Bundling Insurance: Car and Home Savings

Understanding the Basics of Bundling Insurance for Car and Home - A Comprehensive Guide

Hey there! Ever wonder how you can save a few bucks (or maybe a lot of bucks!) on your insurance? Bundling insurance, that is, getting your car and home insurance from the same company, is a super common and often smart way to do it. Let's break down why it works and how you can get the best deal.

Why Insurance Companies Offer Discounts for Bundling Car and Home Policies - The Insiders Perspective

So, why do insurance companies even offer these discounts? It's all about risk and customer retention. When you have multiple policies with one company, they see you as a more loyal customer, and they're less likely to lose you to a competitor. Plus, they figure if you trust them with your car, you'll probably trust them with your home, too. It's a win-win!

The Advantages of Bundling Car and Home Insurance - Savings, Convenience, and More

Beyond just saving money, bundling your insurance offers a ton of convenience. You only have one company to deal with for both your car and home. That means one bill, one website, and one customer service number. Imagine the time you'll save! Plus, some companies offer even *better* customer service to bundled customers. Think of it as being a VIP!

Real-World Examples of Savings with Bundled Car and Home Insurance - Case Studies and Scenarios

Let's get down to the nitty-gritty. How much can you *actually* save? It varies, but many people report savings of 5% to 25% on their overall insurance costs. Imagine you're paying $1200 a year for car insurance and $1000 a year for home insurance. A 15% discount could save you over $300 a year! That's like a mini vacation fund right there.

Consider Sarah, who lives in California. She was paying $1500 for car insurance and $1200 for home insurance. After bundling, she saved 20%, which translated to $540 annually. Then there's John in Texas. His savings were closer to 10%, but that still meant an extra $250 in his pocket each year. It really depends on the company, your location, and your specific circumstances.

Top Insurance Companies Offering Bundling Discounts - A Comparative Analysis

Okay, so you're sold on the idea. Now, which companies offer the best bundling deals? Here are a few to consider:

State Farm:

State Farm is a giant in the insurance world. They're known for their strong customer service and a wide range of coverage options. They often offer significant bundling discounts, especially if you have a good driving record and a safe home. They also have local agents, which some people prefer for personalized service.

Progressive:

Progressive is another popular choice, especially for car insurance. They're known for their online quoting tool and competitive rates. Their bundling discounts can be quite attractive, and they offer a lot of flexibility in terms of coverage options.

Allstate:

Allstate is similar to State Farm in that they have local agents and a wide range of insurance products. They often run promotions for bundled policies, so keep an eye out for those. They might be a good fit if you value personalized service and want to work with a local agent.

USAA:

If you're a member of the military or a veteran, or if you have family members who are, USAA is worth a look. They consistently rank high in customer satisfaction and offer very competitive rates, especially for bundled policies. Their eligibility requirements are stricter, but if you qualify, it's often a great choice.

Comparing Bundled Insurance Products - Features, Coverage Options, and Pricing Details

Let's dive into a more detailed comparison. Remember, prices and coverage options vary widely based on your individual circumstances. The following are examples and should be considered as a starting point for your own research.

State Farm vs. Progressive:

State Farm generally offers more comprehensive coverage options, but their prices might be slightly higher than Progressive's. State Farm's customer service is also often rated higher. Progressive, on the other hand, is known for its ease of use and online quoting tools. Progressive often has lower base premiums and offers usage-based insurance programs. So, if you're a safe driver, you might save even more.

Allstate vs. USAA:

Allstate is a good choice if you want local agent support and a wide range of policy options. USAA consistently wins awards for customer satisfaction and offers excellent rates, but you need to be eligible. USAA also offers unique benefits tailored to military families.

How to Get the Best Deal on Bundled Car and Home Insurance - Tips and Tricks

Alright, let's talk strategy! Here's how to maximize your savings when bundling:

Shop Around and Compare Quotes:

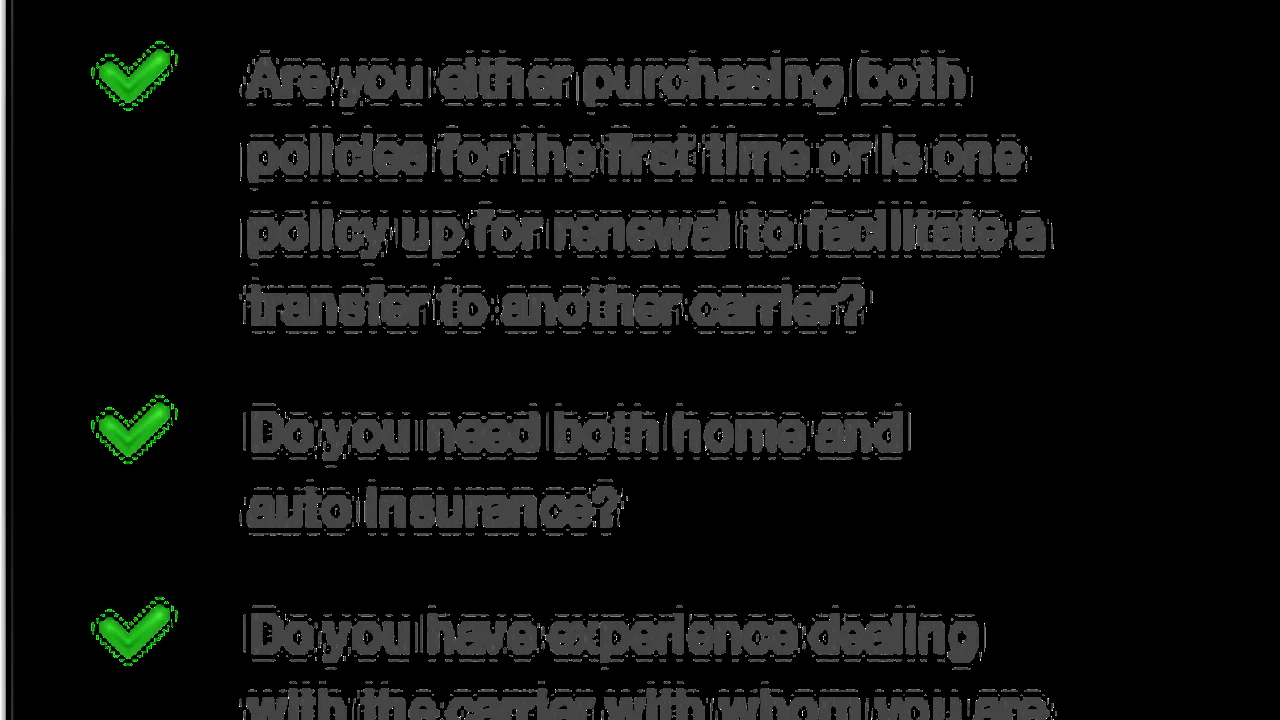

This is the most important tip! Don't just settle for the first quote you get. Get quotes from at least three or four different companies. Use online quoting tools, but also talk to local agents. Remember, online quotes are just estimates. The final price will depend on your specific information.

Increase Your Deductibles:

Increasing your deductibles (the amount you pay out-of-pocket before your insurance kicks in) can lower your premiums. However, make sure you can comfortably afford the higher deductible if you need to file a claim.

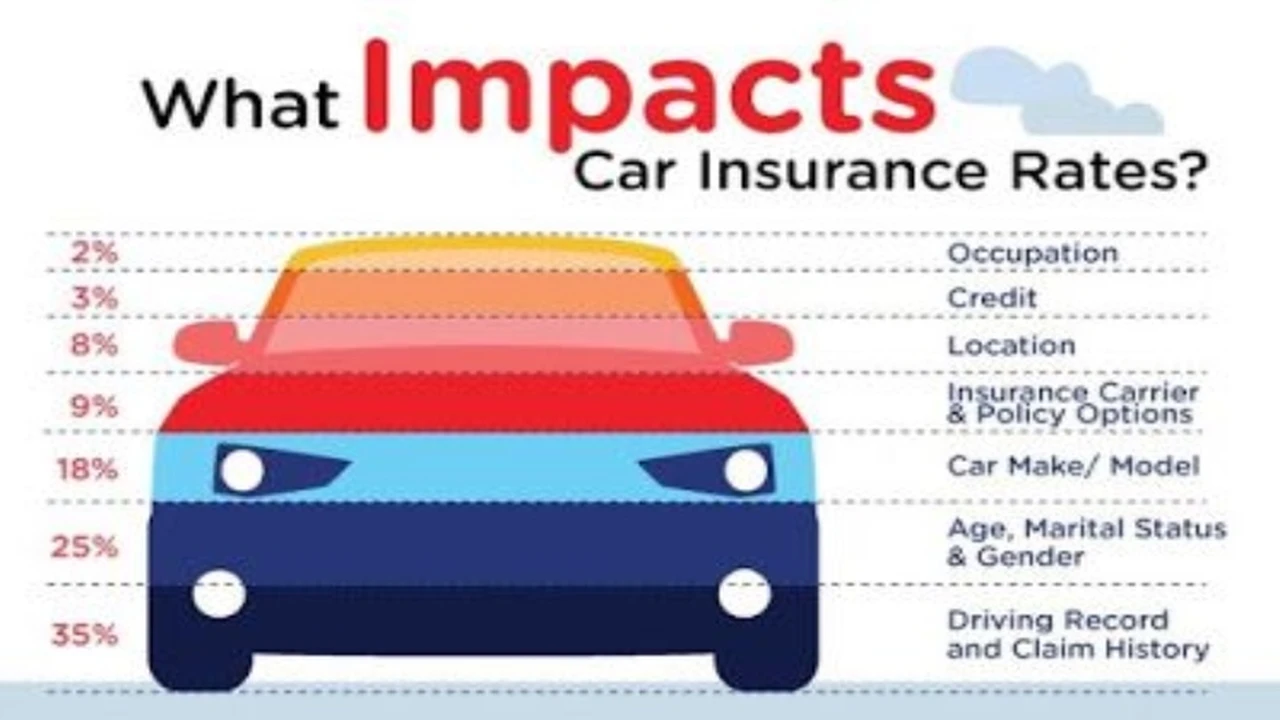

Maintain a Good Credit Score:

In many states, insurance companies use your credit score to determine your premiums. A good credit score can result in lower rates.

Improve Your Home's Security:

Installing security systems, smoke detectors, and deadbolt locks can often lead to discounts on your home insurance. Make sure to inform your insurance company about these improvements.

Ask About Additional Discounts:

Many companies offer discounts for things like being a member of certain organizations, having multiple cars insured, or being a long-time customer. Don't be afraid to ask!

Bundled Insurance Product Spotlight - Specific Recommendations and Use Cases

Let's look at some specific product examples:

State Farm's Drive Safe & Save + Homeowners Policy:

Product: State Farm Drive Safe & Save is a usage-based insurance program that tracks your driving habits. Combined with their homeowners policy, you can see significant savings. Use Case: Ideal for safe drivers who live in well-maintained homes. Comparison: More personalized pricing than a standard policy. Price: Varies significantly; requires enrollment in Drive Safe & Save. Expect to pay around $1500/year bundled, but it depends on driving habits and home value.

Progressive's Snapshot + HomeShield:

Product: Progressive Snapshot tracks driving, HomeShield offers standard home coverage with options for water backup and identity theft protection. Use Case: Great for tech-savvy individuals who want to manage their policy online. Comparison: Generally lower premiums than State Farm, but potentially less comprehensive coverage. Price: Around $1300/year bundled, depending on driving and home factors.

Allstate's Drivewise + Home Insurance:

Product: Allstate Drivewise monitors driving behavior, offering discounts for safe practices. Home insurance offers standard coverage with customizable options. Use Case: Best for those who prefer working with a local agent and want personalized advice. Comparison: More comprehensive coverage options than Progressive, but typically higher premiums. Price: Can range from $1400 to $1700/year bundled, depending on your location and coverage needs.

Potential Downsides of Bundling Car and Home Insurance - What to Watch Out For

While bundling is generally a good idea, there are a few things to keep in mind:

Not Always the Cheapest:

Sometimes, even with the discount, bundling might not be the cheapest option. Always compare individual quotes from different companies to make sure you're getting the best deal.

Coverage Limitations:

Make sure the bundled policy provides adequate coverage for both your car and your home. Don't sacrifice coverage for the sake of a lower price.

Customer Service Issues:

If you have a bad experience with one aspect of your bundled policy (e.g., a claim on your car insurance), it could affect your overall satisfaction with the company. Consider reading reviews before bundling.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)