Why Do I Need Car Insurance? The Importance of Coverage

Understanding the Core Reasons for Car Insurance Coverage

Okay, let's be real. Car insurance. It's one of those things you pay for and hope you never have to use, right? But trust me, it's way more important than just ticking a box to stay legal. Think of it as a safety net, a financial shield, a "just in case" plan for all the unexpected craziness that can happen on the road. We're talking fender benders, hail damage, even worse scenarios. So, why *do* you really need it? Let's break it down.

Legal Requirement

First and foremost, in most places, it's the law. Driving without insurance can land you in some serious hot water. Fines, license suspension, even jail time in some cases. It's just not worth the risk. Consider it the price of admission to the open road. You wouldn't try to sneak into a concert, would you? (Okay, maybe you would, but car insurance is a much better investment!). Beyond the legal aspect, it's about being a responsible driver and contributing to a safer road environment for everyone.

Financial Protection

This is where it gets really crucial. Imagine causing an accident. The other driver's car is totaled, they need medical attention, and maybe they can't work for a while. Without insurance, you're on the hook for all of that. We're talking potentially tens of thousands, even hundreds of thousands of dollars. Could you handle that kind of financial hit? Car insurance is designed to protect you from these kinds of catastrophic expenses. It's a buffer that prevents a single bad day from ruining your financial life. Think of it as a financial bodyguard – always there to protect you from unexpected threats.

Protection Against Uninsured Drivers

Here's a scary thought: not everyone follows the rules. What happens if you're hit by someone who doesn't have insurance? Or worse, someone who flees the scene? Uninsured/underinsured motorist coverage steps in to protect you in these situations. It covers your medical bills, car repairs, and even lost wages if you're injured. It's like having a backup plan for when other drivers aren't playing by the rules.

Peace of Mind

Honestly, this is one of the biggest benefits. Knowing you're covered allows you to drive with confidence and without constantly worrying about the "what ifs." It's a weight off your shoulders. You can focus on the road and enjoy the ride, knowing that you have a safety net in place if things go wrong. That peace of mind is priceless.

Exploring Different Types of Car Insurance Coverage Options

So, you know you need car insurance, but what kind? There's a whole alphabet soup of coverage options, and it can be confusing. Let's break down some of the most common types and what they cover:

Liability Insurance Coverage: Protecting Others

This is the most basic type of coverage and is usually required by law. It covers damages you cause to other people or their property in an accident. There are two parts: **Bodily Injury Liability** (covers medical expenses and lost wages for people you injure) and **Property Damage Liability** (covers damage to other people's cars or property). The limits are usually expressed as three numbers, like 25/50/25. This means $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage coverage. Make sure you choose limits that are high enough to adequately protect you. Imagine causing a serious accident – you don't want to be personally responsible for paying the difference between your coverage limits and the actual damages.

Collision Insurance Coverage: Fixing Your Car After an Accident

Collision coverage pays to repair or replace your car if it's damaged in an accident, regardless of who's at fault. This is super helpful if you cause an accident yourself, or if you're hit by an uninsured driver and don't have uninsured motorist property damage coverage. It usually comes with a deductible, which is the amount you pay out of pocket before the insurance company kicks in. A higher deductible means a lower premium, but you'll have to pay more if you have a claim. Think about what you can comfortably afford to pay out of pocket if you have an accident.

Comprehensive Insurance Coverage: Protection from the Unexpected

Comprehensive coverage protects your car from things other than collisions, like theft, vandalism, fire, hail, flood, and hitting an animal. Basically, anything that isn't an accident with another vehicle. Like collision coverage, it usually has a deductible. If you live in an area prone to hail storms or where car theft is common, comprehensive coverage is definitely worth considering. It's also a good idea if you have a newer or more expensive car.

Uninsured/Underinsured Motorist Coverage: When Others Don't Play Fair

As mentioned earlier, this coverage protects you if you're hit by someone who doesn't have insurance or doesn't have enough insurance to cover your damages. It can cover your medical bills, car repairs, and lost wages. There are two types: **Uninsured Motorist Bodily Injury (UMBI)** and **Uninsured Motorist Property Damage (UMPD)**. UMBI covers your injuries, while UMPD covers damage to your car. In some states, UMPD is not available, and you'll need collision coverage to repair your car if you're hit by an uninsured driver.

Personal Injury Protection (PIP) Coverage: Medical Bills and Lost Wages

PIP coverage (also known as "no-fault" insurance) covers your medical bills and lost wages after an accident, regardless of who's at fault. It's required in some states and optional in others. It can be helpful even if you have health insurance, as it can cover your deductible and copays. It can also cover lost wages, which health insurance typically doesn't.

Comparing Car Insurance Providers and Plans Detailed Comparison

Choosing a car insurance company can feel overwhelming. There are so many options! Here's a rundown of some popular providers, their strengths, and potential drawbacks:

State Farm Car Insurance: The Reliable Giant

**Pros:** State Farm is known for its strong financial stability, excellent customer service (often cited as a top performer), and a wide network of local agents. They offer a variety of discounts, including discounts for safe driving, good grades (for students), and bundling your auto and home insurance. They also have a solid mobile app for managing your policy and filing claims.

**Cons:** State Farm's premiums can sometimes be higher than other providers, especially if you have a less-than-perfect driving record. Their online quote process isn't as streamlined as some of the newer, tech-focused companies.

GEICO Car Insurance: The Budget-Friendly Option

**Pros:** GEICO is famous for its competitive rates, especially for drivers with clean records. They offer a user-friendly website and mobile app for getting quotes, managing your policy, and filing claims. They also offer a variety of discounts, including discounts for military personnel, federal employees, and members of certain organizations.

**Cons:** GEICO's customer service isn't always rated as highly as State Farm's, and they may not have as many local agents available for in-person assistance. Their coverage options may be less customizable than some other providers.

Progressive Car Insurance: The Tech-Savvy Innovator

**Pros:** Progressive is known for its innovative technology, like its Snapshot program, which tracks your driving habits and rewards safe drivers with discounts. They offer a user-friendly website and mobile app, and their online quote process is very straightforward. They also offer a variety of discounts, including discounts for bundling your auto and home insurance, and discounts for paying in full.

**Cons:** Progressive's rates can vary significantly depending on your driving record and location. Their customer service ratings are generally good, but not always as high as State Farm's. They also rely heavily on online and phone support, which may not be ideal for everyone.

Allstate Car Insurance: The Comprehensive Coverage Specialist

**Pros:** Allstate offers a wide range of coverage options, including unique add-ons like roadside assistance and accident forgiveness. They have a strong network of local agents and offer personalized service. They also offer a variety of discounts, including discounts for safe driving, good grades, and bundling your auto and home insurance.

**Cons:** Allstate's premiums can be higher than other providers, especially for drivers with less-than-perfect records. Their online quote process isn't as streamlined as some of the newer, tech-focused companies.

Real-World Car Insurance Scenarios and Product Recommendations

Let's look at some specific scenarios and recommend car insurance products that might be a good fit:

Scenario 1: The Young Driver with a New Car

**Challenge:** Young drivers typically face higher insurance rates due to their lack of experience. They also might have a newer car that needs comprehensive coverage.

**Recommendations:**

- **Provider:** State Farm or GEICO. State Farm often has good student discounts, while GEICO is generally budget-friendly.

- **Coverage:** Liability coverage (at least the state minimum), collision coverage, and comprehensive coverage. Consider a higher deductible to lower the premium.

- **Specific Product:** GEICO DriveEasy app. This app monitors driving behavior and offers discounts for safe driving.

Scenario 2: The Experienced Driver with an Older Car

**Challenge:** Experienced drivers usually have lower rates, but an older car might not need collision or comprehensive coverage.

**Recommendations:**

- **Provider:** Progressive or GEICO. Both offer competitive rates for experienced drivers with good records.

- **Coverage:** Liability coverage (with higher limits for better protection), uninsured/underinsured motorist coverage. Consider dropping collision and comprehensive coverage if the car's value is low.

- **Specific Product:** Progressive Snapshot program. This program rewards safe driving with discounts, even for experienced drivers.

Scenario 3: The Family with Multiple Cars

**Challenge:** Families with multiple cars need to find affordable coverage for all vehicles and drivers.

**Recommendations:**

- **Provider:** State Farm or Allstate. Both offer multi-car discounts and have strong customer service.

- **Coverage:** Liability coverage (with high limits), collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Consider adding umbrella insurance for extra liability protection.

- **Specific Product:** State Farm Drive Safe & Save. This program monitors driving behavior and offers discounts for safe driving across all vehicles in the household.

Understanding Car Insurance Costs and Pricing Factors Explained

Ever wonder why your neighbor pays less for car insurance than you do, even though you drive the same car? Car insurance pricing is complex and based on a variety of factors. Here's a breakdown:

Driving Record: The Biggest Factor

Your driving record is one of the most significant factors in determining your car insurance rates. Accidents, tickets, and DUI convictions can all significantly increase your premiums. Insurance companies see drivers with clean records as less risky to insure.

Age and Experience: Younger Drivers Pay More

Younger drivers, especially those under 25, typically pay higher rates than older, more experienced drivers. This is because they are statistically more likely to be involved in accidents. As you gain more driving experience, your rates will generally decrease.

Location: Urban vs. Rural

Your location also plays a role in determining your car insurance rates. Drivers in urban areas typically pay more than drivers in rural areas due to higher traffic density, increased risk of accidents, and higher rates of theft and vandalism.

Vehicle Type: Sports Car vs. Minivan

The type of vehicle you drive also affects your insurance rates. Sports cars and other high-performance vehicles typically cost more to insure than minivans or sedans. This is because they are more likely to be involved in accidents and are more expensive to repair.

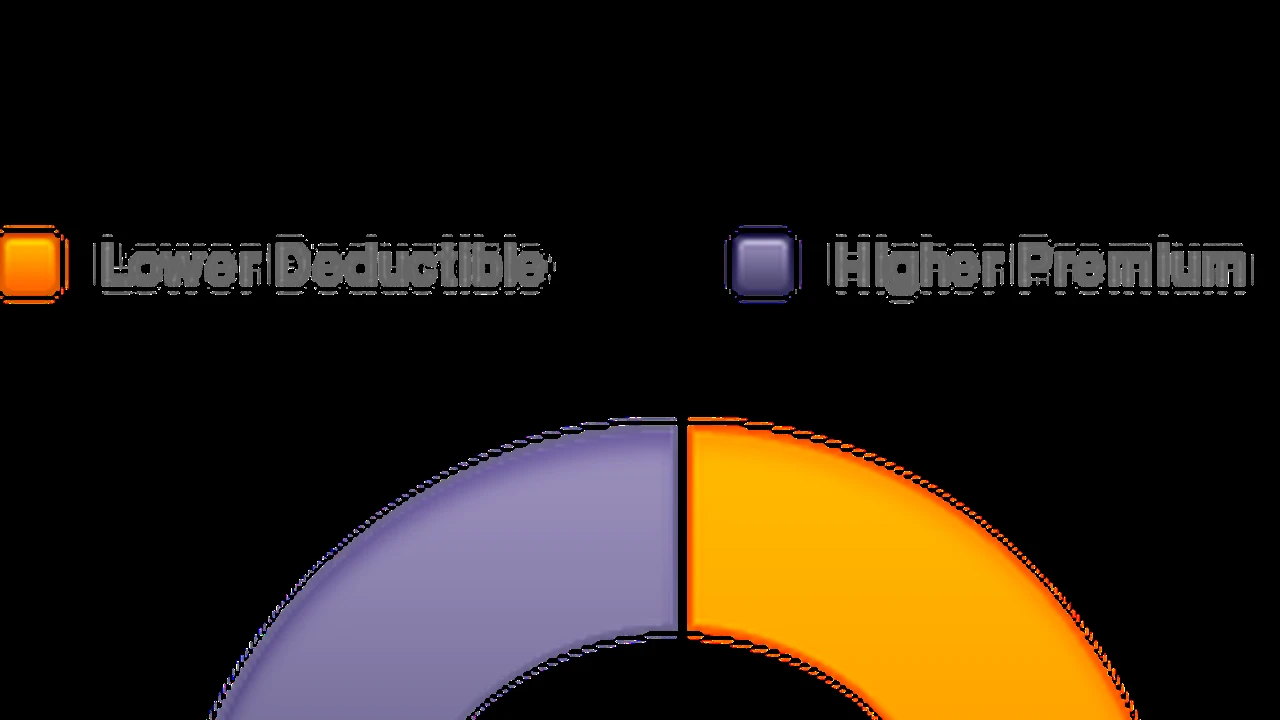

Coverage Limits and Deductibles: Balancing Cost and Protection

The coverage limits you choose and the deductibles you select also affect your insurance rates. Higher coverage limits provide more protection but also cost more. Higher deductibles lower your premiums but require you to pay more out of pocket if you have a claim.

Credit Score: A Controversial Factor

In some states, insurance companies use your credit score to determine your insurance rates. Drivers with lower credit scores typically pay higher rates. This practice is controversial, as it can disproportionately affect low-income individuals.

Specific Product Examples, Pricing, and Usage Scenarios Breakdown

Let's get into some specific product examples and their pricing (keep in mind these are estimates and can vary based on individual circumstances):

Progressive Snapshot: Usage-Based Insurance

**Description:** A device or app that tracks your driving habits (speed, hard braking, time of day) and rewards safe drivers with discounts.

**Pricing:** Free to enroll. Discounts can range from 5% to 30% or more.

**Usage Scenario:** A young driver who is a safe driver can use Snapshot to significantly lower their premiums. A commuter who drives during off-peak hours and avoids hard braking can also benefit.

State Farm Drive Safe & Save: Another Telematics Option

**Description:** Similar to Snapshot, Drive Safe & Save tracks your driving habits and rewards safe drivers with discounts.

**Pricing:** Free to enroll. Discounts can range from 5% to 50% or more.

**Usage Scenario:** A family with multiple cars can use Drive Safe & Save to monitor the driving habits of all drivers and earn discounts across the household.

Allstate Accident Forgiveness: Protection After a Mistake

**Description:** Prevents your rates from increasing after your first at-fault accident.

**Pricing:** Varies depending on your policy and location. Typically adds a small amount to your premium.

**Usage Scenario:** A driver with a clean record might consider Accident Forgiveness to protect themselves from a rate increase if they have an accident.

Gap Insurance: Protecting Your Investment

**Description:** Covers the difference between what you owe on your car loan and what your insurance company pays out if your car is totaled.

**Pricing:** Typically costs a few hundred dollars.

**Usage Scenario:** Someone who buys a new car and finances it might consider Gap Insurance to protect themselves from owing money on a car that's no longer drivable.

Tips for Lowering Your Car Insurance Premiums Savings Guide

Want to save money on car insurance? Here are some tips:

Shop Around: Get Multiple Quotes

Don't just stick with the first insurance company you find. Get quotes from multiple providers to compare rates and coverage options.

Increase Your Deductible: A Risky But Rewarding Strategy

Increasing your deductible can significantly lower your premiums. Just make sure you can afford to pay the higher deductible if you have a claim.

Bundle Your Insurance: Home and Auto Discounts

Bundling your auto and home insurance with the same company can often result in significant discounts.

Maintain a Good Driving Record: Stay Safe on the Road

Avoid accidents and tickets to keep your driving record clean. This is the best way to lower your insurance rates over the long term.

Take a Defensive Driving Course: Improve Your Skills

Completing a defensive driving course can sometimes qualify you for a discount on your car insurance.

Ask About Discounts: Student, Military, and More

Be sure to ask about all available discounts, such as student discounts, military discounts, and discounts for members of certain organizations.

Review Your Coverage Annually: Adjust as Needed

Review your coverage annually to make sure it still meets your needs and that you're not paying for coverage you don't need.

Pay in Full: Save on Installment Fees

Paying your insurance premium in full can often save you money on installment fees.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)