage to protect your assets.

-

Collision Coverage: This covers damage to your vehicle if you're at fault in an accident.

-

Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

-

Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by an uninsured or underinsured driver.

-

Deductibles: Consider the deductible amounts for each type of coverage. A higher deductible will result in a lower premium, but you'll have to pay more out of pocket in the event of a claim.

Navigating the Subrogation Process: Tips and Best Practices

Dealing with an accident and the subsequent subrogation process can be stressful. Here are some tips and best practices to help you navigate the process smoothly:

-

Stay Calm: Take a deep breath and try to remain calm. Panic won't help the situation.

-

Document Everything: Gather as much information as possible at the scene of the accident, including photos, witness statements, and the other driver's insurance information.

-

Report the Accident Promptly: Contact your insurance company as soon as possible after the accident.

-

Cooperate with Your Insurance Company: Be responsive to their requests for information and provide them with all the necessary documents.

-

Seek Legal Advice: If you have questions or concerns about the subrogation process, consult with an attorney.

Understanding Car Insurance Products: Recommendations and Comparisons

Let's look at some specific car insurance products and compare their features, benefits, and costs. Keep in mind that prices can vary depending on your location, driving history, and other factors.

Product Recommendations

-

Progressive: Known for its Name Your Price tool, Progressive allows you to input your desired premium and then finds coverage options that fit your budget. This is great for budget-conscious drivers. Progressive also offers Snapshot, a usage-based insurance program that rewards safe driving habits with discounts.

Typical User: Drivers looking for affordable rates and flexible coverage options.

Pricing: Generally competitive, especially for drivers with good credit scores.

-

State Farm: A well-established and reputable insurance company known for its excellent customer service and wide range of coverage options. State Farm offers Drive Safe & Save, a telematics program that monitors your driving habits and rewards safe drivers with discounts. They also have a strong local agent network for personalized support.

Typical User: Drivers who value customer service and a strong local presence.

Pricing: Mid-range, but often justified by the level of service and coverage provided.

-

GEICO: Another popular insurance company known for its competitive rates and user-friendly online platform. GEICO offers a variety of discounts, including discounts for military personnel, students, and federal employees. They also have a mobile app for easy access to your policy and claims information.

Typical User: Tech-savvy drivers looking for convenient online access and competitive rates.

Pricing: Generally very competitive, especially for drivers with clean driving records.

-

Allstate: Offers a wide range of coverage options, including accident forgiveness and new car replacement coverage. Allstate also has a rewards program called Drivewise, which tracks your driving habits and rewards safe drivers with points that can be redeemed for merchandise and gift cards.

Typical User: Drivers who want comprehensive coverage and value added benefits.

Pricing: Can be slightly higher than other options, but the added benefits may be worth it for some drivers.

Product Comparison Table

| Insurance Company | Key Features | Pros | Cons | Estimated Monthly Cost (Example) |

|---|---|---|---|---|

| Progressive | Name Your Price tool, Snapshot program | Affordable, flexible coverage | Customer service can be inconsistent | $80 - $120 |

| State Farm | Excellent customer service, local agent network | Strong reputation, personalized support | Can be more expensive than other options | $100 - $150 |

| GEICO | Competitive rates, user-friendly online platform | Affordable, convenient online access | Less personalized service | $70 - $110 |

| Allstate | Accident forgiveness, new car replacement | Comprehensive coverage, added benefits | Can be more expensive | $90 - $140 |

Disclaimer: These are just estimates, and actual costs may vary. It's always best to get quotes from multiple insurance companies to find the best rates and coverage for your specific needs.

Usage Scenarios

-

Scenario 1: Young Driver with a New Car: A young driver with a new car might benefit from Allstate's new car replacement coverage, which would replace the car with a brand new one if it's totaled within a certain timeframe.

-

Scenario 2: Budget-Conscious Driver: A budget-conscious driver might find Progressive's Name Your Price tool helpful for finding affordable coverage.

-

Scenario 3: Driver Who Values Customer Service: A driver who values customer service and personalized support might prefer State Farm's local agent network.

-

Scenario 4: Safe Driver: A safe driver could benefit from usage-based insurance programs like Snapshot (Progressive), Drive Safe & Save (State Farm) or Drivewise (Allstate), which reward safe driving habits with discounts.

Common Subrogation Mistakes to Avoid

Even with a good understanding of subrogation, it's easy to make mistakes that could jeopardize your claim. Here are some common pitfalls to avoid:

-

Failing to Report the Accident Promptly: Delaying the report can make it difficult for your insurance company to investigate the accident and pursue a subrogation claim.

-

Signing Releases Without Consulting Your Insurance Company: Signing a release with the at-fault driver or their insurance company without consulting your insurance company could waive their subrogation rights.

-

Failing to Cooperate with Your Insurance Company: Not providing the requested information or being unresponsive to their inquiries can delay the subrogation process.

-

Discarding Evidence: Throwing away important documents or failing to preserve evidence can weaken your insurance company's subrogation claim.

The Future of Subrogation: Trends and Developments

The world of insurance is constantly evolving, and subrogation is no exception. Here are some trends and developments to watch out for:

-

Increased Use of Technology: Insurance companies are increasingly using technology to streamline the subrogation process, including AI-powered claims processing and data analytics to identify potential subrogation opportunities.

-

Greater Focus on Data Security: With the increasing reliance on digital data, insurance companies are placing a greater emphasis on data security to protect sensitive information during the subrogation process.

-

Changes in Legislation: Subrogation laws can vary from state to state, and changes in legislation can impact the subrogation process. Stay informed about any relevant legal updates in your state.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)