Reading Car Insurance Reviews: What to Look For

Understanding Car Insurance Reviews A Comprehensive Guide

Alright, let's dive into the world of car insurance reviews. You're probably thinking, "Ugh, reviews? Sounds boring." But trust me, understanding what to look for in these reviews can save you a ton of money and heartache down the road. We're not just talking about avoiding scams; we're talking about finding the *right* coverage for *your* specific needs. Think of it like choosing the perfect coffee – you wouldn't just grab the first bag you see, right? You'd check the roast, the origin, the reviews! Car insurance is the same deal.

Decoding Car Insurance Review Jargon Key Terms Explained

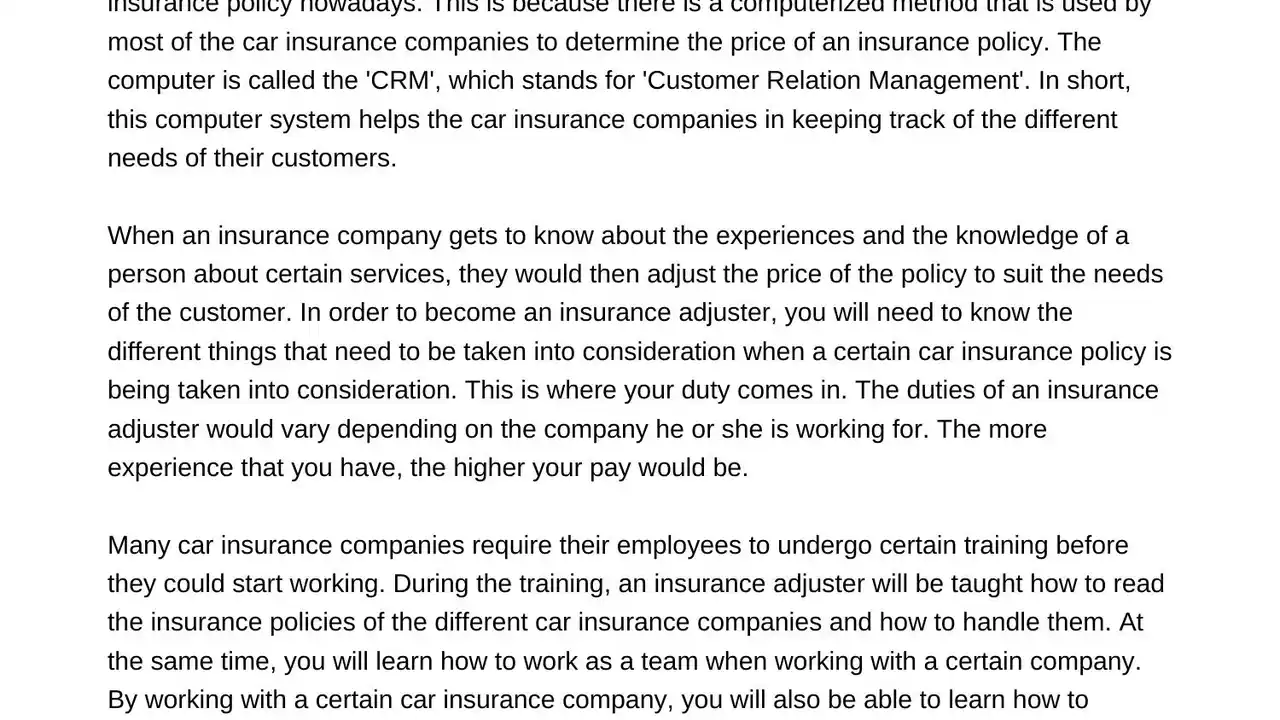

First things first, let's decode some of the jargon you'll encounter. You'll see words like "deductible," "premium," "liability," "collision," and "comprehensive." Don't let these terms intimidate you! A deductible is the amount you pay out-of-pocket before your insurance kicks in. A premium is your monthly (or sometimes annual) payment for the insurance. Liability covers damage you cause to others. Collision covers damage to your car from an accident, regardless of fault. And Comprehensive covers damage from things like theft, vandalism, weather, or even hitting a deer (yikes!). Understanding these key terms is crucial when reading car insurance reviews because you need to know what the reviewer is actually talking about. Are they complaining about a high deductible? Or are they praising the comprehensive coverage after a tree fell on their car?

Identifying Reliable Car Insurance Review Sources Where to Find Honest Feedback

Now, where do you find these magical reviews? Not all review sites are created equal. Some are biased, some are outdated, and some are just plain unreliable. Start with well-known consumer review websites like Consumer Reports, J.D. Power, and the Better Business Bureau (BBB). These sites often provide in-depth ratings and rankings based on customer satisfaction, claims handling, and overall value. Don't forget to check out independent review blogs and forums dedicated to car insurance. These can offer more personal and unfiltered opinions. Also, look for reviews on the insurance company's own website, but take these with a grain of salt. They're likely to be cherry-picked! Finally, ask your friends, family, and colleagues for their experiences. Word-of-mouth can be incredibly valuable.

Analyzing Customer Experiences Claims Handling and Customer Service Insights

When you're reading reviews, pay close attention to what people are saying about claims handling and customer service. This is where the rubber meets the road! A company might offer a low premium, but if it takes them months to process a claim or if their customer service reps are rude and unhelpful, it's not worth the hassle. Look for reviews that specifically mention the claims process – was it smooth and efficient? Did the company communicate clearly and promptly? Were the reviewers satisfied with the outcome? Also, pay attention to reviews that mention customer service interactions – were the reps knowledgeable and helpful? Did they resolve the issue quickly and efficiently? A company with a reputation for excellent claims handling and customer service is worth its weight in gold.

Evaluating Policy Coverage Details Matching Your Specific Needs

This is where things get personal. Everyone's car insurance needs are different. A young driver with a brand-new sports car will have different needs than a retiree with a paid-off sedan. When reading reviews, focus on the coverage details that are relevant to you. Are you looking for the cheapest possible liability coverage to meet the minimum state requirements? Or are you looking for comprehensive coverage with all the bells and whistles, including roadside assistance, rental car reimbursement, and gap insurance? Read reviews that discuss the specific coverage options offered by each company and see how they align with your needs. For example, if you live in an area prone to flooding, you'll want to pay close attention to reviews that discuss flood coverage. If you're a rideshare driver, you'll need to look for companies that offer specific rideshare insurance policies.

Comparing Car Insurance Prices Beyond the Premium Finding the Best Value

Of course, price is a major factor when choosing car insurance. But don't just focus on the premium! You need to consider the overall value. A company might offer a slightly higher premium, but if they have better coverage, better customer service, and a smoother claims process, it might be worth the extra money. When comparing prices, be sure to get quotes from multiple companies and compare the coverage details side-by-side. Also, look for discounts! Many companies offer discounts for things like being a safe driver, having multiple cars insured, being a student, or being a member of certain organizations. Don't be afraid to ask about discounts! You might be surprised at how much you can save.

Recommended Car Insurance Products and Their Use Cases A Detailed Comparison

Okay, let's get down to specifics. Here are a few car insurance companies and their products that are worth considering, along with their pros, cons, and target audiences:

State Farm Car Insurance A Reliable Option for Most Drivers

State Farm is a well-established company with a strong reputation for customer service and claims handling. They offer a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer discounts for safe drivers, good students, and multiple policies. Use Case: State Farm is a good choice for drivers who value reliability and customer service and are willing to pay a slightly higher premium for it. Pros: Excellent customer service, strong financial stability, wide range of coverage options. Cons: Premiums can be higher than some competitors. Price: Expect to pay around $1200-$1800 per year for full coverage, depending on your driving record and location.

GEICO Car Insurance An Affordable Choice for Budget-Conscious Consumers

GEICO is known for its competitive prices and user-friendly online tools. They offer a variety of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer discounts for safe drivers, military personnel, and federal employees. Use Case: GEICO is a good choice for drivers who are looking for the cheapest possible rates and are comfortable managing their policy online. Pros: Competitive prices, easy-to-use online tools, wide range of discounts. Cons: Customer service can be inconsistent, claims handling can be slow at times. Price: Expect to pay around $800-$1400 per year for full coverage, depending on your driving record and location.

Progressive Car Insurance A Flexible Option with Unique Features

Progressive is a tech-savvy company that offers a variety of innovative features, such as Snapshot (a program that tracks your driving habits and rewards safe drivers with discounts) and Name Your Price (a tool that allows you to set your own budget and find coverage that fits). They offer a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Use Case: Progressive is a good choice for drivers who are looking for flexible coverage options and innovative features. Pros: Innovative features, flexible coverage options, competitive prices. Cons: Customer service can be inconsistent, claims handling can be slow at times. Price: Expect to pay around $900-$1500 per year for full coverage, depending on your driving record and location.

Allstate Car Insurance A Comprehensive Choice with Personalized Service

Allstate offers a personalized approach to car insurance, with local agents who can provide tailored advice and support. They offer a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer discounts for safe drivers, good students, and multiple policies. Use Case: Allstate is a good choice for drivers who value personalized service and are willing to work with a local agent. Pros: Personalized service, strong financial stability, wide range of coverage options. Cons: Premiums can be higher than some competitors. Price: Expect to pay around $1300-$1900 per year for full coverage, depending on your driving record and location.

USAA Car Insurance (For Military Members and Families) The Best Option for Military Community

USAA is exclusively for military members and their families. They consistently rank high in customer satisfaction surveys and offer competitive rates and excellent benefits. Use Case: If you are eligible for USAA, it's almost always the best choice. Pros: Exceptional customer service, excellent benefits, competitive rates. Cons: Eligibility is limited. Price: Typically offers the best rates for eligible members, varying widely based on individual circumstances.

Understanding Car Insurance Company Financial Stability Ensuring Long-Term Security

Beyond customer reviews, it's crucial to assess the financial stability of the car insurance company. You want to make sure they have the resources to pay out claims, especially in the event of a major disaster. Look for ratings from independent agencies like A.M. Best, Standard & Poor's, and Moody's. These agencies assess the financial strength of insurance companies and assign ratings based on their ability to meet their financial obligations. A company with a high rating is more likely to be able to pay out claims promptly and efficiently.

Leveraging Car Insurance Comparison Websites Streamlining the Research Process

Using car insurance comparison websites can significantly streamline the research process. These websites allow you to enter your information once and receive quotes from multiple companies at the same time. This can save you a lot of time and effort. However, be aware that not all comparison websites are created equal. Some are biased and may only show you quotes from companies that pay them a commission. It's always a good idea to compare quotes from multiple sources to ensure you're getting the best deal.

Staying Updated on Car Insurance Industry Trends Informed Decision-Making

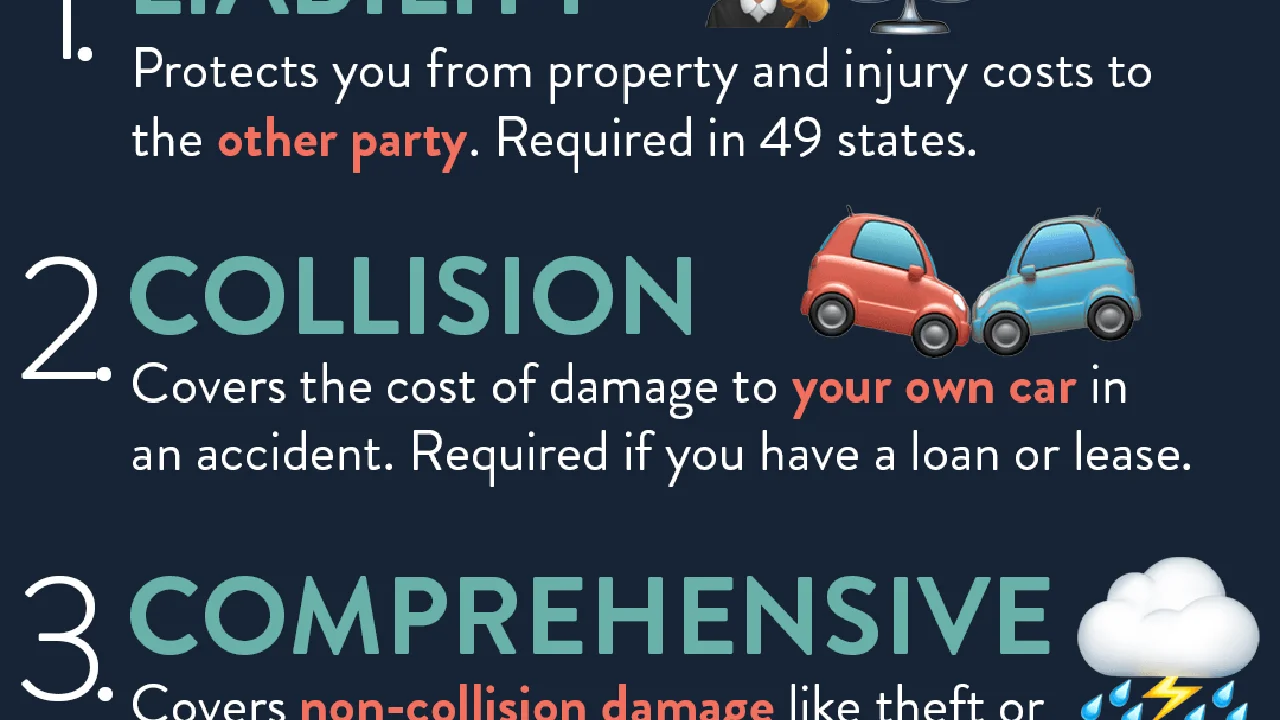

The car insurance industry is constantly evolving. New technologies, regulations, and market conditions can all impact your insurance rates and coverage options. Stay updated on industry trends by reading news articles, following industry blogs, and attending webinars and conferences. This will help you make informed decisions about your car insurance and ensure you're getting the best possible value.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)